Table of Contents

Home / Blog / Blockchain

How to Build a Secure and Scalable Crypto Margin Trading Platform

February 18, 2025

February 18, 2025

Margin trading in cryptocurrencies has revolutionized the trading of digital assets by enabling traders to increase their positions through the use of borrowed funds. When traders do spot trading, they can only use the assets they already have. With crypto margin trading, users can trade with more capital, which increases both the possible profits and risks. Building a scalable and safe margin trading crypto

currency exchange, however, calls for thorough preparation, strong security systems, and regulatory standard compliance.

It is recommended that a good crypto margin trading tool allow for real-time data analysis, automated risk management, and smooth blockchain integration. Blockchain technology allows exchanges to lower counterparty risks, increase liquidity, and strengthen security. This article will guide you through the crucial stages, obstacles, and best practices for creating a trustworthy margin trading crypto exchange regardless of your position—that of an entrepreneur wishing to enter the market or an enterprise blockchain development company.

Ready to build a secure and scalable crypto margin trading platform?

Explore our comprehensive development services now!

Understanding Crypto Margin Trading

Understanding how crypto margin trading operates and what distinguishes it from other trading methods is absolutely essential before building a margin trading crypto exchange. Margin trading in cryptocurrencies allows traders to borrow funds from an exchange or third-party lender to raise the size of their position, in contrast to spot trading, where traders are limited to using their available funds. Even if there’s a better chance of making money, there’s also a higher chance of losing everything if the market goes against the transaction.

What is Crypto Margin Trading?

Crypto margin trading is a type of leveraged trading in which users borrow money to increase their market risk. Leverage allows traders to open positions much bigger than their initial deposit, which might increase their gains. On the other hand, it increases the likelihood of losses, so it’s crucial to monitor risks closely and maintain margins to prevent liquidation.

When people do standard spot trading, they need to have the full amount of capital to make a trade. Margin trading is different. Conversely, the amount a trader can borrow in relation to their initial deposit is determined by leverage ratios, which can be anything from 5x to 100x.

With a 10x leverage, a trader with $100 in their account can make a trade worth $1,000. If the market goes in the desired direction, the leverage makes the earnings bigger. But if the trade goes against you, your losses will also go up, and if your margin level isn’t high enough, you may have to liquidate your position.

How Crypto Margin Trading Works

There are borrowing and lending mechanisms on margin trading sites that let users take on leveraged positions while keeping risk management systems in place. The margin trading process is broken down just here below:

1. Collateral Deposit

A trader opening a margin deal must first deposit collateral, sometimes referred to as the initial margin. This acts as collateral for the money that was borrowed. The leverage ratio determines the needed margin; higher leverage reduces initial capital but also increases risk exposure.

2. Applying Leverage

In accordance with platform regulations and risk evaluations, the exchange provides preset leverage ratios. Typical ratios of leverage include:

- 2x to 5x – Lower risk, fit for conservative traders.

- 10x to 20x – Moderate risk that lets you make more money but calls close observation.

- 50x to 100x – High risk, typically used by experienced traders in high-volatility markets.

A trader’s ability to borrow funds and use them in a transaction is directly correlated to the leverage level they choose.

3. Trade Execution

Once leverage is used, the trader decides to either long or short:

- Long position – If the trader expects the asset price to increase.

- Short position – If the trader expects the asset price to decline.

Using borrowed money to make the trade increases the trader’s risk beyond their actual balance.

4. Risk Monitoring and Maintenance Margin

Real-time risk management solutions used by crypto margin trading platforms help to track changes in the market. These systems monitor the margin to guarantee the trader keeps enough collateral. Maintaining a certain amount of money in the account is needed in case the price goes against the trade.

The risk management tools included in many crypto margin trading platforms are powered by AI. These systems monitor market patterns in real time and notify traders when their margin level is about to reach crucial limitations.

5. Liquidation Mechanism

The platform will initiate forced liquidation if a trader’s losses are above the collateral margin. In other words, the position is closed automatically, and the remaining collateral is utilized to back the borrowed cash.

For example, if a trader with $1,000 and 10x leverage initiates a $10,000 position and the market moves negatively by 10%, their whole margin can be sold until more money is added to meet the margin need.

Essential Features of a Secure and Scalable Crypto Margin Trading Platform

Adding important features that put security, liquidity, and speed first is necessary to create a strong and expandable crypto margin trading platform. To guarantee dependability and confidence, a well-designed platform should offer superior risk management capabilities, smooth trade, and regulatory compliance.

Multi-Layer Security System

Given the prevalence of cyber risks and hacks in the digital asset market, security is of the utmost importance in margin trading crypto exchanges. Multi-layer security keeps user funds and info safe. By calling for further verification during login or withdrawals, two-factor authentication (2FA) provides even more security. If you want to keep a large chunk of your money offline and safe from hackers, cold wallet storage is the way to go. Data leaks can be prevented via end-to-end encryption, which secures user conversations and transactions. Anti-DoS defense also lessens cyberattacks that can disrupt trading operations.

High-Performance Trading Engine

Executing transactions effectively depends mostly on a fast and trustworthy trading engine. The use of order-matching algorithms ensures that no price slippage occurs because buy and sell orders are processed promptly. In the fast-moving crypto markets, low-latency processing is essential for ensuring that trades are executed in real time. To provide traders with more control over their holdings, the platform should also permit market orders, limit orders, stop-loss orders, and trailing stops, among other kinds.

Advanced Risk Management

When risk management is done right, traders and the exchange are both protected from losing too much money. When a margin level puts users in danger, automated margin calls let them change their positions or increase collateral. Stop-loss and take-profit orders let traders create pre-defined exit points to reduce risk. Furthermore, an insurance fund can be created to pay for forced liquidation losses, guaranteeing market stability amid very strong price movements.

Liquidity Aggregation

Deep liquidity is very necessary for flawless order execution on a successful crypto margin trading platform. To improve trading efficiency, liquidity aggregation integrates various liquidity sources. Traders can get the money they need for leveraged trades by working with top liquidity providers, connecting to decentralized finance (DeFi) liquidity pools, and providing peer-to-peer (P2P) lending options. A market with a lot of buyers and sellers helps keep prices competitive and stops order books from becoming imbalanced.

Regulatory Compliance and KYC/AML Procedures

A margin trading crypto exchange has to follow financial rules if it is to run lawfully and win user confidence. Only confirmed users can trade through Know Your Customer (KYC) validation, which lowers fraud and illegal activity. Anti-Money Laundering (AML) protocols also aid in preventing the platform’s exploitation of illicit transactions. If you want to make sure your platform complies with regulations in all the places it needs to be, it’s a good idea to hire blockchain developers.

Cross-Chain Interoperability

Modern trade platforms depend critically on cross-chain interoperability as multi-chain ecosystems grow. Supporting several blockchain networks increases trading flexibility, asset movement, and liquidity. The Polkadot blockchain and other blockchain ecosystem protocols allow flawless communication between several blockchains, enabling users to transfer assets across several networks without restrictions.

Mobile and Web Accessibility

As more traders use mobile devices, it’s important to make sure that the interface is easy to use on both desktop and mobile systems. Advanced charting tools, order execution, and account administration are just a few of the features that a well-designed mobile app should include, the same as the web version. Cross-device accessibility improves user experience and keeps traders interested wherever they go.

Including these key elements will help creators create a scalable, safe crypto margin trading platform with great performance, regulatory compliance, and flawless trading experience.

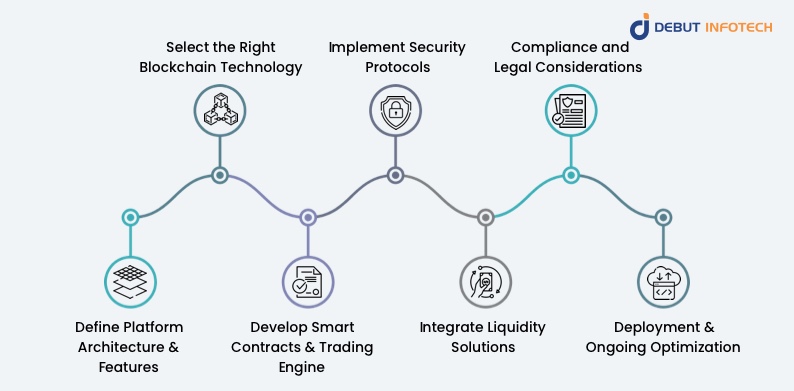

Step-by-Step Guide to Building a Crypto Margin Trading Platform

Developing a margin trading crypto exchange calls for several technological and commercial development steps.

Step 1: Define Platform Architecture & Features

Make a list of all the important aspects, including:

- Supported cryptocurrencies and trading pairs.

- Leverage limits and risk management tools.

- Security and compliance requirements.

Step 2: Select the Right Blockchain Technology

Scalability and security depend on selecting an appropriate blockchain platform. Among the several choices are:

- Ethereum is popular but faces scalability issues.

- Polkadot Blockchain provides cross-chain interoperability.

- Binance Smart Chain (BSC) allows for lower transaction fees and faster execution.

Speaking with blockchain consultants can help you determine the best choice for your project.

Step 3: Develop Smart Contracts & Trading Engine

Smart contracts streamline the main features of a margin trading market. Among these are:

- Managing loan issuance and repayments.

- Executing leveraged trades securely.

- Automating liquidation and collateral management.

Step 4: Implement Security Protocols

- Regular security audits.

- Real-time fraud detection mechanisms.

- Multi-layered authentication.

Step 5: Integrate Liquidity Solutions

A successful exchange depends on liquidity.

- Partnering with liquidity providers.

- Incorporating liquidity mining incentives.

Step 6: Compliance and Legal Considerations

Engaging blockchain business development professionals is a good idea to stay in compliance with financial authorities since legislation can vary among countries.

Step 7: Deployment & Ongoing Optimization

Maintaining platform integrity calls for ongoing updates and security improvements after launching.

Challenges in Building a Crypto Margin Trading Exchange

Regulatory compliance, security, and cost are just a few of the many obstacles that must be overcome while developing a crypto margin trading platform. These are the main difficulties:

1. Regulatory Challenges

The legal landscape is complicated and jurisdictional when it comes to cryptocurrency exchanges and margin trading. To stop illegal activity, governments have enforced rigorous KYC (Know Your Customer) and AML (Anti-Money Laundering) rules. Navigating these compliance criteria requires legal professionals and qualified blockchain consultants to guarantee the platform runs legally and upholds user privacy.

2. Security Risks

Many forms of cybercrime, such as hacking, phishing, and smart contract vulnerabilities, target cryptocurrency exchanges. To keep assets and user data safe, it’s important to use multiple layers of security, like storing funds in cold storage, using multi-signature wallets, DDoS protection, and strong encryption protocols.

3. High Blockchain Development Costs

A safe and scalable margin trading exchange that uses blockchain technology will cost a lot to build. Infrastructure set-up, liquidity management, trading engine development, smart contract integration, and security standard compliance count among expenses. By working with a seasoned blockchain development company, you can guarantee a high-performance platform and maximize expenses.

4. Market Volatility

It’s risky to trade on margin because crypto markets are very volatile. Mass liquidations brought on by price swings could cause major losses to traders. Platforms have to include artificial intelligence-driven risk management tools, automatic stop-loss systems, and margin call warnings to guard traders from unanticipated market swings and help lower risks.

5. Blockchain vs Distributed Ledger Considerations

The performance, scalability, and decentralization of a platform are all affected by whether it is built on blockchain or distributed ledgers. Although blockchain systems like Ethereum and Polkadot have smart contract capability, they could experience network congestion and high gas prices. Conversely, distributed ledger technologies (DLT) offer better scalability but might compromise decentralization. By means of enterprise blockchain development companies, one can choose the appropriate architecture depending on the long-term objectives of the platform.

Blockchain business development knowledge, thorough planning, and strategic execution will help one overcome these obstacles to create a scalable, compliant, and safe crypto margin trading exchange.

Benefits of Blockchain in Crypto Margin Trading Platforms

Blockchain technologies improve security, openness, and efficiency when integrated into crypto margin trading systems. Important benefits are listed below:

- Decentralization: Decentralization cuts middlemen, lowering delays and expenses. Decentralized lending pools let traders access liquidity without depending on brokers.

- Security & Transparency: Blockchain’s unchangeable ledger logs every transaction, guaranteeing fraud protection. Users can verify lending rates, margin usage, and liquidation events in real-time.

- Smart Contract Automation: This feature reduces the need for human involvement by automating risk management, liquidation, and margin loans. It ensures that trades are executed smoothly.

- Improved Liquidity: Decentralized liquidity pools provide traders with immediate access to margin loans, minimizing dependency on centralized lenders.

- Cross-Chain Compatibility: The Polkadot blockchain and other blockchain ecosystem protocols allow platforms to trade on more than one chain simultaneously, allowing traders to make trades across networks.

Using enterprise blockchain development, crypto margin trading exchanges can lower expenses while simultaneously increasing security, access, and efficiency.

Have Questions About Building a Crypto Margin Trading Platform?

Contact Us Today and Get Expert Guidance!

Conclusion

To build a margin trading exchange platform, you need to know a lot about blockchain technology, security methods, and following the rules. Businesses can provide traders with a consistent margin trading experience by integrating strong security measures, sophisticated trading engines, and liquidity aggregation.

Working with Debut Infotech, a seasoned blockchain development company, will guarantee the best security and scalability standards and aid in expediting the process.

Frequently Asked Questions

Crypto margin trading is a trading strategy that allows users to borrow funds from an exchange or liquidity provider to increase their trade size beyond their available capital. This enables higher potential profits but also increases risk, as traders must maintain a required margin to avoid liquidation.

A margin trading crypto exchange facilitates leveraged trading by providing traders access to borrowed funds. Traders deposit collateral, choose their leverage ratio (e.g., 5x, 10x), and open positions. If the trade moves against them, the platform may issue a margin call or liquidate the position to prevent losses exceeding the collateral.

To build a secure margin trading exchange, developers should implement:

1. Two-factor authentication (2FA) for user logins.

2. Cold wallet storage to protect user funds.

3. End-to-end encryption for data security.

4. Smart contract audits to eliminate vulnerabilities.

5. Anti-DoS protection to prevent cyberattacks.

The blockchain development cost for a crypto margin trading platform depends on various factors, including:

1. The complexity of the trading engine.

2. Security infrastructure and compliance measures.

3. Liquidity provider integration.

4. Choice of blockchain platform (Ethereum, Polkadot, Binance Smart Chain, etc.).

5. On average, development costs can range from $100,000 to several million dollars, depending on the features and scale of the exchange.

The benefits of blockchain in banks and trading platforms include:

Transparency – All transactions are recorded on an immutable ledger.

Security – Decentralization reduces fraud and hacking risks.

Efficiency – Smart contracts automate lending, liquidation, and risk management.

Liquidity – Decentralized finance (DeFi) protocols enhance trading liquidity.

1. Centralized exchanges (CEXs) offer faster transactions, high liquidity, and compliance with financial regulations.

2. Decentralized exchanges (DEXs) provide greater transparency, security, and user control over funds but may have lower liquidity and higher execution times.

Many platforms integrate both models using hybrid blockchain ecosystem protocols for better security and scalability.

Blockchain vs Distributed Ledger: While both provide decentralized transaction records, blockchain uses cryptographic chains to store blocks of data, whereas DLT can have multiple architectures (e.g., directed acyclic graphs, permissioned ledgers).

Blockchain is ideal for crypto margin trading due to its smart contract functionality, whereas other DLT models may be used for enterprise financial solutions.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment