Table of Contents

Home / Blog / Cryptocurrency

Cryptocurrency Payment Gateway: A Complete Guide for Businesses

March 20, 2025

March 20, 2025

A crypto payment gateway enables businesses to accept cryptocurrency payments seamlessly. As digital assets gain traction globally, businesses are increasingly exploring crypto payment solutions to streamline transactions and reduce costs.

As of 2024, global cryptocurrency ownership reached over 560 million users, accounting for approximately 6.8% of the world’s population. Not just that, the crypto payment gateway market was valued at $1.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% between 2024 and 2032. This rapid growth highlights the increasing adoption of crypto payments, making them a valuable addition for businesses seeking to expand their payment options and reach a global audience.

In this article, we will learn the meaning of a crypto payment gateway, its advantages and disadvantages, and how it works. We will also dive into how to choose the best payment gateway, and a step-by-step guide on integrating crypto payment solutions.

Your Business, Powered by Blockchain

Give your customers the flexibility to pay in crypto while you enjoy low fees and fast settlements. We design and integrate custom crypto payment solutions that fit your needs perfectly.

What is a Crypto Payment Gateway?

A crypto payment gateway is a digital platform that facilitates cryptocurrency transactions between buyers and merchants. Unlike traditional payment processors, it operates on blockchain technology, ensuring transparent, immutable, and decentralized transactions. These gateways eliminate the need for intermediaries, enabling direct and cost-effective financial interactions.

How Cryptocurrency Gateway Payment Works

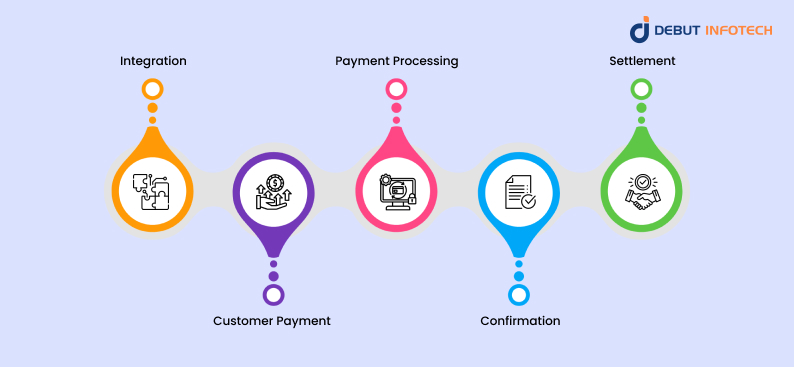

1. Integration

A cryptocurrency payment gateway integrates with a business’s website or point-of-sale system through APIs or plugins. Merchants configure supported cryptocurrencies and set up automatic conversion options. Secure wallet connections ensure seamless transactions, allowing businesses to accept digital payments without directly managing blockchain transactions or private keys.

2. Customer Payment

When a customer selects cryptocurrency as the payment method, the gateway generates a unique payment address or QR code. The customer sends the specified amount from their crypto wallet. The gateway verifies the transaction details, ensuring the correct amount and network fee are included before proceeding to the next stage.

3. Payment Processing

Once the customer initiates the transaction, the gateway monitors the blockchain for confirmation. It ensures the payment meets required security conditions, such as network confirmations. Advanced gateways use real-time monitoring to detect transaction status and prevent fraudulent attempts, enhancing reliability and efficiency.

4. Confirmation

After the transaction receives sufficient blockchain confirmations, the payment gateway notifies both the merchant and the customer. This step ensures that the funds are securely transferred, reducing risks of double-spending. Some gateways provide instant confirmation mechanisms, allowing businesses to process orders without waiting for multiple confirmations.

5. Settlement

The gateway finalizes the transaction by transferring the funds to the merchant’s ai integrated smart crypto wallet or converting them into fiat currency if enabled. Settlement options vary based on provider policies, with some offering instant withdrawals and others processing settlements periodically. This ensures businesses can manage liquidity efficiently while benefiting from cryptocurrency payments.

Advantages of Crypto Payment Gateways

1. Lower Transaction Fees

Crypto payment gateways eliminate intermediaries like banks and credit card networks, significantly reducing transaction costs. Businesses benefit from lower processing fees compared to traditional payment systems, allowing them to retain more revenue. This cost-effectiveness makes cryptocurrency payments an attractive option for merchants seeking to maximize profitability.

Leveraging cryptocurrency trading bots can further enhance cost savings by automating trades and optimizing transaction timing.

2. Faster Transactions

Blockchain-based payments settle within minutes, bypassing the delays of bank transfers and card processing. Businesses no longer have to wait days for payments to clear, improving cash flow and operational efficiency.

Faster settlements are particularly beneficial for international transactions, ensuring smooth cross-border commerce without long waiting times. This advantage is also valuable in crypto exchange development, where instant transactions enhance user experience and liquidity.

3. Enhanced Security and Fraud Protection

Crypto payments are secured through blockchain encryption, making transactions tamper-proof and irreversible. Businesses are protected from chargeback fraud, a common issue with credit card payments. This reduces financial risks and administrative burdens associated with handling disputed transactions.

4. Global Market Expansion

Businesses can reach customers worldwide without worrying about currency conversion or banking restrictions. Crypto payment gateways facilitate seamless cross-border transactions, opening new revenue streams. This global accessibility is particularly advantageous for e-commerce platforms and international service providers.

5. Customer Privacy and Trust

Unlike traditional payment methods that require extensive personal details, crypto transactions rely on wallet addresses, preserving customer privacy. This builds trust among privacy-conscious consumers and reduces the risk of data breaches. Businesses that offer crypto payments can attract a broader customer base looking for secure and anonymous transactions.

6. Access to the Unbanked Market

Crypto payment gateways enable businesses to serve unbanked and underbanked populations who lack access to traditional banking services. By accepting cryptocurrencies, businesses can tap into new demographics, expanding their customer base in regions with limited financial infrastructure.

Disadvantages of Crypto Payment Gateways

1. Price Volatility

Cryptocurrency values fluctuate rapidly, posing a financial risk for businesses. A payment received today may lose value before conversion to fiat currency. To mitigate this, businesses often use instant conversion features, but market instability remains a challenge, affecting revenue predictability and pricing strategies.

Volatility is an issue in the crypto ecosystem, including trading. However, advanced tools like a flash loan arbitrage bot can help traders capitalize on price differences across exchanges, potentially offsetting some volatility risks.

2. Regulatory Uncertainty

Crypto regulations vary across jurisdictions and frequently change, creating legal complexities for businesses. Compliance challenges, tax implications, and potential restrictions on crypto transactions can impact operations. Businesses must stay updated on legal requirements to avoid penalties or disruptions in accepting digital payments.

Partnering with a crypto wallet development company can help ensure secure and compliant transactions.

3. Limited Customer Adoption

Despite growing interest in cryptocurrencies, many consumers still prefer traditional payment methods. Businesses integrating crypto payment gateways may face low adoption rates, limiting their customer base. Encouraging crypto payments requires additional marketing efforts and incentives to drive consumer interest and trust.

4. Security Risks and Fraud

While blockchain transactions are secure, businesses must safeguard their crypto wallets (i.e., trc20 wallets) and payment infrastructure. Cyber threats such as hacking, phishing, and wallet breaches can lead to financial losses. Without proper security measures, businesses risk losing funds, as crypto transactions are irreversible.

5. Integration and Technical Complexity

Implementing a crypto payment gateway requires technical expertise, which may be challenging for businesses without in-house blockchain developers. Integration with existing systems, managing the best crypto wallets, and ensuring seamless user experience demand additional resources. Companies may need third-party solutions or external support, increasing operational costs.

How Much Do Crypto Payment Gateways Charge?

Crypto payment gateway fees vary depending on the provider, transaction volume, and additional features offered. So, businesses should compare costs, transaction limits, and additional services to find the most suitable gateway. Here’s a breakdown of what influences crypto payment gateway fees:

1. Transaction Fees

Most crypto payment gateways charge between 0.5% and 1.5% per transaction, making them more cost-effective than traditional credit card processors, which typically charge 2% to 4%. This lower fee structure helps businesses save on payment processing costs while offering secure and efficient transactions.

2. Withdrawal and Conversion Fees

Some gateways impose fixed withdrawal fees when transferring funds to a bank account or digital multicurrency wallet. Additionally, suppose businesses opt for instant fiat conversion. In that case, they may incur extra charges of 0.5% to 1% for converting cryptocurrency into local currency.

3. Network and Additional Fees

Since crypto transactions depend on blockchain networks, businesses may face network fees, which fluctuate based on network congestion. Some gateways also charge subscription-based fees, offering flat-rate pricing instead of per-transaction costs.

How to Choose the Right Crypto Payment Gateway

Selecting an ideal cryptocurrency payment processor depends on several factors:

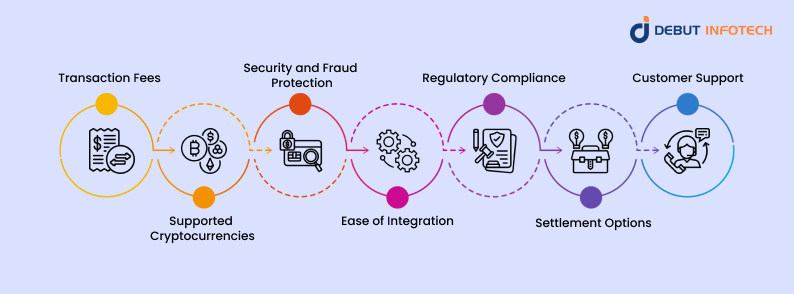

1. Transaction Fees

Compare processing fees, withdrawal charges, and conversion costs among providers. Most gateways charge 0.5% to 1.5% per transaction, but additional fees for fiat conversion or network congestion may apply. Selecting a provider with transparent pricing ensures cost-effective payment processing for your business.

2. Supported Cryptocurrencies

Ensure the gateway supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, and stablecoins. A diverse selection allows businesses to cater to more customers while reducing volatility risks. Some gateways also offer automatic conversion to stablecoins or fiat to protect against price fluctuations.

3. Security and Fraud Protection

Choose a payment gateway with strong security features like multi-signature wallets, encryption, and fraud detection mechanisms. Since crypto transactions are irreversible, businesses must ensure their chosen gateway prevents unauthorized access and protects against potential cyber threats.

4. Ease of Integration

Look for a cryptocurrency payment gateway that seamlessly integrates with your e-commerce platform, website, or point-of-sale system. APIs, plugins, and SDKs simplify the integration process, ensuring smooth transactions without disrupting existing payment flows. A user-friendly setup reduces technical complexities for businesses.

5. Regulatory Compliance

Crypto regulations vary across regions, so selecting a compliant payment gateway is crucial. Providers offering KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance help businesses avoid legal risks. Understanding tax implications and reporting requirements is also essential when accepting cryptocurrency payments.

Regulatory compliance often adds to crypto wallet development cost, as businesses must integrate security protocols, identity verification, and reporting features to meet legal standards.

6. Settlement Options

Consider whether the cryptocurrency exchange gateway allows direct crypto payouts, fiat conversions, or hybrid options. Some businesses prefer instant fiat settlement to avoid price volatility, while others hold cryptocurrency for potential appreciation. Flexible settlement methods help businesses manage funds more effectively.

7. Customer Support

Reliable customer support is essential for resolving payment issues, technical difficulties, and security concerns. Look for gateways that offer 24/7 support via live chat, email, or phone to ensure quick assistance. A responsive support team minimizes downtime and enhances the general payment experience for businesses and customers.

This level of reliability is also crucial in crypto trading bot development, where seamless transactions and real-time issue resolution are vital for automated trading success.

Use Cases and Industries Benefiting from Crypto Payment Gateways

Several industries are leveraging crypto payment gateways to enhance operations:

1. E-Commerce and Online Retail

Crypto payment gateways enable e-commerce businesses to accept digital currencies, offering customers a faster and more secure payment alternative. With lower transaction fees and no chargebacks, merchants can improve profit margins while expanding their customer base globally. Accepting crypto also attracts tech-savvy consumers who prefer decentralized payment methods, enhancing brand reputation and competitiveness in the digital economy.

2. Travel and Hospitality

Hotels, airlines, and travel agencies benefit from crypto payments by offering seamless international transactions without currency conversion hassles. Crypto gateways reduce processing delays and foreign exchange fees, making travel bookings more cost-effective. With blockchain ensuring security and transparency, businesses in this sector can cater to global travelers who prefer using digital currencies for their trips.

3. Gaming and Digital Entertainment

The gaming industry, including online casinos, esports platforms, and digital marketplaces, thrives on cryptocurrency payments. Crypto transactions allow instant in-game purchases, secure payouts, and cross-border accessibility. With blockchain integration, players can trade digital assets securely. At the same time, businesses benefit from lower fraud risks and a borderless payment infrastructure that enhances user experience and revenue potential.

4. Subscription-Based Services

Streaming platforms, SaaS providers, and content creators use crypto payment gateways to offer seamless, recurring billing without relying on traditional banks. Cryptocurrencies enable borderless payments, making it easier for global users to subscribe to services. Additionally, businesses reduce dependency on third-party payment processors, lowering costs and ensuring uninterrupted service for subscribers worldwide.

5. Freelance and Remote Work Platforms

Freelancers and gig economy workers benefit from crypto payments by receiving fast, low-cost cross-border payments. Traditional payment methods often involve high fees and delays, but crypto transactions settle quickly with minimal charges. Businesses hiring international talent can use crypto payment gateways to streamline payments, ensuring financial flexibility for freelancers while reducing administrative costs.

6. High-Risk Industries

Sectors like adult content, online gambling, and CBD sales often face restrictions from traditional financial institutions. Crypto payment gateways provide an alternative by enabling secure, unrestricted transactions. With decentralized payments, businesses in these industries can operate without banking limitations while ensuring privacy and security for their customers.

Investing in ewallet app development further enhances transaction security and accessibility for users.

Steps to Integrate a Crypto Payment Gateway

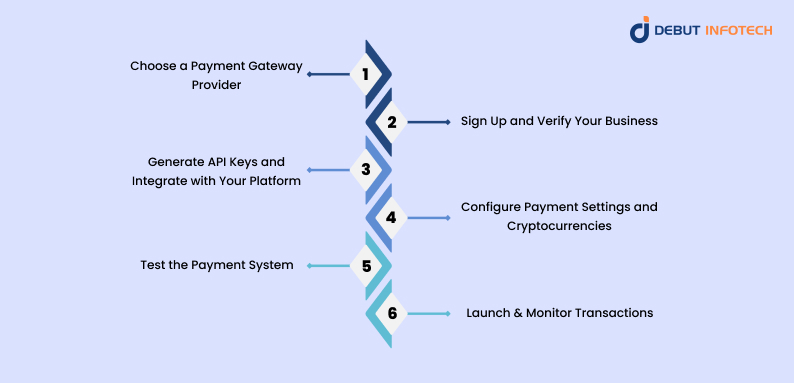

1. Choose a Payment Gateway Provider

Research and select a reliable digital currency payment gateway that aligns with your business needs. Consider factors like transaction fees, supported cryptocurrencies, security features, and ease of integration. Popular providers include BitPay, CoinGate, and CoinPayments, offering various features like instant conversion and multi-currency support to streamline transactions.

2. Sign Up and Verify Your Business

Create an account with the chosen provider and complete the business verification process. Some gateways require KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance to ensure regulatory adherence. Providing business details, identification, and banking information helps establish credibility and enables smooth fund withdrawals.

3. Generate API Keys and Integrate with Your Platform

Once verified, access API keys, plugins, or SDKs to connect the gateway to your website, e-commerce store, or app. Many providers offer pre-built integrations for platforms like Shopify, WooCommerce, and Magento to simplify the process. Custom API integration allows businesses to tailor payment flows to their specific requirements.

4. Configure Payment Settings and Cryptocurrencies

Customize payment settings, including accepted cryptocurrencies, automatic fiat conversion, and transaction notifications. Some gateways allow real-time exchange rate conversion, ensuring businesses receive stable payments. Setting up wallet addresses for different asset backed cryptocurrencies helps streamline payment processing and fund management.

5. Test the Payment System

Before going live, conduct test transactions to ensure the system works smoothly. Simulate payments to verify transaction speed, security, and user experience. Checking for API errors, payment confirmations, and settlement accuracy ensures a seamless experience for customers and prevents technical issues post-launch.

6. Launch and Monitor Transactions

Once testing is successful, enable crypto payments for customers. Continuously monitor transactions, address customer queries, and update security protocols to safeguard funds. Regularly reviewing analytics and payment reports helps businesses optimize their crypto payment strategy while complying with evolving regulations.

Integrate the Best Crypto Payment Gateway for Your Business

Not sure which crypto payment gateway suits your needs? We’ll help you pick the right provider and handle the entire integration process—secure, fast, and hassle-free.

Conclusion

Crypto payment gateways are transforming digital transactions, offering businesses and consumers secure, cost-effective, and global payment solutions. By understanding how these gateways work, their benefits, and how to choose the right payment provider, businesses can harness blockchain technology to streamline payments and enhance financial security.

As adoption continues to rise, integrating crypto payments will become a strategic advantage for businesses aiming to stay ahead in the evolving digital economy.

FAQs

A. There’s no one-size-fits-all answer—it depends on what you need. BitPay, CoinGate, and NOWPayments are popular for their reliability and low fees. If you want instant conversions, check out Coinbase Commerce. The best choice comes down to your business model and preferred crypto features.

A. Fees vary, but they’re usually lower than credit card processors. Most gateways charge between 0.5% and 1.5% per transaction, while some, like Coinbase Commerce, have no fees unless you convert crypto to fiat. Always check the fine print—some providers sneak in extra charges for withdrawals or currency conversions.

A. Most gateways let you convert crypto to fiat instantly, so you’re not stuck watching prices swing. Services like BitPay and CoinPayments automatically settle transactions in stablecoins or local currency. If you prefer to hold crypto, some gateways let you take the risk—and the potential rewards.

A. Nope! If you’re running an online store, integration is usually as easy as adding a plugin or API. For physical stores, some POS systems support crypto payments. No fancy hardware is needed—just a business wallet and a gateway provider that fits your setup.

A. Yes, as long as you pick a reputable provider. Transactions are encrypted and recorded on the blockchain, making them hard to tamper with. Look for gateways with multi-signature wallets, fraud protection, and two-factor authentication. Just keep your private keys safe—security starts with you.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment