Table of Contents

Home / Blog / Tokenization

Security Token Offering: Key Insights on Next-Gen Fundraising

March 7, 2025

March 7, 2025

Security token offerings (STOs) have emerged as a secure, regulated method to raise capital with the help of blockchain technology.

Compared to Initial Coin Offerings (ICOs), STOs represent legally compliant investment assets backed by real or fiat instruments, including equity, debt, and real-world assets. Designed to function within specific regulatory frameworks for offering security assets, STOs combine smart contracts and decentralized technology to improve transparency, investor protection, and compliance with financial regulations.

As per a report by Business Research Insights, the global security token market size was USD 1.91 billion in 2024 and is forecast to be USD 17.44 billion in 2033, representing a compound annual growth rate (CAGR) of 27.3% from 2024 to 2033. Moreover, a forecast by Arca and Coalition Greenwich estimate that the tokenized securities market could exceed $20 trillion by the end of the decade, making STOs a suitable investment option in the near future.

In this article, we will explain the meaning of STO, how it works, its different types, benefits, challenges, and the steps to launch one.

What is A Security Token Offering?

A Security Token Offering (STO) is a regulated fundraising method that issues blockchain-based tokens representing ownership in an asset, company, or financial instrument. Unlike Initial Coin Offerings (ICOs), security tokens comply with securities regulations, offering investors legal protection and transparency. These tokens can represent shares in a company, debt instruments, or ownership in physical assets, making STOs an attractive option for institutional and retail investors.

Your STO Deserves A Solid Foundation

We provide end-to-end solutions to make your security token offering smooth, compliant, and successful.

Types of Security Tokens

Security tokens are categorized based on the type of asset or financial right they represent. Here are the different types:

1. Equity Tokens

Equity tokens signify ownership in a company, similar to traditional shares. Investors gain rights such as dividends, voting power, and profit-sharing. These tokens are issued on blockchain networks, ensuring transparent record-keeping and reducing intermediaries. Regulatory compliance is required, as they fall under securities laws. Equity tokens provide liquidity advantages, allowing fractional ownership and enabling broader investor participation in private or public markets.

2. Asset-Backed Tokens

These tokens are tied to physical or financial assets like real estate, commodities, or precious metals. By tokenizing tangible assets, investors gain easier access to traditionally illiquid markets.

A crypto token development company can help structure asset-backed tokens to ensure transparent ownership verification and efficient transfers.

The asset’s value determines the token’s price, ensuring a more stable investment compared to speculative cryptocurrencies. Compliance with securities regulations ensures investor protection and legal clarity.

3. Debt Tokens

Debt tokens represent loans or financial obligations, functioning similarly to bonds. Investors lend funds to an entity in exchange for periodic interest payments and principal repayment. These tokens automate compliance through smart contracts, ensuring transparent debt management. Debt tokens improve market efficiency, reducing costs associated with traditional bond issuance. Token holders benefit from enhanced liquidity, enabling secondary market trading of financial obligations.

4. Utility Tokens

Unlike other security tokens, utility tokens provide access to a platform’s services rather than ownership rights. While often used in blockchain ecosystems, they can also be classified as securities if they pass the Howey Test. Some utility tokens offer staking rewards or exclusive platform benefits. Regulatory scrutiny applies if they promise financial returns, necessitating legal compliance for token issuers and investors.

How Does A Security Token Offering Work?

An STO follows a structured process to ensure compliance with regulations and provide investors with secure, legally recognized investment opportunities. Here’s how the process unfolds:

1. Preparation

The STO process begins with thorough planning, including legal structuring, regulatory compliance, and defining the token’s purpose. Issuers must assess jurisdictional regulations, draft whitepapers, and establish investor eligibility criteria. Engaging legal and financial advisors ensures compliance with securities laws, reducing risks and increasing the likelihood of regulatory approval for the tokenized asset.

2. STO Design

Designing an STO involves determining the token’s structure, such as equity, debt, or asset-backed models. Issuers define token economics, including supply, distribution, and investor benefits.

STO development includes integrating governance mechanisms, compliance features, and smart contract automation to ensure transparency and regulatory adherence. A well-structured STO enhances investor confidence and simplifies market entry.

3. Selection of Technology

Choosing the right blockchain and smart contract infrastructure is critical for security, scalability, and compliance. Platforms like Ethereum, Polkadot, or private blockchains offer different benefits, including transaction speed and cost efficiency. Incorporating ERC20 token development ensures compatibility and seamless functionality within Ethereum’s ecosystem.

Security features, such as identity verification and automated compliance protocols, are integrated to prevent fraud, enhance transparency, and facilitate secure transactions.

4. Choosing a Financial Service Provider

Issuers partner with licensed custodians, brokers, and legal firms to ensure regulatory compliance and secure asset management. A financial service provider helps structure the offering, manage token issuance, and facilitate investor onboarding. Working with a reputable partner enhances trust, streamlines fundraising, and ensures adherence to securities regulations in various jurisdictions.

5. Raising Capital

The fundraising phase involves marketing the STO to accredited or institutional investors through private placements or public offerings. Investors undergo KYC/AML verification before purchasing security tokens. Smart contracts automate transactions, ensuring compliance with securities laws. Transparent fundraising processes and clear investment terms attract investors while mitigating risks associated with regulatory scrutiny.

6. Token Listing

Once the STO concludes, tokens can be listed on regulated security token exchanges or secondary markets. Listing enhances liquidity, allowing investors to trade tokens under compliance rules. Exchanges enforce investor eligibility and jurisdictional restrictions to maintain regulatory integrity. A successful listing increases market visibility and provides investors with exit opportunities.

What Is Deemed a Security? The Howey Test Explained

Tokenizing assets on the blockchain creates security tokens, but what qualifies as a security?

Legal standards define whether an asset meets the criteria for classification as a security, particularly under the U.S. Securities Act of 1933. The Howey Test, recognized by the U.S. Supreme Court in the 1946 SEC v. W.J. Howey Co. case, is the most widely applied framework.

According to this test, an asset is considered a security if it meets the following four criteria:

- Investment of Money (investors provide capital)

- Common Enterprise (funds are pooled with shared risks and rewards)

- Profit Expectation (investors anticipate financial gains),

- Efforts of Others (returns depend on a third party’s work).

Benefits of Security Token Offering

Security Token Offerings provide multiple advantages over traditional fundraising methods:

1. Regulatory Compliance

STOs follow securities regulations, providing legal protection for investors. Compliance with financial authorities ensures transparency, reduces fraud risks, and fosters investor confidence. Unlike ICOs, security tokens undergo strict scrutiny, making them a more secure and legitimate option for raising capital in both private and public markets.

2. Enhanced Liquidity

Tokenization allows fractional ownership, enabling investors to trade security tokens on secondary markets. This flexibility opens investment opportunities to a broader audience, including those who may not afford traditional assets. The ability to trade 24/7 on blockchain-powered exchanges further enhances market accessibility and liquidity.

3. Cost Efficiency

Blockchain-based issuance eliminates intermediaries such as brokers and banks, reducing costs associated with traditional fundraising. Smart contracts automate compliance, dividend distribution, and transaction execution, streamlining operations. This efficiency enables startups and enterprises to raise funds with lower administrative expenses, ultimately benefiting both issuers and investors.

4. Transparency and Security

STOs leverage blockchain technology to provide immutable transaction records, reducing fraud and manipulation risks. Smart contracts enforce compliance, ensuring all transactions adhere to predefined regulations.

Just as stablecoin development services focus on security and transparency in digital assets, STOs provide investors with real-time visibility into asset ownership, transaction history, and company performance, fostering trust in the investment process.

5. Global Investment Access

Security tokens enable cross-border investment opportunities, allowing companies to attract capital from international investors. Unlike traditional securities, which often face geographical restrictions, STOs provide a more inclusive funding model.

Investors from various jurisdictions can participate in compliant offerings, broadening the potential capital pool for businesses.

Challenges of STO

Despite its benefits, STOs come with certain challenges that issuers and investors must navigate:

1. Regulatory Complexity

STOs must comply with strict securities laws that vary across jurisdictions, requiring thorough legal guidance. Navigating these regulations can be costly and time-consuming, especially as global regulatory frameworks continue to evolve.

Unlike meme coin development, which often faces fewer regulatory hurdles, STOs require strict compliance to avoid penalties, legal disputes, or restrictions on token issuance and trading.

2. Limited Investor Pool

Unlike ICOs, which often allow unrestricted public participation, STOs are typically restricted to accredited or institutional investors. These limitations reduce the number of potential participants, making it harder for businesses to raise capital quickly. Expanding regulatory-compliant access to retail investors remains a challenge in many jurisdictions.

3. Technical Barriers

Launching an STO requires expertise in blockchain development, smart contracts, cybersecurity, and regulatory technology. Ensuring token security, compliance automation, and seamless platform integration can be complex.

Without the right technological infrastructure, issuers may face operational inefficiencies, security vulnerabilities, or difficulty in managing tokenized assets effectively.

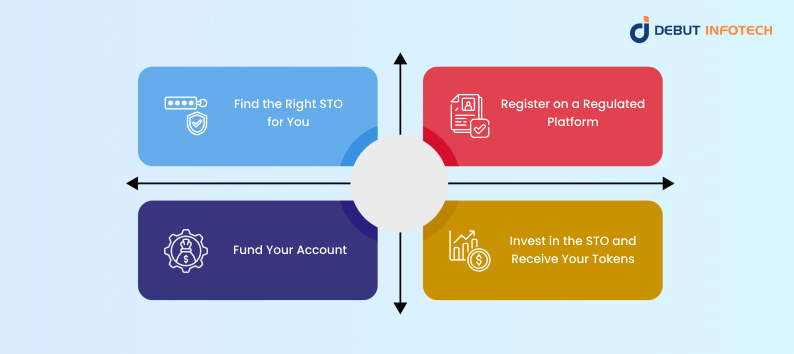

How to Buy a Security Token Offering? A Step-by-Step Guide

1. Find the Right STO for You

Before investing in an STO, conduct thorough research on the project. Assess its objectives, use case, and growth potential. Evaluate the team’s expertise, past experience, and credibility.

Also, analyze token economics, including supply, distribution, and investor benefits. Verify the underlying asset’s legitimacy and valuation. Seeking financial or legal guidance can help ensure informed decision-making and regulation compliance.

2. Register on a Regulated Platform

To participate in an STO, sign up on a compliant platform that facilitates security token investments. Regulated exchanges or issuance platforms conduct KYC and AML checks to verify investor identity. Some offerings may utilize BEP20 tokens for added flexibility and efficiency.

Providing personal details, proof of funds, and accreditation status may be required. Completing this step ensures secure transactions and compliance with jurisdictional securities regulations.

3. Fund Your Account

Once registered, deposit funds into your account using accepted payment methods such as bank transfers, cryptocurrencies, or stablecoins.

Some platforms may require fiat-crypto conversion, depending on the STO’s structure. Ensuring sufficient funds and confirming transaction fees helps avoid delays. Always use secure channels to protect financial data and maintain regulatory compliance.

4. Invest in the STO and Receive Your Tokens

After funding your account, choose the STO you wish to invest in and confirm your purchase. The platform will process your investment, and upon completion, security tokens will be issued to your wallet. These tokens grant ownership or rights based on the STO terms. Once listed on exchanges, you may trade them or hold them for long-term benefits.

Factors to Consider Before Launching an STO

A well-planned STO requires careful consideration of several key factors:

1. What is Tokenized?

Determining the type of asset to tokenize—whether equity, debt, or physical assets—shapes the STO’s legal and financial structure. Each asset class has specific regulatory requirements and investor expectations.

Proper valuation, liquidity potential, and long-term viability must be assessed to ensure the tokenized asset aligns with investor demand and compliance frameworks, maximizing the success of the offering.

2. AML and KYC

Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance are mandatory to prevent fraud, ensure regulatory adherence, and verify investor identities. STO issuers must implement automated KYC procedures and real-time monitoring to detect suspicious transactions.

Non-compliance can lead to regulatory penalties, loss of investor trust, and restrictions on listing security tokens on regulated exchanges.

3. Proper Corporate Framework and Governance

A strong corporate framework is essential for aligning STO operations with legal requirements and investor protections. This includes establishing a compliant business structure, drafting clear shareholder agreements, and defining token holder rights.

Governance mechanisms, such as transparent reporting and dispute resolution frameworks, help maintain credibility and ensure long-term investor confidence in the offering.

4. Tokenization Platform

Selecting the right tokenization platform ensures secure issuance, management, and trading of security tokens. A well-planned token development process ensures the platform supports regulatory compliance, integrates smart contract automation, and provides seamless investor access.

Features such as built-in compliance protocols, custodial services, and secondary market support enhance liquidity while reducing operational complexities for both issuers and investors.

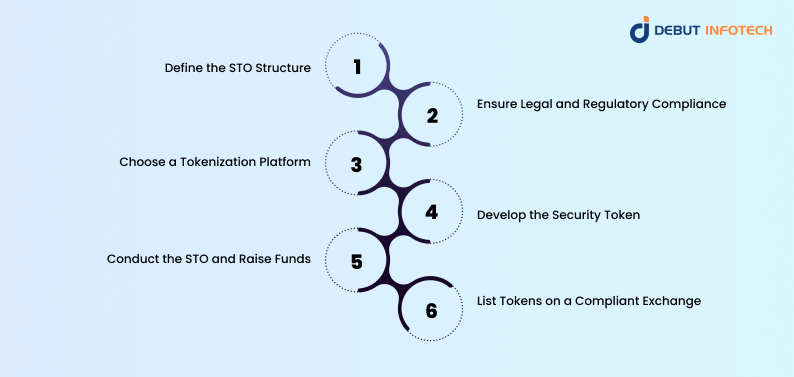

Steps to Launch an STO

Launching a successful STO involves the following six steps:

1. Define the STO Structure

Determine the type of security token—equity, debt, or asset-backed—based on business objectives. Establish token supply, investor rights, and compliance measures. Consider factors like dividend distribution, voting rights, and transferability.

A well-defined structure ensures regulatory approval, enhances transparency, and builds investor trust in the offering.

2. Ensure Legal and Regulatory Compliance

Engage legal experts to assess regulatory requirements across jurisdictions. Compliance with SEC, FINMA, ESMA, or local securities authorities is crucial.

Prepare legal documents like token purchase agreements and investor disclosures. Ensuring proper licensing, KYC/AML procedures, and smart contract compliance minimizes legal risks and promotes a smooth STO launch.

3. Choose a Tokenization Platform

Selecting a secure and scalable blockchain network is essential for compliance and efficiency. Platforms like Ethereum, Tezos, or Polymath offer token standards such as ERC-1400 for security tokens.

Features like automated compliance, investor authentication, and auditability must be integrated to facilitate smooth issuance, management, and secondary market trading.

4. Develop the Security Token

Program smart contracts to enforce compliance, automate transactions, and ensure security. Define token functionality, including ownership rights, dividend distribution, and transfer restrictions. Partner with blockchain developers or an IDO development company to conduct security audits, preventing vulnerabilities.

A well-structured security token strengthens regulatory adherence, enhances transparency, and simplifies corporate governance for long-term market credibility.

5. Conduct the STO and Raise Funds

Develop a marketing strategy targeting accredited investors through institutional channels and private placements. Implement investor verification (KYC/AML) before accepting funds. Set up a compliant fundraising mechanism using STO platforms. Clear investment terms, transparent communication, and legal assurance help attract institutional backing and secure necessary capital efficiently.

6. List Tokens on a Compliant Exchange

Post-STO, security tokens must be listed on regulated exchanges like tZERO or INX to provide liquidity. Ensure the exchange complies with securities laws and investor eligibility requirements.

A successful listing enables trading under regulatory oversight, broadens investor access, and enhances long-term token value while maintaining transparency in transactions.

Ready To Launch Your STO The Right Way?

Let’s handle the legalities, tokenization, and investor onboarding—so you can focus on raising capital.

Conclusion

By combining blockchain technology with securities regulation, STOs provide a trusted, compliant, and regulated framework for investing in digital assets. They allow issuers to access a broader investor base while providing investors with peace of mind.

While tokenized assets offer advantages, including improved liquidity, fractional ownership, and greater security, issuers face various regulatory and technical hurdles. In order to successfully launch any STO, meticulous planning, compliance with legal and regulatory obligations, and strategic execution are crucial.

FAQs

STOs and ICOs might look similar, but they’re not. ICOs offer utility tokens with little regulation, while STOs are backed by real assets and follow strict financial laws. STOs give investors legal rights, making them safer but more complex to launch than ICOs.

STOs have to follow securities laws, which vary by country. Companies usually need to register with financial authorities, provide clear disclosures, and ensure investor protection. There’s also a lot of paperwork, KYC/AML checks, and compliance measures to keep everything above board.

Almost anything with value can be tokenized—real estate, company shares, fine art, or even revenue streams. The key is that these tokens represent a stake in something real, making them different from the typical crypto tokens you see in ICOs.

Regulations depend on the country. In the U.S., the SEC keeps a close eye on STOs, enforcing strict compliance. Europe has its own rules, and some places, like Switzerland and Singapore, are more STO-friendly. The bottom line: companies must follow local securities laws or face penalties.

While STOs are more secure than ICOs, they’re not risk-free. Regulations can change, markets can be unpredictable, and liquidity isn’t always guaranteed. Also, if a company doesn’t comply with legal requirements, investors could lose money or face complications retrieving their funds.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment