Table of Contents

Home / Blog / Cryptocurrency

What is a Paper Wallet – Your Secure Crypto Cold Storage

November 4, 2024

November 4, 2024

Paper wallets have long been regarded as a secure method of storing cryptocurrency offline, providing protection against hacking and online theft. Because of this, many cryptocurrency holders prefer offline storage methods like paper wallets over online storage methods.

According to a report by Statista, the number of users in the crypto market is projected to reach 861.00m users in 2025. This implies that millions of investors are seeking the safest ways to store their digital assets. While hardware wallets have gained popularity, paper wallets remain a viable option for long-term holders looking for an affordable, offline solution.

This article will define paper wallets and how to use and create them. We will also explore how paper wallets work, their advantages and disadvantages, and the key factors to consider before using them.

Unlock the potential of paper wallets for secure crypto storage.

Partner with Debut Infotech to implement cutting-edge solutions for safeguarding your digital assets

What is a Paper Wallet?

A paper wallet is a method of storing cryptocurrency offline by writing (or printing) the personal and public keys onto a piece of paper. Unlike other storage methods, such as hardware or software wallets, a paper wallet does not use any form of digital storage. Therefore, it is a safe way to store cryptocurrencies for the long term.

At the core, a Bitcoin paper wallet involves the creation of two sets of cryptographic keys (private and public) that are generated online and stored physically with no connection to any network. This reduces the risk of online hacks, malware, or phishing attacks.

You need the public key when you want someone to send you any cryptocurrencies, while private keys are what give you access to your funds. Without access to the private key, no one can spend the funds associated with the wallet.

Related Article: Top 10 Crypto Wallet Companies in 2024

History of Paper Wallet

The history of paper wallets traces back to the early days of Bitcoin, when security was a major concern for cryptocurrency holders. As the first decentralized digital currency, Bitcoin required innovative storage solutions.

When digital wallets first started out, they were generally software-based and often connected to the internet, in which case users would lose funds if their computers were hacked. Paper wallets arrived as the solution around 2011, providing a way to store private keys offline.

The idea was simple: users could generate a Bitcoin address and its corresponding private key, print it out, and store it securely in a physical location. The private key printed on the paper allowed access to the funds stored in the corresponding Bitcoin address. Since the private key was offline, this method provided an additional layer of security, protecting users from cyber threats.

Paper wallets gained popularity during Bitcoin’s growth in the early 2010s as users sought secure ways to store their wealth. Various tools and websites were created to help users generate paper wallets securely. These tools allowed users to create wallets offline, reducing the risk of exposure to potential online threats.

However, with technology and security protocols further evolving, paper wallets began to lose popularity. This led to consumers choosing hardware wallets and more secure software solutions for storing their cryptocurrency, providing a better UI/UX with added functionality.

Despite still being possible to use as cold storage, today, a cryptocurrency paper wallet is viewed more like a specialist device, with users being encouraged to use it only if they follow proper security rules.

How Paper Wallets Work

Paper wallets function by leveraging the principles of public and private key cryptography. When you generate a paper wallet, it creates a unique set of keys—one public and one private. The public key, sometimes represented as a QR code, allows you to receive cryptocurrency by sharing it with others. Meanwhile, the paper wallet private key, which must remain confidential, is the key to accessing and managing your funds.

Paper wallets work entirely offline, which reduces the risk of digital theft. To create one, you typically use an open-source generator that runs on your computer without needing an internet connection. This ensures that the keys are not exposed to any potential online threats during the generation process. Once the wallet is created, you print or write down the keys, and the wallet can now receive funds. However, the process of spending or transferring the funds from the wallet requires importing the private key into a digital wallet software.

The security of paper wallets lies in the fact that the private key never exists in a digital form outside of the brief moment when it is generated. Once printed or written, the key can be stored safely offline. The only risk comes from physical damage or theft of the paper itself, meaning proper storage is crucial.

How to Use and Create a Paper Wallet

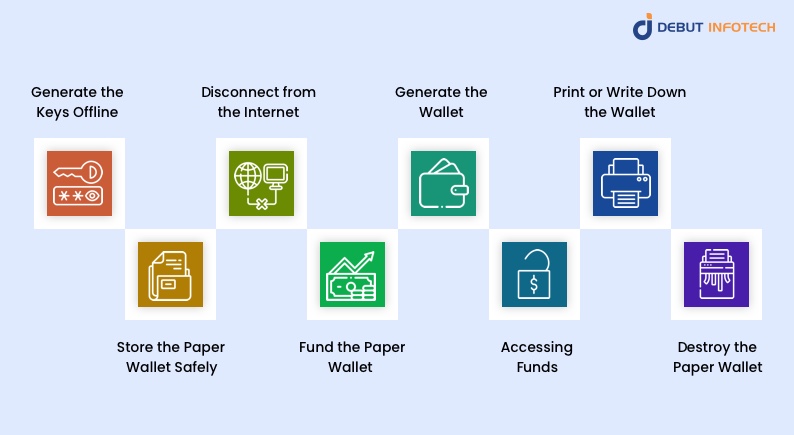

Creating a paper wallet requires attention to detail, as any misstep could lead to loss of funds. Here’s a step-by-step guide on how to make a paper wallet to ensure a secure process:

1. Generate the Keys Offline

Start by using a trusted and open-source paper wallet generator like BitcoinPaperWallet.com or WalletGenerator.net (or even Solana paper wallet). Download the generator to your local machine to ensure the process is completed offline, protecting your keys from being intercepted online.

2. Disconnect from the Internet

To further enhance security, disconnect your computer from the internet entirely. This step ensures that no malicious actor can intercept the key generation process.

3. Generate the Wallet

Run the wallet generator on your offline machine. The software will generate a new set of public and private keys. Depending on the generator, these keys may also be presented as QR codes for easy scanning and future use.

4. Print or Write Down the Wallet

After generating the keys, print the wallet on paper using a printer that is not connected to the internet. If you prefer, you can write down the keys manually, but make sure to double-check the accuracy of each character. Ensure that the printer does not store any copy of the document in its internal memory.

5. Store the Paper Wallet Safely:

Once printed, the paper wallet must be stored in a secure place. Some users opt for fireproof safes, deposit boxes, or sealed envelopes to protect the wallet from physical damage. It is crucial that no one else has access to your private key.

6. Fund the Paper Wallet:

To deposit cryptocurrency into your paper wallet (i.e., Solana paper wallet), use the public key provided. You can share the public key with others or use it yourself when transferring funds from another wallet or exchange. The private key should never be shared.

7. Accessing Funds:

When the time comes to spend or transfer your cryptocurrency, you’ll need to import or “sweep” the private key into a digital wallet that supports paper wallets. Wallets such as Electrum or Mycelium can import the private key by scanning the QR code or manually inputting the string.

8. Destroy the Paper Wallet:

After using the funds or transferring them to a more secure method, it is wise to destroy the paper wallet to ensure it cannot be used again. Since private keys are not reusable, keeping the paper wallet after funds have been transferred could lead to confusion or vulnerability.

Benefits of Paper Wallets

1. Enhanced Security

Paper wallets are immune to cyber threats such as malware, phishing, or hacking attempts because they exist entirely offline. This is one of their most significant advantages, as no digital file is vulnerable to exploitation. Best crypto wallets also keep digital assets secure.

2. Cost-Effective

Unlike hardware wallets, which may require a financial investment, creating a paper wallet is essentially free. All you need is a printer, paper, and a secure way to store the printed document.

3. Control Over Funds

A paper wallet gives complete control to the user. There are no third-party intermediaries or dependencies on software services, meaning that as long as you have access to the physical wallet, you control the funds.

4. Long-Term Cold Storage

For individuals looking to hold cryptocurrency long-term, paper wallets provide an easy way to store funds without needing constant management or software updates. Once the wallet is generated and stored, no further action is required.

5. Privacy

Because paper wallets can be generated offline and do not require user information, they provide an additional layer of privacy compared to wallets, even a white label crypto wallet, hosted on exchanges or online services, which often require personal details for account creation.

Disadvantages of Paper Wallets

1. Physical Vulnerability

One of the greatest risks to paper wallets is their physical nature. Paper can easily be damaged by fire, water, or general wear and tear. If the wallet is lost or destroyed, access to the associated cryptocurrency is permanently lost as well.

2. Human Error

The process of creating a paper wallet involves several manual steps, including writing or printing keys and storing them safely. Any error in this process—such as misplacing the paper, printing a corrupted version, or failing to record the keys correctly—can result in permanent loss of funds.

3. Difficult to Access Funds

Unlike hardware or software wallets, which provide easy and convenient access to your funds, paper wallets are cumbersome to use. To spend or transfer cryptocurrency, the private key must be imported into a digital wallet, adding complexity and the potential for user mistakes.

4. No Backup Mechanism

Since a paper wallet is a physical object, there is no built-in backup mechanism. If the paper is lost, stolen, or destroyed, the cryptocurrency is lost as well. Some users create multiple copies, but this introduces new security risks by increasing the chances of unauthorized access.

5. Less Practical for Regular Use:

Paper wallets are not designed for everyday transactions. They are best suited for long-term holding, as importing private keys repeatedly to access funds is inefficient and introduces additional risks with each use.

Factors to Consider Before Using a Paper Wallet

1. Security vs. Convenience

Paper wallets offer high security but at the cost of convenience. If you plan to hold your cryptocurrency for years without frequent transactions, a paper wallet could be a good option. However, if you need regular access to your funds, a hardware or software wallet might be more practical.

2. Proper Storage

Consider how and where you will store your paper wallet. Environmental factors such as humidity, fire risk, or accidental loss could destroy your wallet. Fireproof safes or bank deposit boxes can offer additional protection, but they also come with their own costs and risks. You can seek professional guidance from a top-rated cryptocurrency wallet development company like Debut Infotech.

3. Backup Copies

Some users make duplicate copies of their paper wallets to prevent accidental loss. While this can protect against physical destruction, it also increases the risk of theft. If you choose to make backups, ensure they are stored in separate, secure locations.

4. Reliability of Key Generation

Using a trusted and offline wallet generator is essential. Ensure that the generator you choose has a solid reputation and can be used without exposing your keys to potential online threats. Some users go as far as using air-gapped computers to create their paper wallets, further reducing any risk of exposure.

5. Plan for Future Access

Since paper wallets are not as common today as they once were, consider the steps required to access your funds in the future. Will the software needed to import private keys still be available and compatible with future systems? Consider having a reliable method of accessing the funds if the need arises.

6. Emergency Access

Plan for emergencies where someone else may need to access your funds. Ensure trusted individuals know how to locate and use the paper wallet if needed. While this can be a sensitive topic, having a plan in place can prevent lost assets in the case of death or incapacity.

7. Consider Alternative Solutions

As technology evolves, more advanced and secure methods of cryptocurrency storage have emerged. The demand for blockchain wallet development is also on the rise. Hardware wallets, in particular, offer many of the same security benefits as paper wallets without the risk of physical damage or human error. Before committing to a paper wallet, weigh the pros and cons of using more modern solutions.

Ready to secure your crypto with a paper wallet?

We offer expert guidance on safe storage solutions to protect your digital assets with ease.

Conclusion

Paper wallets offer a secure, offline method of storing cryptocurrency that is ideal for long-term holders who want to minimize exposure to digital risks. However, they come with unique challenges, including physical vulnerability, human error, and the need for careful planning.

While paper wallets were once a popular choice, many users have transitioned to hardware wallets, which provide similar levels of security with greater convenience. Before deciding to use a paper wallet, consider your individual needs, the risks involved, and whether more modern alternatives might offer a better balance of security and convenience.

Suppose you still insist on using paper wallets. In that case, it’s vital to follow the best practices in generating and storing it, so your private key can be saved from both physical and digital threats.

FAQs

Paper wallets can still be safe, but they’re not as popular or convenient as other options like hardware wallets. The safety depends on how carefully you generate and store them. If you create the wallet offline using secure tools and keep it in a place inaccessible to others (like a safe), they’re pretty secure. However, because they are literally a piece of paper, they can easily be lost, damaged, or stolen. So, while they offer protection from online hacking, they come with their own set of risks. Make sure you backup and secure your paper wallet properly if you decide to use one.

A paper wallet is a physical piece of paper containing your cryptocurrency’s private and public keys. It’s often printed as a QR code for easy scanning when making transactions. On the other hand, a brain wallet is entirely in your head—it’s a private key you generate using a passphrase that you remember. The downside to brain wallets is that they’re susceptible to guessing attacks if your passphrase isn’t strong enough. Paper wallets, in contrast, are vulnerable to physical damage or theft. In short, a paper wallet is something you can hold, while a brain wallet relies solely on your memory.

To move bitcoins out of a paper wallet, you need to “sweep” the private key into a digital wallet, like a software wallet or a mobile app. This involves scanning the private key (often printed as a QR code) and transferring the balance to another wallet that’s connected to the internet. Once the transfer is complete, the funds are no longer associated with the paper wallet, and it’s generally considered unsafe to reuse that paper wallet since the private key has been exposed to an online environment.

Transferring funds from a paper wallet is a similar process to withdrawing them. You’ll need a digital wallet that can scan the QR code or allow you to input the private key manually. The digital wallet will then take the funds stored on the paper wallet and transfer them to a new address, either to another wallet you own or to someone else’s wallet. Once that’s done, the private key on the paper wallet should be considered compromised, so it’s best to avoid reusing it for future transactions.

If you lose your Bitcoin paper wallet, unfortunately, there’s no way to recover the funds it holds. The private key is the only access to your cryptocurrency, and if that’s lost, so are the coins associated with it. It’s like losing a key to a vault with no duplicate or recovery option. That’s why it’s crucial to store paper wallets in secure, multiple locations or create backups. Some people even laminate them to protect against damage. Still, the key is always to have a backup plan for recovery, just in case.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment