Table of Contents

Home / Blog / Cryptocurrency

Crypto Hardware Wallets: Everything You Need to Know

November 14, 2024

November 14, 2024

Imagine buying bitcoins in 2012 for around $14, only to lose most of it in November 2022 when the price soared past $17,000. Think of it: millions of dollars in crypto investments, built up over a decade ago, vanished because a company executive chose to gamble with your hard-earned money. This was the experience of many crypto investors who traded on FTX and lost millions when the exchange declared bankruptcy in November 2022. This could have been avoided if they had stored their crypto offline in a crypto hardware wallet.

Storing cryptocurrency offline in a crypto hardware wallet protects your assets during events like exchange collapse because offline storage–often called cold storage–keeps your private keys out of reach from the internet. This reduces exposure to the risks tied to exchanges like insolvency and hacking.

With crypto hardware wallets, you alone control the private keys to your crypto assets, meaning that only you can authorize transactions. In essence, you become your own bank. While hardware wallets offer a higher level of protection against insolvency and hacking, you need a clear understanding of how they work to help secure your crypto assets better.

This article provides a detailed guide on crypto hardware wallets, their features, security benefits, and how they fit into the broader context of crypto storage solutions. Whether you’re new to crypto or a seasoned investor, this guide will help you understand why you need a crypto hardware wallet for long-term asset protection.

Leverage Hardware Wallets for Secure Crypto Asset Management

Partner with Debut Infotech to build secure hardware wallets for enhanced crypto asset protection.

What is a Crypto Hardware Wallet

A crypto hardware wallet is a physical device–typically resembling a USB drive–in which you can store the private keys needed to access your cryptocurrency assets. Unlike software wallets, which are connected to the internet, these devices are not vulnerable to online attacks. This means that hackers cannot access your private keys even if the device your hardware wallet is connected to is compromised.

Hardware wallets support various types of cryptocurrencies and are compatible with popular software wallets, making it easy to manage your assets with a secure physical device.

The Evolution of Crypto Hardware Wallets

The evolution of crypto hardware wallets started with the introduction of Bitcoin Core in 2009. At the time, Bitcoin Core allowed users to manage their Bitcoin by controlling their private keys. This was done to improve security as Bitcoin users engaged with the Blockchain.

As cryptocurrency became more popular, exchanges began offering custodial services to provide convenient storage for crypto asset holders who traded on these platforms. While these custodial wallets are much more convenient for crypto trading, they come with an increased risk of hacking. These vulnerabilities prompted the demand for enhanced security.

In response to the rising security concerns, companies started offering cold storage methods. For example, Armory introduced a cold storage method in 2011 that utilized multi-signature wallets to keep private keys offline. With the increase in custodial wallet hacks, crypto investors started to prioritize security over convenience, prompting crypto companies to roll out more secure wallet options.

This quest for a more robust security solution culminated in the inception of hardware wallets such as Trezor, Ledger, KeepKey, Coldcard, etc. These hardware wallets improved the security of crypto assets, establishing a new standard for safeguarding your crypto assets in an increasingly complex and often vulnerable environment.

How a Crypto Hardware Wallet Works

If you’re looking to store your cryptocurrency offline, understanding how a crypto hardware wallet works can help you gain confidence in its security and encourage you to make the switch sooner.

Here’s how these devices function in securing your assets

1. Key Generation

When setting up a hardware wallet, the wallet generates your unique private key, which it stores inside the device. It also generates a public address derived from the private key, which others can use to send you cryptocurrency.

2. Transaction Signing

When you wish to send crypto to another account, the hardware wallet signs the transaction with your private key, allowing you to send the funds securely. The signed transaction is then transmitted to the Blockchain, but your private key stays in your device.

3. Secure Verification

Hardware devices require a PIN or passphrase before you can use them, and most of them also come with two-factor verification to offer an added layer of protection. Additionally, most hardware wallets display transaction details on an external screen so that you can verify transactions before giving the go-ahead. This helps reduce the risk of malware and phishing scams.

Key Benefits of a Crypto Hardware Wallet

Are you thinking of switching to a hardware wallet?

Here are the most convincing reasons to make the switch today:

Enhanced Security

With hardware wallets, you do not have to worry about hackers getting into your wallet or losing your investment to insolvency. Even if your computer has been hacked, your hardware wallet keeps your crypto assets safe from unauthorized access.

Full Ownership and Control

If you learned anything from the FTX debacle, it should be that keeping your crypto assets safe is your responsibility and no one else’s.

Hardware wallets offer unprecedented control over how and when your cryptocurrency is used. With a hardware wallet, nothing happens except you want it to.

Multi-Currency Support

Most hardware crypto wallets support multiple cryptocurrencies. This allows you to store all your different crypto assets in one place. Many are also compatible with custodial wallets, allowing you to trade on popular crypto exchanges conveniently.

Portability and Accessibility

Most hardware crypto wallets are small enough to fit in your pocket, and many are about the size of a USB drive, making them easy to carry about and store securely.

Disadvantages of Hardware Crypto Wallets

While hardware best crypto wallets improve security, they also come with certain drawbacks. Highlighting these drawbacks does not take anything from hardware crypto wallets; it simply equips you with all the information you need to make a more informed decision.

1. Initial Cost

Hardware crypto wallets can be pricey, with some costing over $200. In comparison, software crypto wallets are typically free. The pricing of hardware crypto wallets makes them suitable for those who hold substantial amounts of cryptocurrency.

2. Complexity

Setting up and using a hardware wallet can involve more steps than a software wallet. This can be a barrier for new crypto users who might find the process daunting.

3. Single Point of Failure

While the private keys are stored securely offline, the hardware device itself becomes a single point of failure. If the device is damaged, lost, or stolen, you’ll need your recovery phrase to regain access to your funds.

4. Limited Functionality

Hardware wallets are primarily designed for secure storage. They may not offer all the features of a software wallet, such as integrated exchange functionality or advanced trading tools.

Types of Crypto Hardware Wallets

Crypto hardware wallets can be categorized into two classes based on their connection type. These are:

- Air gapped wallets

- Wireless-enabled wallets

Air-Gapped Wallets

An air-gapped wallet is a cryptocurrency wallet that is disconnected from the Internet and any form of wireless communication. It aims to provide an additional layer of security against potential hacks and exploits by signing transactions in an offline environment.

Although air-gapped hardware wallets were once thought to be totally disconnected from the internet, this definition has since changed. Currently, these wallets use two primary strategies:

- Fully air-gapped: These wallets are physically isolated from any network connection. For offline signatures, they transmit transaction data using techniques like QR codes or detachable storage.

- Partially air-gapped: These hardware wallets use a USB connection to provide limited functionality. But most importantly, they keep an air gap for the most important part, which is the storage of private keys. With partially air-gapped wallets, unsigned transaction data is sent over USB, and the signature process takes place solely inside the wallet’s safe environment.

Wireless-Enabled Wallets

Hardware wallets that are wirelessly enabled include Bluetooth or NFC for a better user experience. This makes linking mobile devices simple, and you can even activate contactless payment features.

However, despite this wireless capability, the wallet still protects the private keys. If you want a high degree of security and a slightly more simplified use, these wallets are ideal.

You may also like to read about AI Integrated Smart Crypto Wallet

How to Use a Crypto Hardware Wallet

Using a hardware crypto wallet is easy; just follow these steps:

- Connect the wallet to your device and follow the instructions displayed on the screen.

- Next, create a PIN or password

- Record your recovery phrase. The wallet generates a recovery phrase and displays it on your device screen. You should write it down on multiple sheets of paper and keep it safe. Do not store it digitally.

- Once you are done setting it up, test the wallet by sending a small transaction.

Hardware Wallet vs. Software Wallet

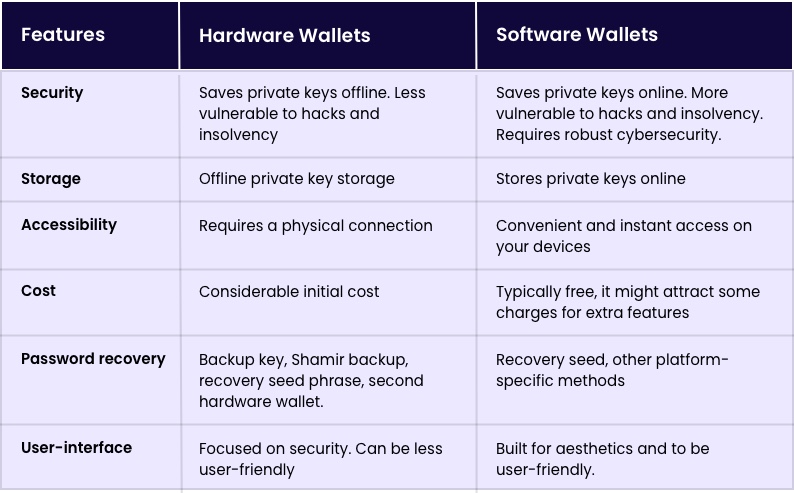

The major difference between a hardware wallet and a software wallet is that the former stores your private keys offline while the latter does so online. This difference makes one (hardware) more secure than the other (software).

The table below highlights key differences and the specifics of each distinction between them.

Factors to consider when choosing a crypto hardware wallet

To guarantee security, ease of use, and suitability for your requirements, there are a number of considerations to make while choosing a cryptocurrency wallet:

- Security: Seek out wallets with multi-signature capabilities, two-factor authentication, and robust encryption. Additionally, consider whether the wallet has passed extensive security assessments and is open-source.

- Control of Private Keys: Make sure you have complete authority over your private keys. A wallet that is directly under your control is more secure than one that a third party manages.

- Device Compatibility: Consider whether you want a wallet that works with mobile devices, desktop PCs, or both. While some wallets are platform-specific, others are accessible on several platforms.

- EAL Rating: Hardware wallets are frequently rated according to the Evaluation Assurance Level (EAL). This uniform score reflects the degree of security assessment the gadget has received. The wallet’s security is more certain when the EAL level is higher (for example, EAL5+ or EAL6+), which indicates more thorough testing and verification.

Best Crypto Hardware Wallets In 2025

Here is a list of the best crypto hardware wallets you can get your hands on in 2025. In compiling this list, we made sure to check what customers were saying about them. We also tried to include those that are well-rated but do not require you to break the bank.

Without further ado, here is a list of the best crypto hardware wallets:

Ledger Nano S Plus

This hardware wallet is highly secure. It comes equipped with an EAL6+ secure element chip. Additionally, it supports over 5,500 cryptocurrencies, allowing you to store all your crypto assets securely in one place.

Furthermore, it comes with a bigger screen and more storage than the Nano S. The Nano S Plus is perfect for those who need large storage, high security, and an easy-to-use hardware wallet.

Trezor Safe 3

Trezor Safe 3 is one of the best cold hardware wallets available. It supports over 7000 digital assets and features a new Secure Element chip that is certified EAL6+ and designed to withstand brute-force attacks. The code is open-source, so users can conduct their audit and determine whether the firmware is reliable.

Additionally, the Trezor Safe 3 comes with great backup options, including recovery seeds and the advanced Shamir Backup, which splits the recovery seed into several shares. This improves the wallet’s security and also makes it easier to use.

NGRAVE ZERO

Touted as “the coldest wallet” because of its EAL7 rating, the NGRAVE ZERO is designed with ultimate security in mind. It operates entirely offline (air-gapped), minimizing the risk of hacks.

The NGRAVE ZERO features a high-resolution touchscreen, and its premium materials and construction reflect its commitment to top-tier protection. This wallet is worth getting if you want an uncompromising level of security and are willing to invest in it.

Ellipal Titan 2.0

With the Ellipal Titan, you can effortlessly link your wallet to decentralized apps over an extremely safe air-gapped connection. The Ellipal Titan 2.0 does not support Bluetooth, WiFi, or wired connections; rather, it uses QR codes for everything.

With its support for 46 blockchains, Ellipal Titan 2.0 can handle more than 10,000 cryptocurrency assets. You can even stake, earn interest, and use DeFi platforms from the wallet. The Ellipal Titan 2.0 is perfect for you if you want a totally air-gapped hardware wallet.

Ready to Develop Custom Secure Hardware Wallets?

Debut Infotech specializes in developing secure wallet solutions that guarantee enhanced protection for your cryptocurrencies.

Conclusion

Crypto investors are increasingly making the switch from software wallets to hardware wallets, prompted by increasing cybersecurity threats.

If you are thinking of creating a software crypto wallet, then security should be your top priority. As such, you need to work with a cryptocurrency wallet development company like Debut Infotech, with years of experience creating some of the most secure software wallets in the market

Get in touch today, and we’ll help you build the safest wallet at the best price.

Frequently Asked Questions

The best hardware crypto wallets typically have a high EAL rating, store multiple cryptocurrencies, have several password recovery options, and feature easy-to-use interfaces. Some hardware wallets that balance these features include:

Trezor safe 3

BC vault

Ledger Nano S Plus

Tangem wallet

Ellipal Titan 2.0

It depends on what you want. If you have substantial amounts of cryptocurrencies, a hardware wallet might be a great option since it is more secure than “hot wallets,” which are connected to the internet.

While both Trezor and Ledger are quality wallets for crypto investors, ledger might be the better option if you value ease of use and features like staking. However, if you prefer lower prices and transparency, then Trezor may be the right choice for you.

No. Trust Wallet is not a hardware wallet. It is a popular software wallet that grants you self-custody. However, like all software wallets, it is prone to hacking.

To choose a hardware wallet, you first need to check its EAL rating. Hardware wallets with higher EAL ratings are typically more secure. Next, you should consider other features like user experience, accessibility, wallet type, etc. Finally, you should consider the crypto wallet development cost.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment