Table of Contents

Home / Blog / Cryptocurrency

What are Asset-Backed Cryptocurrencies?

February 27, 2024

February 27, 2024

Asset backed cryptocurrencies give investors confidence by offering underlying assets that can be independently verified and certified in this era of decentralization, where trust and accountability are crucial. The inherent worth of the assets supporting these cryptocurrencies, along with the immutability of blockchain technology, stimulates a broader acceptance and use of cryptocurrencies in the global financial system.

Asset backed cryptocurrency are intrinsically linked to physical assets, actual commodities, or conventional financial instruments, in contrast to typical cryptocurrencies like Bitcoin or Ethereum, which get their value only from market demand and speculative trading. Both seasoned investors and novices are drawn to this combination because it offers the digital financial ecosystem a new degree of security, transparency, and verifiability.

With an emphasis on smart contracts and various assets, this article will examine the best asset backed cryptocurrencies and the financial innovation influencing the direction of digital finance.

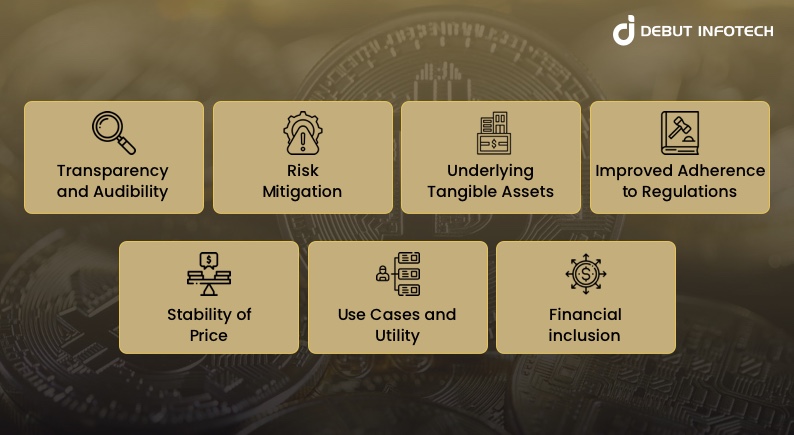

Characteristics of Asset-Backed Cryptocurrencies

Unlike traditional cryptocurrencies like Bitcoin and Ethereum, which run on blockchain technology, asset-backed cryptocurrencies (ABCs) offer actual backing and intrinsic value, revolutionizing digital asset interactions. Some of the characteristics include the following:

- Transparency and Audibility

When it comes to transparency, asset-backed cryptocurrencies frequently outperform traditional ones. These tokens can be independently audited and verified because they are backed by tangible assets. Users and investors benefit from this transparency because it gives them peace of mind that the value of their ABC holdings is supported by actual, physical assets.

- Risk Mitigation

ABCs’ underlying assets reduce some of the risks of regular cryptocurrencies. Because ABCs’ value is tied to physical things, they offer some risk hedging against market downturns, whereas unbacked cryptocurrencies are more vulnerable to market emotion and speculative bubbles.

- Underlying Tangible Assets

The existence of underlying physical assets is the primary distinction between ABCs and conventional cryptocurrencies. ABCs are not like Bitcoin or entirely digital tokens; their value comes from physical assets like real estate, precious metals, fiat currencies, and commodities. Since their value is closely correlated with the performance of the assets they represent, these tangible reserves give ABCs a certain level of stability and trust.

- Improved Adherence to Regulations

Because asset-backed cryptocurrencies have inherent links to real-world assets, authorities and regulators frequently support them. An additional degree of legitimacy and accountability provided by the backing of actual reserves can help integration into current regulatory systems go more smoothly.

- Stability of Price

The well-known price volatility of traditional cryptocurrencies is one of their main problems. Due to external variables, investor sentiment, and market speculation, the value of non-backed coins is prone to extreme fluctuations. On the other hand, ABCs provide more stability because of their underlying asset reserves. Because ABCs’ price swings are more directly correlated with the performance of the underlying assets, their valuation is comparatively more stable.

- Use Cases and Utility

Beyond simple investing and speculation, asset-backed cryptocurrencies can have unique applications and benefits. For example, some ABCs might make remittances, cross-border transactions, or fractional ownership of valuable assets easier. These use cases increase ABCs’ practicality and usefulness in the actual world, elevating them above the status of theoretical tools.

- Financial inclusion

ABCs can help promote financial inclusion by fusing the advantages of blockchain technology with real support. They can offer a method for those who don’t have access to traditional banking services to engage with the global financial ecosystem, creating avenues for investment and empowering people economically.

Advantages of Asset-backed Cryptocurrency

Asset-backed cryptocurrencies, or ABCs, transform digital finance by fusing blockchain technology with physical assets, providing special global advantages to consumers and investors. These cutting-edge tokens are appealing to both novices and experts. Read on to find the main benefits of cryptocurrencies backed by assets.

- Consistency and Decreased Volatility

They offer intrinsic stability compared to ordinary cryptocurrencies because they are connected to physical assets like precious metals, real estate, fiat currencies, asset-backed cryptocurrencies, or ABCs. Because of its stability, investors are more confident, and risk-averse people looking for a trustworthy online retailer are drawn to it.

- Transparency and Substantiality

Because asset-backed cryptocurrencies retain underlying assets in reserve and permit public audits, they enhance verifiability and transparency within the financial sector. Given that the value of these tokens is closely linked to physical assets, the transparency of digital assets promotes confidence and accountability, which in turn drives their wider adoption and acceptance.

- Reduced Risk to Counterparties

Regarding peer-to-peer transactions, asset-backed cryptocurrencies leverage blockchain technology, whereas traditional financial systems introduce counterparty risk through intermediaries. By automating procedures, smart contracts lower the chance of fraud or default by guaranteeing that duties are completed.

- Improved Inclusion and Accessibility

Cryptocurrencies with asset backing give new financial options to people who can’t use standard services. Anybody with a smartphone and internet connection can invest in these digital assets, enabling underbanked and unbanked people worldwide to become more financially inclusive and economically empowered.

- Fractional Owned Assets and Liquidity

By dividing big assets like real estate or artwork into more manageable, tradable units, tokenization of assets enables fractional ownership. This innovation democratises investing by allowing anyone to hold a portion of valuable assets. Because fractional tokens are easily traded on blockchain-based exchanges, improving asset liquidity.

- Opportunities for Diversification

By providing diversification among traditional assets, cryptocurrencies, and commodities, asset-backed cryptocurrencies expand investment alternatives and may minimize risk and optimize returns through portfolio diversification.

- Global Reach and Efficiency

By removing middlemen and fees and enabling borderless transactions, ABCs employ blockchain technology to make asset-backed cryptocurrencies appealing for remittances and cross-border transactions. This allows for more affordable value transfer.

The Best Asset-Backed Cryptocurrencies

Several asset-backed cryptocurrencies have attracted interest due to their novel ideas and possible benefits. These are a few instances of well-known lists of asset-backed cryptocurrencies:

- USDT, or Tether

One of the most well-known stablecoins backed by fiat money is Tether. To maintain openness and user confidence, the reserves supporting the stablecoin are routinely inspected, and each USDT token is set to equal one US dollar.

- USD Coin (USDC)

Like Tether, USD Coin is a stablecoin with a one-to-one dollar backing from the US dollar. Its usage in numerous decentralized finance (DeFi) applications and adherence to regulatory norms have contributed to its popularity.

- PAX Gold (PAXG)

PAX Gold is a cryptocurrency backed by physical gold ownership. One troy ounce of a London Good Delivery gold bar supports each PAXG token, giving investors digital exposure to precious metals.

- USD Binance (BUSD)

Binance Stablecoin USD is distributed by Binance, a cryptocurrency exchange. Because of its affiliation with a reliable exchange, it has been extensively used for trade reasons and is backed by the US dollar.

- Franc (XCHF) cryptocurrency

Stablecoin CryptoFranc is linked to the Swiss Franc (CHF). It uses the Ethereum blockchain and undergoes routine audits to make sure the necessary reserves equal the total amount of tokens that have been issued.

- Terra (Luna)

A leading blockchain platform, Terra, offers stablecoins linked to several fiat currencies, like the TerraSDR (SDR-Special Drawing Rights), a collection of global reserve currencies.

- Bitcoin wrapped (WBTC)

On the Ethereum network, Wrapped Bitcoin is an ERC-20 token symbolising Bitcoin (BTC). Users can utilize their Bitcoin holdings to access DeFi applications since an equivalent amount of BTC backs each WBTC.

- DigixDAO (DGD)

The goal of the DigixDAO project is to tokenize real gold on the Ethereum network. Digix Gold (DGX) is one token that allows users to own and transfer digital gold by representing the precise weight of the precious metal.

How Debut Infotech Can Help Businesses

Debut Infotech provides excellent cryptocurrency development services with end-to-end solutions that cover initial consultation, proof-of-concept preparation, pilot development, and full-fledged crypto creation. Debut Infotech’s proficiency and creative methodology make them a dependable collaborator in asset tokenization creation, guaranteeing safe, expandable, and legal solutions for various commercial requirements, including crowdfunding, fractional ownership, and increased liquidity.

Businesses using Debut Infotech’s specially designed solutions can see an increase in return on their investment. Contact Debut Infotech right now to take advantage of their extensive industry experience and superior technological capabilities for your cryptocurrency and asset tokenization needs.

Conclusion

To sum up, asset-backed cryptocurrencies have entirely changed the financial industry, and Debut Infotech’s innovative work has been a major factor in this development. The convergence of traditional assets and digital currencies will continue to change the global economy as we enter a new era of blockchain-based financial systems, with Debut Infotech paving the way for a more secure and successful financial future.

Frequently Asked Questions: What are Asset-Backed Cryptocurrencies?

Asset-backed cryptocurrencies (ABCs) are digital tokens that draw their value from real-world assets, including commodities, precious metals, real estate, and other tangible or financial assets.

Blockchain technology establishes an ABC by tying the digital token’s value to the underlying asset. The market value and performance of the asset that a cryptocurrency represents have a direct impact on its worth.

ABCs’ primary goal is to bring stability and lessen the volatility sometimes connected to established cryptocurrencies like Bitcoin. These tokens are designed to offer a more secure and predictable investment option by tying their value to actual assets.

A. Different jurisdictions have different regulations regarding cryptocurrencies backed by different kinds of assets. Regulations governing traditional financial institutions may apply to stablecoins backed by fiat currencies, but securities regulations may apply to tokens backed by commodities or real estate. Before investing, investors should learn about and comprehend the regulatory environment around asset-backed cryptocurrencies.

Since the value of asset-backed cryptocurrencies is linked to real things, they have lower volatility than standard cryptocurrencies, among other advantages. Additionally, they offer a mechanism to tokenize and fractionalize asset ownership, making ownership transfers simpler and more effective. They can also act as a hedge against inflation and market volatility.

A cryptocurrency is considered an asset when it can be owned, traded, and holds value. Examples include Bitcoin, Ethereum, and other digital currencies used for investment, trading, or as a store of value.

Backed crypto refers to a cryptocurrency that is supported by a tangible asset, such as fiat currency, commodities, or other cryptocurrencies, providing it with intrinsic value and stability compared to traditional cryptocurrencies.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment