Table of Contents

Home / Blog /

Top 15 DeFi Use Cases – Redefining Traditional Finance

November 27, 2024

November 27, 2024

Unprecedented expansion in decentralized finance (DeFi) has recently changed the way people and companies interact with financial systems. DeFi use cases now surpass their early promises and provide practical solutions beyond traditional financial services. From loan and borrowing to yield farming and decentralized insurance, the possibilities DeFi offers excite both creators and investors equally. As a reputable Defi development company, Debut Infotech has closely watched and added to this ecosystem’s growth.

DeFi is a movement that questions accepted centralized finance (CeFi) models. Although DeFi and CeFi want to facilitate financial transactions, DeFi uses decentralized technologies like blockchain to bring transparency, inclusion, and autonomy. The chances for both people and businesses are significant, given the fast development of blockchain systems and the growing need for customized DeFi development tools. This blog analyzes the most interesting defi use cases, thus illuminating how they are changing sectors and lives.

Explore our cutting-edge DeFi development services page to see how we can help you transform your business!

Understanding DeFi: A New Financial Shift

Decentralized finance involves financial applications developed on blockchain systems free of middlemen. DeFi uses smart contracts to automatically enforce agreements rather than depending on banks or other centralized organizations. This fundamental change has democratized financial services so that customers worldwide may engage in lending, borrowing, trading, and other activities DeFi offers.

DeFi systems use decentralized networks’ ability to provide transparency and lower single point of failure risk. A network of DeFi platforms built on top of these protocols allows for the decentralization of trust away from traditional institutions and toward code and consensus. As a prominent provider of blockchain development services, Debut Infotech has assisted many companies in investigating the potentially revolutionary effects of decentralized financial systems.

The Evolution of DeFi

Before DeFi, smart contracts were only available on Ethereum, one of the most famous blockchain platforms. To fix the problems with current financial systems, creative developers and DeFi development companies have added more cases of decentralized finance over time. From complex derivatives markets to decentralized exchanges (DEXs), DeFi now covers a wide range of uses.

Thanks to technological improvements and simplified development procedures, the cost of blockchain development connected with DeFi projects has been more under control. Because of this, businesses can use blockchain’s benefits without having to pay huge amounts of money upfront. Our specialty at Debut Infotech is providing scalable and reasonably priced DeFi solutions adapted to our customer requirements.

DeFi vs. CeFi: Key Differences

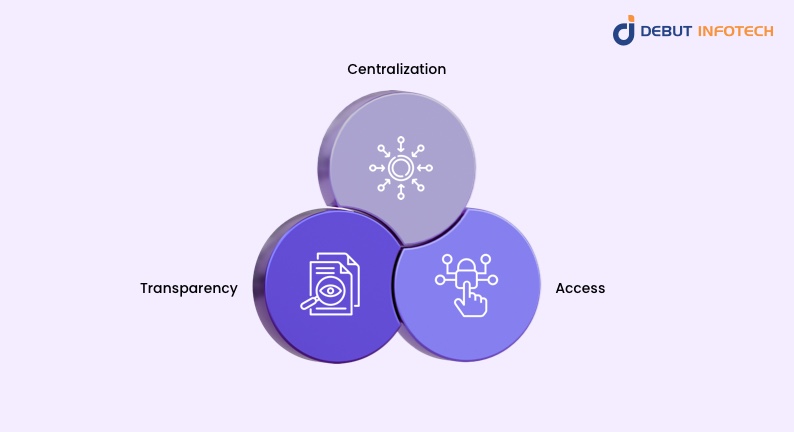

Comparing DeFi vs CeFi emphasizes the basic change in the way financial systems run:

- Centralization is the cornerstone difference. To control money, monitor transactions, and provide services, CeFi depends on centralized entities such as banks, financial institutions, or centralized exchanges. Although these organizations serve as reliable middlemen, they sometimes carry related risks such as inefficiencies, more expenses, and abuse of authority potential. Conversely, DeFi runs on decentralized networks driven by blockchain technology. DeFi eliminates middlemen by using smart contracts, creating a trustless and self-governing space for financial operations.

- Transparency is another noticeable difference. DeFi systems guarantee that every transaction is logged on public blockchains, providing real-time auditable and traceable capability. This degree of transparency helps consumers develop confidence and lowers the possibility of manipulation or fraud. Although under supervision, CeFi systems sometimes lack such visibility since decisions and transaction records are frequently kept behind closed doors.

- Access further sets DeFi apart. DeFi allows anyone with an internet connection to join in since it needs no authorization or lengthy validation. This inclusiveness enables underprivileged groups—such as those in areas with inadequate banking infrastructure—to get financial services. CeFi platforms, on the other hand, could impose geographical and identity-based limitations, barring many possible consumers from the worldwide financial ecosystem.

Another important issue in the DeFi vs. CeFi debate is who controls the funds. CeFi users entrust their assets to centralized systems, thus running the risk of mismanagement or loss from insolvency or hackers. DeFi guarantees customers have complete control over their assets thanks to private keys, preserving their full custody.

Because of these differences, DeFi is becoming a more appealing option, especially for people in underdeveloped areas or who want more control over their finances. However, the decision between DeFi and CeFi usually comes down to personal preferences like regulatory compliance, simplicity of usage, or degree of financial system trust.

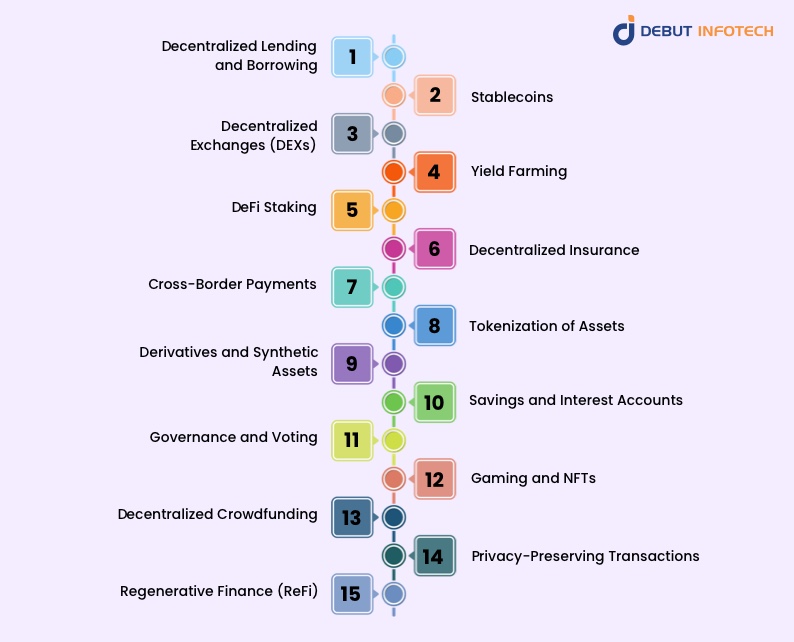

Top 15 DeFi Use Cases

1. Decentralized Lending and Borrowing

By removing traditional constraints, DeFi lending platforms such as Aave, Compound, and MakerDAO have transformed loan accessibility. By offering collateral—usually in the form of cryptocurrencies—borrowers may access money almost immediately. DeFi loans are open to anyone with collateral, therefore democratizing financial access, unlike traditional loans, which demand a good credit score or thorough documentation. In turn, lenders can make money by earning interest on the assets they don’t use. With blockchain technology’s enhanced transparency guaranteeing fairness and security, this invention offers a win-win situation for lenders and borrowers.

2. Stablecoins

Stablecoins are essential for close bridging of the volatility of cryptocurrencies with stable fiat currencies. These cryptocurrencies promise the advantages of blockchain technology without price volatility by being pegged to assets like the US dollar or gold. DeFi platforms produce and manage decentralized stablecoins like DAI, guaranteeing total transparency and decentralization. They can be used for foreign money transfers, savings, and to pay for things online, making them an essential part of the DeFi ecosystem.

3. Decentralized Exchanges (DEXs)

With top decentralized exchanges like Uniswap, SushiSwap, and PancakeSwap, users may trade cryptocurrencies straight from their wallets, which has completely changed traditional trading. DEXs work differently than centralized exchanges because they use automatic smart contracts to make sure users always have control of their funds. These systems also leverage liquidity pools, so users may donate money or receive fees or rewards in exchange. DEXs are a necessary part of DeFi since they lower transaction costs and provide security by removing middlemen.

4. Yield Farming

Users of yield farming—also known as liquidity mining—lock their money into DeFi systems to get rewards. For example, providing liquidity to Yearn or Curve Finance lets people create returns—sometimes as governance tokens. Because of its possible large profits, yield farming has drawn a lot of attention, but it also carries risks like market swings and smart contract deficiencies.

5. DeFi Staking

By “staking,” you agree to support the processes of a blockchain network in exchange for rewards. By extending this idea to DeFi platforms, users can bet their tokens and earn interest or more tokens. For Ethereum 2.0, platforms like Lido Finance and Rocket Pool provide staking services wherein users may engage without requiring technical knowledge or minimal staking criteria. Users looking for long-term development and passive revenue will especially find DeFi staking to be appealing.

6. Decentralized Insurance

Risk management primarily relies on insurance; hence, DeFi has advanced this area with tools like Nexus Mutual and Etherisc. These decentralized insurance systems cover several risks, including smart contract failures, trade secrets, and travel delays. DeFi insurance systems guarantee faster, more transparent reimbursements by pooling user funds, removing conventional insurers’ needs. This invention has great power in solving the flaws in existing insurance models.

7. Cross-Border Payments

Cross-border payments are among the most logical decentralized finance examples available. High fees, lengthy settlement periods, and restricted access define traditional remittance systems. Using blockchain technology, DeFi apps like Stellar and Celo allow flawless worldwide transactions, substantially lowering processing times and costs. For companies handling foreign clients or migrant workers returning money home, this is especially relevant.

8. Tokenization of Assets

Tokenizing turns tangible objects—such as real estate, artwork, or commodities—into digital tokens on a blockchain. Since these tokens represent fractional ownership, people may invest more easily in high-value assets. This innovation is spearheaded by platforms like RealT and Securitize, making more liquidity and accessibility possible. DeFi democratizes ownership in once-exclusive markets and creates new investment opportunities by tokenization.

9. Derivatives and Synthetic Assets

Derivatives are financial tools derived from an underlying asset, say commodities, stocks, or currencies. Synthetic assets created using DeFi tools such as Synthetix and UMA let users expose themselves to traditional financial markets without owning the real assets. A synthetic stock token, for instance, can replicate the price of a company’s shares, enabling traders to hedge risks. This use case closes the distance separating traditional investment markets from decentralized finance.

10. Savings and Interest Accounts

Anchor Protocol and Yearn Finance are DeFi platforms that provide savings accounts with interest rates much higher than regular banks. These protocols accept user deposits and distribute that money to various strategies that generate yield, including lending or liquidity provision. These accounts are a good choice for optimizing idle money since the interest acquired returns to the customers. Smart contract automation and openness guarantee a safe and quick procedure.

11. Governance and Voting

In traditional finance, governance is usually centralized, and only a small number of people influence decision-making. DeFi uses platforms like MakerDAO and Curve to set up decentralized governance. Token holders can vote on important ideas. This covers adjustments to fund payments, protocol parameters, or fresh feature implementations. Mechanisms of governance guarantee that DeFi systems stay community-driven and in line with the needs of their users.

12. Gaming and NFTs

Gaming companies have jumped on the DeFi bandwagon to boost user engagement and provide new revenue models. DeFi ideas include play-to-earn (P2E) models—where players may earn tokens or NFTs with actual worth—and are included in blockchain games, including Axie Infinity and Decentraland. NFT staking also lets players lock their digital treasures in exchange for rewards, fusing, and decentralized finance.

13. Decentralized Crowdfunding

DeFi has changed crowdfunding by eliminating middlemen like banks and venture investors. Tools like Gitcoin and Juicebox let companies, developers, and artists fund themselves straight from fans. The blockchain records these donations, guaranteeing transparency and trust. Decentralized crowdfunding lowers financing constraints and helps artists to keep control over their creations.

14. Privacy-Preserving Transactions

Although blockchain technology is mostly transparent, privacy still worries many consumers. Tornado Cash and Aztec are two privacy-focused protocols developed by DeFi that solve this problem by facilitating anonymous transactions. These platforms guarantee that user identities and transaction data stay private while following the blockchain’s decentralized ideas. Companies and people looking for financial privacy without depending on opaque systems significantly benefit from this.

15. Regenerative Finance (ReFi)

ReFi, or regenerative finance, is a developing DeFi application with an eye toward environmental effect and sustainability. Using DeFi, platforms such as KlimaDAO fund other environmentally friendly enterprises, carbon offset schemes, and renewable energy projects. ReFi generates a win-back for the earth and investors by matching financial incentives with environmental objectives. This creative application shows how DeFi might support worldwide issues outside of finance.

Why Businesses Are Turning to DeFi

Businesses are using DeFi more and more because it is open, cheap, and can reach people all over the world. Being a decentralized finance development business, Debut Infotech offers innovative DeFi development tools catered to several sectors. Our knowledge and experience will guide you through every step of the process, from investigating DeFi staking to creating unique protocols and establishing your platform.

Thanks to frameworks that simplify the development process, the cost of blockchain development connected with using DeFi solutions has become more predictable. By drawing on our expertise in providing scalable blockchain development solutions, companies may reduce risks and open fresh revenue sources.

The Future of DeFi

With ideas like layer-2 scaling solutions and cross-chain interoperability solving present difficulties, DeFi has strong future prospects. We expect a rise in use cases of DeFi across sectors as more consumers choose decentralized finance, therefore blurring the boundaries between traditional banking and blockchain-based systems.

Our specialty at Debut Infotech is providing blockchain development tools catered to several DeFi usage scenarios. From insurance markets to decentralized exchanges, our knowledge as a decentralized financial development company guarantees scalable and safe solutions. These initiatives maximize the blockchain development cost using our simplified procedures, allowing companies to introduce creative ideas without going over budget.

Our staff can walk you through each stage, whether you are interested in DeFi staking, tokenizing, DeFi development services, or privacy-preserving techniques. Our thorough knowledge of blockchain systems and DeFi protocols enables us to assist clients in fully realizing decentralized finance.

Ready to bring your DeFi vision to life?

Let’s discuss your project with our blockchain experts!

Conclusion

When it comes to creativity and inclusion, DeFi is changing the financial world in unprecedented ways. From lending and staking to decentralized exchanges and synthetic assets, the DeFi application cases underlined in this blog show the transforming power of decentralized finance.

At Debut Infotech, we are glad to use our extensive DeFi development tools to help bring about this change. Contact us if you are ready to discover how DeFi systems and blockchain platforms might help your company. Let’s help define financial futures together.

Frequently Asked Questions

DeFi, or Decentralized Finance, is a blockchain-based financial system without intermediaries like banks or brokers. It uses smart contracts to execute transactions transparently and efficiently. Unlike traditional finance, DeFi offers global accessibility, greater transparency, and lower transaction costs while empowering users with complete control over their assets.

DeFi platforms offer several advantages that make them highly appealing. They provide accessibility, as they are available to anyone with an internet connection, ensuring inclusivity for unbanked and underserved populations. Transparency is another key benefit, with all transactions publicly recorded on the blockchain. DeFi also enhances cost efficiency by eliminating intermediaries, which significantly reduces fees. Additionally, these platforms operate on decentralized networks, bolstering security by minimizing the risk of single points of failure.

Decentralized exchanges (DEXs) facilitate peer-to-peer trading of cryptocurrencies directly from users’ wallets. They use automated smart contracts to match buyers and sellers, removing the need for intermediaries. Liquidity pools and automated market makers (AMMs) ensure smooth trading by providing liquidity and determining asset prices dynamically.

The primary difference between DeFi vs CeFi lies in centralization. CeFi (Centralized Finance) relies on intermediaries like banks or centralized exchanges to manage assets and transactions. DeFi, on the other hand, operates on decentralized networks using blockchain technology and smart contracts. While DeFi offers more transparency and control, CeFi provides familiarity and regulatory oversight.

DeFi staking involves locking up your cryptocurrency in a protocol to support its operations, such as validating transactions or securing the network. In return, users earn rewards, often through interest or additional tokens. Benefits include generating passive income, supporting blockchain security, and participating in governance processes.

Tokenization converts real-world assets like real estate, art, or commodities into digital tokens on a blockchain. Examples include platforms like RealT, where investors can buy fractional ownership of real estate properties, or Securitize, which allows tokenized equity and debt offerings. This innovation enhances liquidity and broadens access to traditionally exclusive investments.

DeFi development services help businesses build custom solutions tailored to their needs. These services provide access to a global, decentralized audience, reducing operational costs by eliminating intermediaries. They also enhance transparency and trust through the use of blockchain technology while creating opportunities for innovation in areas like lending, insurance, and tokenization. At Debut Infotech, we offer end-to-end blockchain development services, assisting businesses in designing and launching scalable DeFi platforms while optimizing blockchain development costs.

Talk With Our Expert

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment