Table of Contents

Home / Blog / Blockchain

Tokenized Real Estate vs REITs: Key Insights for Investors

October 10, 2024

October 10, 2024

Since real estate offers both passive income along with the potential appreciation over time, investing in it has long been regarded as a consistent approach to creating wealth. Real estate investment approaches have changed dramatically, though, particularly in light of digital assets and blockchain technology. Investors today have an increasing range of choices; two of the most often used ones are traditional Real Estate Investment Trusts (REITs) and the more recent idea of tokenized real estate. Each one has particular advantages, dangers, and factors to take into account.

We’ll go over the main distinctions between REIT vs real estate in this post, explore tokenized real estate, and show how these choices line up. Making wise selections whether your experience with real estate investment is fresh or seasoned depends on knowing what is real estate tokenization and regular REITs are.

To learn more about leveraging blockchain technology for real estate investments, check our Real Estate Tokenization Services and see how our experts can help you tokenize your assets.

Understanding REITs: A Traditional Approach to Real Estate Investment

Real Estate Investment Trusts (REITs) are businesses either owned, run, or funded for revenue generation in real estate. Investors have been able to use them since the 1960s; they are a classic means of real estate investment. Usually pooling money from several investors, REITs buy big-scale real estate like hotels, offices, shopping centers, and apartment buildings.

Many times, investing in REITs is likened to buying company stocks. Through stock exchanges, investors can purchase publicly-traded REITs, therefore exposing themselves to real estate without personally managing any properties. REITs are appealing to income-seeking investors since they must pay at least 90% of their taxable income to shareholders in the form of dividends in return for this capital.

Types of REITs

- Equity REITs: Income-producing properties are owned and managed by equity REITs, which make money from property appreciation as well as rent.

- Mortgage REITs (mREITs): Rather than holding real estate, mortgage REITs (mREITs) fund it by buying or originating mortgages, therefore generating income via interest.

- Hybrid REITs: Investing in both real estate properties and mortgages, hybrid REITs mix mortgage REIT techniques with equity.

Key Benefits of REITs

- Liquidity: Investors can readily acquire and sell shares in publicly traded REITs because of their high liquidity.

- Diversification: Usually investing in a large spectrum of properties, REITs help to lower risk by diversification.

- Income Generation: REITs are a good choice for passive income since legislation mandates that a significant amount of their income be paid as dividends.

- Accessibility: REITs provide individual investors access to commercial real estate markets that, given high capital requirements, could otherwise be out of reach.

Reiterations of market volatility and interest rate risk are two drawbacks of REITs. Furthermore, even if REITs are a more passive investing tool, they lack the direct ownership advantages of physical real estate, including control over property management and the capacity to either enhance or rework assets.

What is Tokenized Real Estate?

A more recent and maybe disruptive approach of real estate investment using blockchain technology is real estate tokenization. Tokenized real estate, then simply said, is the process of turning real estate asset ownership rights into digital tokens sold, exchanged, or bought on blockchain systems. Every token denotes a fractional ownership of the asset, therefore enabling investors to own some of a real estate without purchasing the whole asset.

Usually created and controlled using real estate tokenizing systems, which streamline the creation, distribution, and trading of these tokens, The underlying technology, blockchain, guarantees transparent, safe, easily trackable transactions.

Tokenization offers a degree of liquidity usually difficult to attain with physical real estate. Like REITs, investors can access high-value real estate assets with relatively little capital by means of real world asset tokenization, but with certain unique variations, we will discuss more.

How Real Estate Tokenization Works

- Fractional Ownership: Real estate tokenizing divides property ownership into tiny tokens, each reflecting a percentage of the overall value.

- Blockchain Technology: Blockchain technology removes middlemen usually engaged in real estate transactions and records transactions on a blockchain, therefore offering transparency and immutability.

- Tokenization Platforms: Tokenizing platforms let investors purchase, sell, or trade tokens on the market. RealT, Harbor, and SolidBlock are three instances of real estate blockchain startups and tokenizing systems.

Key Benefits of Tokenized Real Estate

- Increased Liquidity: Investors can exchange tokens on secondary markets compared with conventional property investments.

- Global Accessibility: Tokenized real estate creates markets accessible to a worldwide investor base, thereby offering chances for international investments.

- Lower Capital Requirements: Investors can purchase tokens with lesser financial requirements, therefore distributing access to highly valuable real estate assets.

- Transparency and Security: Blockchain technology guarantees that transactions are visible, open, and unchangeable, therefore lowering the danger of fraud and facilitating proof of ownership.

Since tokenized real estate is still in its infancy, it suffers difficulties including platform dependability, market acceptance, and legal obstacles. Still, the market is projected to expand as more real estate blockchain companies and tokenization platforms surface.

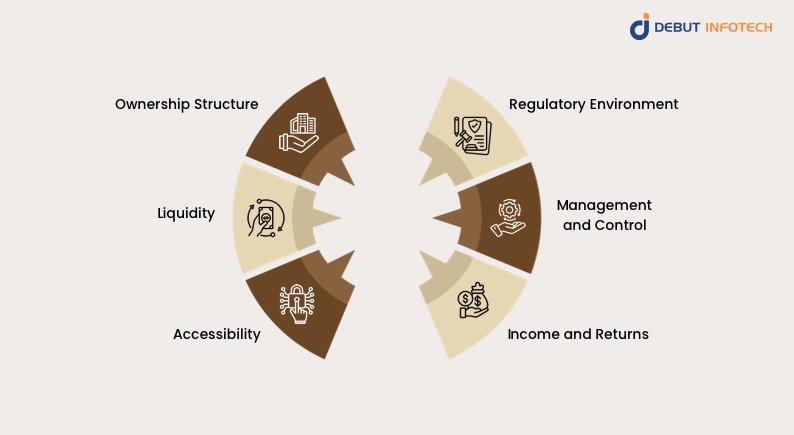

Comparing REITs and Tokenized Real Estate: Key Differences

Investors should weigh certain important factors when comparing REITs vs real estate tokenization.

1. Ownership Structure

- REITs: Investing in a REIT is like owning fundamentally corporation-owned and managed real estate shares. You hold shares in the REIT, which owns the assets; you do not own the properties personally.

- Tokenized Real Estate: Tokenized real estate lets you own a fractional portion of the real world assets. Comparatively to REITs, each token offers greater direct ownership since it reflects a share of the underlying real estate asset.

2. Liquidity

- REITs: Publicly listed REITs, which are quite liquid, let investors purchase and sell shares quickly on stock markets. With restrictions on when and how investors may sell shares, non-traded REITs can also be less liquid.

- Tokenized Real Estate: Tokens can be traded on blockchain-based markets, potentially providing more liquidity than conventional real estate investments. But liquidity relies on the market for the particular tokens; not all tokenized platforms provide strong secondary markets currently.

3. Accessibility

- REITs: Generally speaking, REITs are open to a wide spectrum of investors since they are listed on big stock exchanges and bought via brokerage accounts.

- Tokenized Real Estate: Though it may take some knowledge of blockchain technology and cryptocurrency platforms, tokenized real estate can also be accessible to a great spectrum of investors. Regulatory restrictions may also restrict access in specific areas.

4. Regulatory Environment

- REITs: Government agencies like the SEC in the United States have formed and greatly oversee REITs. Since REITs have to follow tight guidelines about openness, revenue distribution, and taxation, this gives investors some degree of security.

- Tokenized Real Estate: Real estate tokenization still presents major legal obstacles even as it is becoming more common. Certain nations and areas are still to completely specify how tokenized assets fit into current legal systems. Investing in tokenized real estate should let investors be aware of any legal risks and compliance concerns.

5. Management and Control

- REITs: As an investor in a REIT, your direct influence over the operations or administration of the portfolio’s assets is absent. The management staff of the REIT decides about operations, sales, and property acquisitions.

- Tokenized Real Estate: Though their capacity to affect management decisions is usually limited, investors in tokenized real estate may have more direct ownership rights depending on the tokenization framework.

6. Income and Returns

- REITs: As a consistent source of dividends, REITs must distribute at least 90% of their taxable revenue to shareholders. REITs are prone to market swings, hence their performance can be influenced by macroeconomic events such as interest rates.

- Tokenized Real Estate: Like with real world asset ownership, token holders can make money from rental income created by the underlying property. Tokenized real estate provides the possibility for capital appreciation as well; rewards depend on the particular property and market conditions.

Real Estate Syndication vs REIT

Real estate syndication is another important investment choice to take under review with REITs vs real estate tokenization. In real estate syndication, a group of investors combine money to purchase a property usually under the direction of a sponsor. Basically, like REITs, it allows investors to own shares in a property without personally running it.

But the structure is where real estate syndication vs REIT differ most from one another. Typically concentrating on one property or a small portfolio, syndications provide investors greater direct ownership and control than REITs. Experienced or accredited investors would be better suited for syndications since they frequently have less liquidity, less regulatory protection, and higher entry points than REITs.

Real Estate Tokenization Platforms: What Investors Need to Know

Understanding the function of real estate tokenizing platforms is crucial if you’re thinking about buying tokenized real estate. These systems enable the development, marketing, and trading of real estate tokens, therefore acting as a marketplace for property owners and investors. Every real estate tokenizing platform has unique legal frameworks, fees, and features, so it is advisable to assess them depending on your demands and investment objectives.

Popular Real Estate Tokenization Platforms

- Harbor: Providing blockchain-based token issuing and management tools, Harbor is among the top platforms in real estate tokenizing. Harbor provides a secondary market for exchanging tokens and tokenizing real estate assets assistance. It emphasizes regulatory compliance so that token offers follow U.S. securities regulations.

- RealT: Investors may purchase tokenized real estate assets in the United States via the RealT platform. It specializes in fractional ownership, in which investors can purchase tokens denoting shares in certain rental properties. For individuals seeking passive income, this platform is appealing as token holders earn rental income based on their ownership portion.

- SolidBlock: By tokenizing their assets, SolidBlock lets real estate owners and developers raise money. It offers a stage for issuing security tokens that stand for commercial property ownership. Working on building secondary markets to give token holders liquidity, SolidBlock has tokenized projects all around.

- Propy: Propy is a blockchain-driven platform for real estate transactions that specializes in tokenization and the purchase and sale of real estate assets. It provides a market for foreign investors and lets one buy tokenized real estate using cryptocurrency.

How to Choose a Tokenization Platform

Think about the following elements while choosing a real estate tokenizing platform:

- Regulatory Compliance: Make sure the platform follows securities rules in your country and runs inside legal frameworks.

- Market Liquidity: See whether the platform gives access to secondary marketplaces where you may purchase and sell tokens.

- Fees and Costs: Examine transaction fees, listing fees, and any continuous maintenance related to token holding and trading.

- Reputation and Track Record: Select venues with a track record of successful initiatives and satisfied investors.

Real Estate Fund vs REIT: Another Comparison

Apart from syndication and tokenization, several investors might be curious in the variations between REITs vs real estate funds. Although both provide indirect means of real estate investment, there are notable differences:

- Real Estate Fund: A real estate fund is a pooled investment tool whereby money gathered from several participants is invested in real estate assets. Usually arranged as private equity or mutual funds, these funds may concentrate on development, value-add, or income production while also allowing a range of methods. Generally less liquid than REITs, real estate funds have longer lock-in terms.

- REIT: As was before established, REITs—companies either owning or financing income-producing real estate—are Highly liquid, publically traded REITs that give investors a more detached approach to real estate investing. Apart from governmental control, REITs have to satisfy specific income distribution criteria.

Pros and Cons of REITs and Tokenized Real Estate

Pros of REITs

- High Liquidity: Publically listed REITs offer outstanding liquidity since they may be purchased and sold like equities.

- Regular Income: REITs are a consistent income source since most of their profits must be distributed as dividends.

- Diversification: Often owning a range of property kinds, REITs help to lower risk by diversification.

Cons of REITs

- Market Volatility: REITs have certain drawbacks, including market volatility, since they are traded on stock exchanges hence their prices vary with the general market.

- Limited Control: Investors have little direct influence over methods of property management or decision-making.

- Tax Considerations: Often taxed at regular income rates, REIT dividends can be less beneficial than capital gains taxes.

Pros of Tokenized Real Estate

- Fractional Ownership: Investors in tokenized real estate fractional ownership can own a fraction of very valuable real estate assets, therefore reducing the entrance barrier.

- Greater Liquidity: Compared to direct real estate ownership, tokenized assets offer increased liquidity due to their ability to be exchanged on secondary markets.

- Blockchain Transparency: Blockchain technology guarantees safe, open, quick transactions.

Cons of Tokenized Real Estate

- Regulatory Uncertainty: Tokenized real estate is still a quite new market and regulatory systems are not yet completely formed.

- Limited Platforms: Though there are multiple new platforms, the ecosystem for trading real estate tokens is still developing, hence short term liquidity could be limited.

- Technical Barriers: Blockchain technology and cryptocurrencies may not be known to some investors. Hence involvement has a more steep learning curve.

The Future of Real Estate Investment

The relationship between the field of real estate and blockchain technology will probably widen as real estate blockchain businesses keep innovating, providing additional choices for institutional and retail investors. Tokenizing real world estate creates new opportunities and makes usually illiquid markets more accessible and effective.

REITs, with their dividends and liquidity through public markets, remain a dependable and easily available method for now to invest in real estate. Real estate tokenization, especially for investors who value liquidity, fractional ownership, and blockchain transparency, could, however, become a more common investment strategy as real estate tokenization platforms proliferate in count and dependability.

Need help deciding between REITs and tokenized real estate?

Get expert consultation tailored to your investment strategy. Reach out to our experienced team today for personalized advice.

Conclusion

REITs vs real estate tokenization clearly have different benefits based on the objectives, risk tolerance, and technological knowledge of an investor. While real estate tokenization offers a new frontier of investment, allowing more direct ownership and more liquidity via blockchain technology, REITs offer a time-tested, liquid, and income-generating means to engage in significant real estate.

Developing a well-rounded real estate investment plan requires an awareness of the main variations between REITs, tokenized real estate, and other investment vehicles such as syndications and real estate funds. Real estate investment will be much more interesting as blockchain technology and real estate tokenization platforms develop since investors will have even more choices to consider. Your financial objectives and taste for creativity will ultimately determine whether you want the established nature of REITs or the innovative possibilities of real-world asset tokenization.

As a real estate tokenization development company, we are at the forefront of this transformation, offering innovative solutions that allow businesses and investors to harness the power of blockchain technology in real estate. By bridging the gap between traditional real estate and the tokenized world, we provide a seamless solution to explore new avenues of ownership, liquidity, and investment flexibility. Whether you’re seeking to explore tokenization or develop a platform, our team delivers end-to-end solutions that cater to your specific needs.

Frequently Asked Questions

While tokenized real estate provides fractional ownership of individual properties via digital tokens on blockchain platforms, REITs let investors purchase shares of a business owning and managing real estate.

Since they are sold and bought on stock exchanges, publicly traded REITs are quite liquid. Though it depends on the blockchain ecosystem and secondary market of the platform, tokenized real estate can potentially provide liquidity.

Real estate tokenization lets investors purchase, sell, or exchange fractional shares of property on blockchain systems by turning ownership of that asset into digital tokens.

Government agencies such as the SEC control REITs, therefore providing established investor protection. Since tokenized real estate is newer and less regulated, depending on the platform and country there could be more risk.

Although a wide spectrum of investors can access tokenized real estate platforms, local regulations in some areas could restrict involvement. Some systems might additionally call for knowledge of bitcoins and blockchain.

Through blockchain technology, tokenization provides fractional ownership, more liquidity, worldwide accessibility, and transparency, therefore enabling smaller investors to engage in high-value real estate markets.

Tokenized real estate, though in its early years, has the power to transform real estate investment by means of blockchain technology’s security, liquidity, and accessibility. Future expansion of it will rely on platform acceptance and changes in regulations.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment