Table of Contents

Home / Blog / Cryptocurrency

Non-Custodial Crypto Wallets: Key to Expanding Revenue Streams

November 8, 2023

November 8, 2023

Did you know that the average transaction volume in the crypto space is expected to double over the next three years? If you’re searching for a unique way to secure your financial future, you’ve just stumbled upon it—white-label crypto wallets.

Ready to take a bite out of the $8 trillion digital asset market? In this blog, we’ll explore the various aspects of this exciting opportunity and how it can help you grow your income.

Understanding Custodial And Non-Custodial Wallets

Cryptocurrency wallets stand as important tools for the wise management of your digital assets. They delineate into two primary categories: custodial and non-custodial. The custodial variant, frequently proffered by exchanges, assumes responsibility for safeguarding your private keys, albeit raising security concerns.

Conversely, non-custodial wallets empower you with total control over your private keys, thereby extending authority over your assets.

What is a White Label Crypto Wallet?

A white label crypto wallet solution is like a ready-made, flexible, customizable choice. It is a pre-made, basic wallet that businesses can tweak to match their brand. It’s a template for a crypto wallet, so companies can add their name, logo, and unique features without starting from scratch.

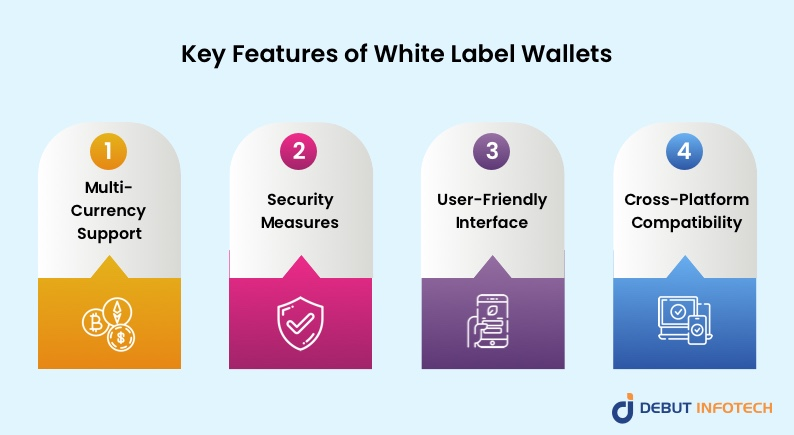

Key Features of White Label Crypto Wallets

The success of a white-label wallet hinges on its features, with an emphasis on security, user-friendliness, and customization. Let’s have a look at them:

- Multi-Currency Support: Users expect wallets to support a variety of cryptocurrencies to meet their diverse needs.

- Security Measures: Robust security features, including encryption, two-factor authentication, and hardware wallet integration, are non-negotiable.

- User-Friendly Interface: Intuitive design and ease of use are critical to attract and retain users.

- Cross-Platform Compatibility: The wallet should be accessible on various devices and operating systems.

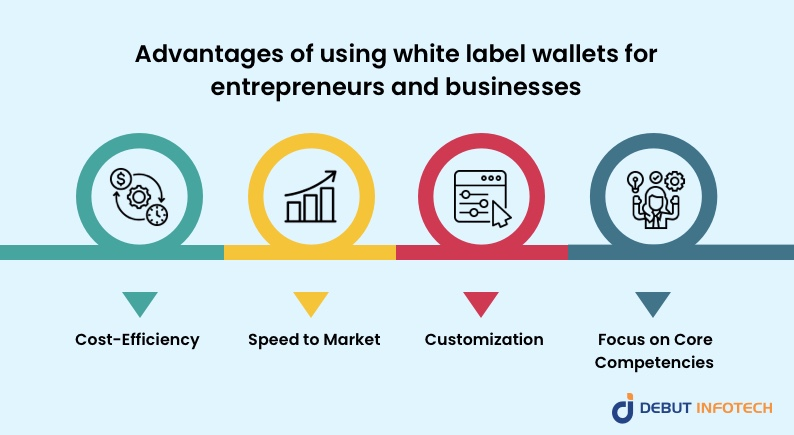

Why White Label Wallets Are A Game Changer?

White-label wallet offers numerous benefits for entrepreneurs and businesses. Let’s explore some of them:

- Cost-Efficiency: Developing a wallet from the ground up can be expensive and time-consuming. White label solutions save on development costs and time.

- Speed to Market: A White label crypto wallet allows businesses to enter the market faster, capitalizing on opportunities without extensive development cycles.

- Customization: The ability to brand and customize a wallet provides businesses with a unique identity and a stronger connection with their user base.

- Focus on Core Competencies: Companies can focus on their core operations while leaving the technical aspects of wallet development to experts.

Understanding the Cost Economics of Non-Custodial White Label Wallets

Cost is an important factor in White Label crypto wallet development. However, crypto wallet development cost is contingent on several variables, including feature set, customization requirements, licensing, usage needs, and team size.

Economical White Label wallet solutions typically offer basic features, limited customization options, and minimal support and maintenance. Conversely, premium solutions are equipped with advanced features, extensive capabilities, and comprehensive support and maintenance services.

Less expensive options are suitable for startups dealing with budget constraints, while advanced wallet solutions are ideal for well-established businesses with specific customization needs and higher transaction volumes. To obtain an accurate cost estimate, it’s always best to reach out to a Non-Custodial Crypto Wallet Development Company with proven expertise.

Generating Income with White Label Wallets

White Label Wallets empower businesses to diversify income streams with adaptable solutions that not only deliver a secure, user-friendly, and fully customizable wallet experience but also present numerous avenues for entrepreneurs and companies to enhance their revenue.

Let’s explore the strategies and income potential in more detail:

- Diversifying Income Streams in the Crypto Industry:

The cryptocurrency industry is characterized by its dynamic and evolving nature. White label wallets enable businesses to diversify their income streams and enhance their financial stability. Here’s how:

- Complementary Services: By offering white label wallets alongside existing crypto services, businesses can create synergy and cross-promotion. For example, if you get cryptocurrency exchange development, integrating a white label wallet can provide your users with a convenient way to store their assets, encouraging them to use both services.

- Staking and Yield Farming: Integrating wallet features for staking or participating in DeFi yield farming can provide users with additional income opportunities. These features can generate fees or commissions for the wallet provider.

- Affiliate Programs: Some white label wallet solutions offer affiliate programs that allow businesses to earn commissions for every user they bring to the platform. This can be a powerful income source, especially when combined with effective marketing strategies.

- Revenue Potential for White Label Wallet Providers:

The income potential for white label wallet providers can be substantial, depending on various factors:

- Transaction Fees: Charging a fee for each transaction made through the wallet can be a primary source of revenue. These fees can vary based on factors like the size of the transaction, network congestion, or the type of cryptocurrency being transferred.

- Subscription Models: Offering premium features through subscription plans can be a steady and predictable source of income. Subscription models can include advanced security features, priority customer support, and exclusive access to new services.

- Licensing Fees: Businesses that develop white label wallet technology can license their solutions to other companies looking to enter the crypto wallet space. This approach can provide a passive income stream, with license fees and royalties from each deployment.

- Premium Features: Offering advanced, fee-based features within the wallet, such as customizable themes, advanced analytics, or integration with third-party services, can attract users willing to pay extra for enhanced functionality.

- Revenue-Sharing Agreements: White label wallet providers can enter into revenue-sharing agreements with other crypto services integrated into the wallet. For instance, integrating an exchange within the wallet and sharing trading fees can be mutually beneficial for both parties.

- Advertising and Promotions: While it should be used thoughtfully, allowing advertisers to display ads or promotions within the wallet’s interface can provide supplementary income. Care must be taken to ensure that advertising doesn’t compromise user experience or security.

- Consulting Services: Beyond the wallet itself, businesses can offer consulting services related to wallet management, security audits, or compliance. This can be an additional source of income while showcasing expertise.

- Building User Trust for Sustainable Income:

To fully utilize the income potential of white label wallets, it’s crucial to prioritize user trust and security:

- Robust Security: Ensuring the highest level of security for your white label wallet is non-negotiable. Regular security audits, encryption, biometric authentication, and hardware wallet integration are vital to instill trust in users and protect their assets.

- Compliance with Regulations: Compliance with evolving cryptocurrency regulations is essential for building trust with users and avoiding legal complications. Different regions may have specific requirements for wallet providers, including KYC/AML procedures.

- Transparency: Maintaining transparency regarding security measures, wallet operations, and any security incidents is crucial. Users should be informed and reassured about the safety of their assets.

- Prompt Support: Providing responsive customer support can help build trust. Users should have a reliable point of contact for inquiries or issues, which enhances their experience and trust in your service.

White Label Wallets in Action

White Label Wallets have emerged as invaluable tools, not only generating revenue streams but also elevating operational capabilities for businesses. In this showcase, we present three compelling case studies of successful enterprises leveraging non-custodial white label cryptocurrency wallets.

- Binance

Binance is one of the most prominent players in the cryptocurrency space, known for its vast exchange platform. However, they offer much more than just trading services. Binance provides a non-custodial white label crypto wallet solution to their business partners, allowing these partners to offer their own branded crypto wallets to customers.

Usage Scenarios:

- Cryptocurrency Exchanges: Numerous cryptocurrency exchange development, including KuCoin, Gate.io, and WazirX, leverage Binance’s white label solution to provide their users with personalized crypto wallets. This offering extends their range of services and enhances user trust.

- Cryptocurrency Payment Processors: Payment processors such as BitPay and CoinGate use Binance’s white label solution to enable their merchants to accept cryptocurrency payments. This feature offers merchants a convenient payment solution and drives cryptocurrency adoption.

- Cryptocurrency Investment Platforms: Investment platforms like eToro and Grayscale Investments rely on Binance’s white label solution to empower their users to invest in cryptocurrencies. This integration adds a layer of diversification to their services.

Benefits

- Enhanced Security: Binance’s non-custodial white label solution places users in control of their private keys, thereby strengthening security. This approach aligns with the core principles of cryptocurrency – putting users in charge of their assets.

- Cost-Efficiency: Businesses benefit from reduced development and maintenance costs by implementing Binance’s white label solution, avoiding the need to build and maintain their wallet infrastructure.

- Faster Market Entry: Binance’s white label wallet solution expedites the deployment of branded crypto wallets. Businesses can enter the market swiftly and begin offering valuable services to their customers.

- Exodus

Exodus, a reputable non-custodial crypto wallet provider, offers a white label solution for businesses. This allows businesses to provide their own customized crypto wallets to their clientele, featuring a range of features and customizations.

Usage Scenarios

- Cryptocurrency Exchanges: Renowned exchanges like Gemini and Kraken employ Exodus’s white label solution to present their users with branded wallets. This enables exchanges to offer a seamless user experience and secure asset management.

- Cryptocurrency Payment Processors: Payment processors such as CoinPayments and BitPay make use of Exodus’s white label solution, permitting their merchants to accept cryptocurrency payments. This integration broadens the payment options for merchants and customers.

- Cryptocurrency Investment Platforms: Investment platforms like Celsius Network and Voyager Digital rely on Exodus Cryptocurrency Wallet solutions to offer their users the opportunity to invest in cryptocurrencies. The customized wallets enhance user engagement and facilitate crypto investments.

Benefits:

- Tailored Customizations: Exodus’s white label solution provides businesses with the flexibility to customize their wallets, aligning them with their branding and target audience preferences.

- Simplified Integration: Utilizing Exodus’s solution simplifies the process of integrating a crypto wallet into existing services, reducing the complexities involved in offering crypto wallet services.

- Cost Savings: Businesses can save on development costs and the ongoing expenses associated with maintaining wallet infrastructure, optimizing their financial efficiency.

- Trust Wallet

Trust Wallet, a non-custodial crypto wallet provider, offers businesses a white label solution to provide their own custom crypto wallets to users, featuring an array of features and personalization options.*

Usage Scenarios:

- Cryptocurrency Exchanges: Exchanges such as Binance DEX and Crypto.com leverage Trust Wallet’s white label solution to offer their users branded wallets. This integration enhances user accessibility and trust.

- Cryptocurrency Payment Processors: Trust Wallet’s white label solution is employed by payment processors like Simplex and Changelly to allow their merchants to accept cryptocurrency payments. This flexibility provides more payment choices to merchants and customers.

- Cryptocurrency Investment Platforms: Investment platforms like Binance Earn and BlockFi use Trust Wallet’s white label solution to enable their users to invest in cryptocurrencies. These customized wallets streamline user interactions and crypto investment opportunities.

Benefits:

- Customization and Branding: Trust Wallet’s white label solution empowers businesses to tailor their wallets to their branding and customer preferences, strengthening their identity and user trust.

- Seamless Integration: The solution streamlines wallet integration, making it more straightforward for businesses to offer crypto wallet services without major development efforts.

- Cost Efficiency: By using Trust Wallet’s white label solution, businesses can minimize development and maintenance expenses, making it a cost-effective choice for wallet provision.

These real-life case studies highlight the diverse applications and benefits of non-custodial white label crypto wallets. They offer enhanced security, cost savings, and accelerated market entry, making them a valuable tool for businesses seeking to diversify income and meet the growing demand for cryptocurrency services.

In conclusion, the future of non-custodial white label wallets promises opportunities and dynamic trends. Staying attuned to these trends and proactively adapting to emerging user demands will be instrumental in utilizing the potential of white label wallet solutions. As the crypto space continues to mature and diversify, businesses that position themselves at the vanguard of these trends stand to thrive in this innovative and ever-evolving industry.

Lead Your Business with Debut Infotech’s Ready-to-Use Crypto Wallet Solution

Debut Infotech, with its well-established track record, realizes the essence of innovation, security, and adaptability, all of which are integral components of the current market trends. We offer a state-of-the-art white label crypto wallet solution designed to elevate your cryptocurrency management experience.

Our white label wallet combines cutting-edge technology, advanced security measures, and a user-friendly interface to provide you with a versatile and customizable solution that meets the unique needs of your business.

Don’t miss out on the opportunity. Contact us today to explore how our Crypto Wallet Solution can reform your business.

FAQs: White Label Wallet Providers

A. A non-custodial white label crypto wallet is a digital wallet solution that allows businesses to offer their own branded cryptocurrency wallets to users without needing to build the wallet infrastructure from scratch. It provides a user-friendly interface for managing cryptocurrencies while giving users full control over their funds and private keys.

A. The primary distinction between a white label crypto wallet and a custodial wallet lies in the custody of assets. White label wallets are non-custodial, meaning users have complete control over their private keys and funds. In contrast, custodial wallets hold users’ assets on their behalf, which can be convenient but introduces counterparty risk. White label wallets prioritize user security and control.

A. White label crypto wallets offer diverse income streams. You can generate revenue through transaction fees, subscription models, licensing fees, affiliate programs, and advertising.

A. Security and compliance are paramount in the crypto space. To safeguard your users’ assets, implement robust security measures, including regular security audits, encryption, biometric authentication, and hardware wallet integration.

A. The non-custodial white label wallet space is evolving rapidly. Keep an eye on trends such as DeFi integration, NFT and digital collectibles support, cross-chain compatibility, advanced security measures, and the demand for highly customizable wallets.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment