Table of Contents

Home / Blog / Blockchain

Real Estate Tokenization: Legal and Regulatory Challenges to Consider

October 18, 2024

October 18, 2024

Real estate security tokens have become a popular term in recent times, all thanks to the rapid development of blockchain technology. According to a 2023 Statista survey, 12% of real estate firms were already using them, while a whopping 26% were piloting the technology.

However, despite this huge popularity, their usage is still plagued with significant legal and regulatory challenges. If you’re looking to position yourself at the forefront of real estate investments using tokenization, you’ll need to understand these regulations properly. This article helps you maintain compliance in real estate by discussing the most significant regulatory obstacles ahead.

But before we dive into all that, let’s get on the same page by understanding the basics.

Maximize Your Investment Potential With the Best Real Estate Tokenization Company

Convert your physical property into digital assets to embrace the future of real estate. From smart contract solutions to token design services, we help you harness the full power of tokenized real estate.

What is Real Estate Tokenization?

Real estate tokenization refers to the process of creating digital assets representing tangible and real-world property assets or their cash flows on a blockchain network. The blockchain tokens created in this process can now be bought, sold, or traded just like conventional cryptocurrencies on designated trading platforms.

This revolutionary process is a novel application of blockchain technology in the otherwise centralized real estate market. By tokenizing a property, you’re essentially dividing it or its value into smaller bits. As a result, multiple investors can take fractional ownership of the same property.

Tokenization can be applied to all kinds of properties, from commercial and residential to industrial. After dividing the property’s value into smaller fractions, the owner or controlling entity can decide to sell to single or multiple entities.

So, what are the benefits of real estate tokenization?

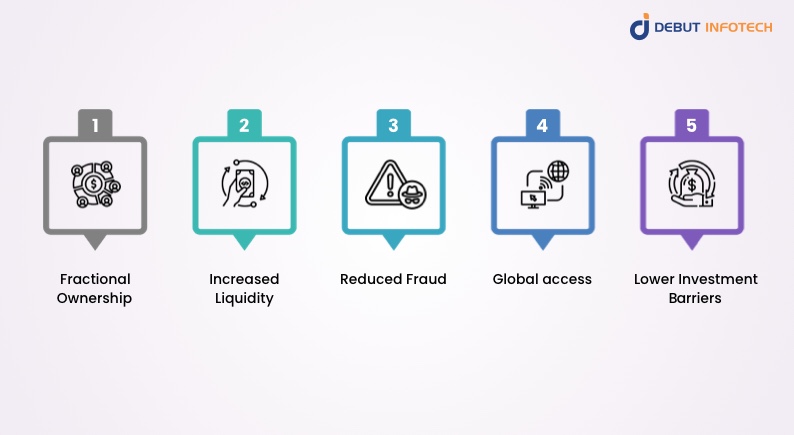

- Fractional Ownership: Buyers can easily purchase smaller or larger portions of a real estate property depending on their investment capacity.

- Increased Liquidity: By fractionalizing real estate properties, the real estate market can welcome more investors, thus leading to more investment capital in circulation.

- Reduced Fraud: The tokenized assets’ construction on the blockchain’s immutable ledger allows for verification of all transactions, thus providing transparency and reducing the likelihood of fraudulent activities.

- Global access: Investors can purchase fractions of properties anywhere in the world, regardless of their location.

- Lower Investment Barriers: Investors can also purchase as little or as much as they please.

Despite the potential benefits attached to real estate tokenization, the industry still faces the following regulatory and legal challenges:

Regulatory Differences Across Regions

In recent times, digital assets have grown significantly from mere speculative (trial and error) investments to legitimate asset classes. This steady traction has prompted governments around the world, tax authorities, enforcement agencies, and regulators in different nations to recognize them. Many of them have also had to develop regulatory frameworks to manage their applications effectively.

Despite this traction, some regions of the world still have no provisions for regulating these token offerings, and a few even prohibit their use altogether.

Meanwhile, the very nature of digital assets is to facilitate value exchange across borders with no restriction.

So you see the problem.

The regulatory landscape of real estate tokenization is uneven, dynamic, and continuously evolving.

Some jurisdictions consider real estate tokens securities, others regard them as cryptocurrencies, and some classify them as an entirely new asset class because they have tangible, real-world assets backing them.

Furthermore, some regions may not consider real estate tokens as a valid form of property ownership. These aspersions cast doubt on their legitimacy and may cause potential conflict between property owners and investors.

Likewise, countries skeptical of real estate tokens as legitimate asset classes may impose strict requirements and fees on the issuance and trading of such tokens in a bid to discourage investors.

There is also no unified reporting system for recording tokenized real estate transactions. This absence implies a lack of transparency, as investors and regulators cannot effectively track these transactions and enforce compliance.

Given all these possibilities, real estate tokenization enthusiasts may face certain regulatory barriers in their attempt to convert physical assets into secure digital tokens.

But you don’t have to.

Real estate tokenization platforms like Debut Infotech can hold your hands through the entire process.

AML and KYC Compliance Requirements

Regulators often mandate Anti-money Laundering (AML) and Know Your Customer (KYC) processes for financial services to prevent illegal activities such as fraud, money laundering, and terrorist financing.

As the name implies, the KYC process ensures that real estate token issuers learn important details about their investors and the activities they’re involved with. Considering that these investors will be owning claims to tangible real-world assets, wouldn’t you agree that it is only fair?

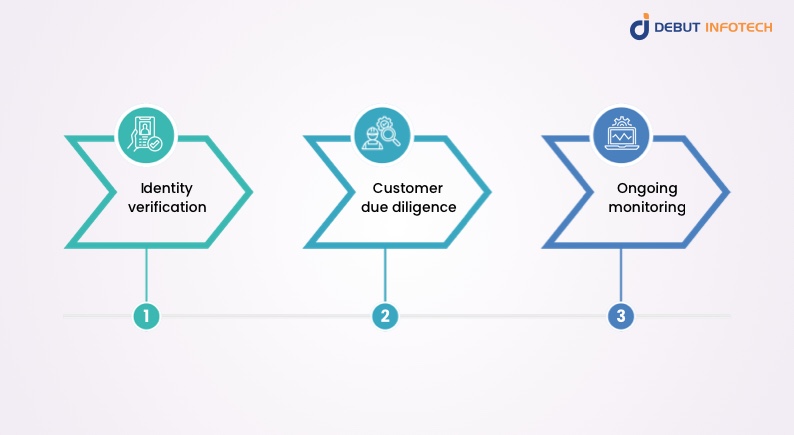

To ensure you’re fully complying with KYC requirements as a real estate token issuer, you have to implement the following:

- Identity verification: The process of confirming that a user is, in fact, who they say they are. You can validate this fact by applying sophisticated technologies like artificial intelligence (AI), advanced security features like holograms, and security checks like biometrics and liveness analysis.

- Customer due diligence: This is basically gathering details about the customer’s identity, the activities they’re involved in, individuals and entities they do business with, and any other valuable information that helps you access any risk factors they may pose.

- Ongoing monitoring: Continuous periodic checks are conducted to monitor users and ensure their risk status remains low.

On the other hand, compliance with AML regulations means making sure that every transaction involving the exchange of your real estate tokens can be duly traced and accounted for legitimately.

While these compliance requirements are vital to everybody’s protection, they often make the tokenization processes more complex for both issuers and investors.

Taxation and Reporting Complications

The US Internal Revenue Service (IRS) defines digital assets as digital representations of value recorded on a cryptographically secured digital ledger or similar technology.

Does that definition cover your real estate token?

Absolutely!

Furthermore, the IRS also considers digital assets as property and not currency for tax purposes. This implies that the real estate token is subject to either a capital gains or loss tax OR an ordinary income tax.

Due to these statutes, many investors need help understanding which taxes apply whenever they invest in, purchase, or sell real estate tokens.

For some clarity, the IRS specifies the following:

- The income from the sale or disposal of any digital asset you own or use for personal or investment purposes will attract a capital gains or loss tax

- The income from the sale or disposal of any digital asset you received in exchange for goods and services in a business context will attract an ordinary income or loss tax.

However, that’s only in the US. Other regions have varying tax laws, and this can be confusing for investors, especially when it comes to cross-border transactions.

In addition to the capital gains and personal income taxes imposed on transactions involving these tokens, the underlying LLCs holding the physical real estate also incur general real estate taxes. The LLC then shares the net rental income with the token holders based on their ownership percentage. Of course, these tax obligations vary across regions and depend on how long the holders keep the tokens before sale.

Compliance with securities regulations

In 2019, the United States Securities and Exchange Commission’s (SEC) Division of Corporate Finance released a 13-page memorandum explaining the criteria for a digital asset to be subject to federal securities law. The SEC titled it the Framework for “Investment Contract” Analysis of Digital Assets. This document serves as a framework for determining whether a digital asset qualifies as a “security” or “investment contract.”

So, what makes a token a security?

Your digital token will be considered security if it meets the requirements of the Howey test.

The Howey test considers a digital token to be an “investment contract” if it:

- Is purchased or otherwise acquired in exchange for value either in the form of real (or fiat) currency, another digital asset, or any other form of consideration

- Is in a common enterprise

- Has a reasonable expectation of profits derived from the efforts of others

If you’re already getting bored of this legal jargon, then you probably understand why compliance with securities regulations is a major challenge faced in real estate tokenization.

Many new investors are still determining whether their real estate tokens should be treated as securities. As a result, they are likely to violate the law.

Most well-advised real estate companies often self-define their real estate tokens as securities and comply with the securities law from the outset to avoid this. Nonetheless, the SEC advises that investors, token issuers, and any other entities involved in the offer, sale, or distribution of a digital asset should analyze their tokens exhaustively using the criteria laid out in the framework for clarity.

This can be quite a rigorous process. However, you can navigate this complex regulatory landscape with ease by getting compliance and legal support from a real estate tokenization development company like Debut Infotech.

Due to these legal complications, many real estate token issuers must file with the SEC before they can offer or sell their tokens. In addition, real estate tokens intended for public trading must also be registered with the SEC. However, there are some opportunities for such issuers to leverage exemptions like Regulation D, which allows them to raise funds from accredited investors without needing a prospectus or advertising restrictions.

Money Service Business (MSB) Regulations

Tax and securities regulations are not the only directives you may have to comply with if you intend to facilitate token transactions for members of the public. On May 9, 2019, the Financial Crimes Enforcement Network (FinCEN) released an interpretive guidance to clarify its regulations as they relate to the regulations of Money Service Businesses (MSB). In this guidance, the agency defines an MSB as “a person wherever located doing business, whether or not on a regular basis or as an organized or licensed business concern, wholly or in substantial part within the United States,” operating directly, or through an agent, agency, branch, or office, who functions as, among other things, a “money transmitter.”

It further describes a “money transmitter” as a “person that provides money transmission services,” or “any other person engaged in the transfer of funds.”

That guide was exhaustive. However, the crux is that your real estate tokenization body might fall into this category. This is because you’ll essentially be issuing and redeeming digital tokens at some point in time.

You know what that means?

Your business is now subject to the regulatory guidelines that MSBs must follow in addition to the other ones we described earlier.

Navigating these various regulatory barriers can be a handful if you’re merely just hoping to transform your real estate assets into liquid investments with tokenization.

That’s why tokenization platforms like Debut Infotech take all that stress off you. They handle the entire process from development to regulatory compliance so that you can focus on maximizing your real estate investment potential.

Property Rights and Ownership

The emergence of blockchain technology has presented an immutable and secure record of representing ownership of tangible assets. While traditional systems of ownership have been largely centralized, the decentralized nature of the blockchain has made fractional ownership possible.

But how do the two systems reconcile?

How do existing property laws apply to the ownership of real estate tokens?

As hinted earlier, the legal statutes in certain locations do not recognize real estate tokens as legitimate proof of property ownership. This poses a serious question for enthusiasts looking to invest in real estate digital assets.

The big question is:

Does the owner of a real estate token have legal claims to the physical property?

Going by the theoretical definition of real estate tokenization, the answer to this question should be a resounding YES! However, this hasn’t been the case in most practical applications.

Wondering why?

The existing legal frameworks regulating real estate in most locations do not have provisions for transferring ownership rights based on the acquisition of digital assets. This lack of clarity has made it difficult to resolve disputes that ensue between property deed holders and owners of digital tokens.

There is

Many real estate tokenization projects have been trying to circumvent this problem by providing investors with an intelligent method of buying into the real estate market. They are set up as LLCs and offer investors a list of properties to invest in. When they do, investors get a share of the ownership rights from them. By putting themselves between the investors and the property, they’re helping both parties avoid contentious issues such as this.

Nonetheless, the big question still looms. Sooner rather than later, legislators, regulators, and token issuers must enact reforms that address these grey areas properly. For now, property and ownership rights are still major legal and regulatory barriers to the growth of the real estate tokenization market.

Short Supply of Regulated Trading Platforms

Many regulatory bodies have strict entry requirements to maintain control over the emerging real estate tokenization market. In fact, some regions allow only established Security Token Offerings (STOs) to offer real estate tokens to the public.

An STO is a powerful process similar to an initial public offering (IPO) in traditional finance. It is a formal process of offering security tokens to the public.

Remember when we declared real estate tokens securities earlier in this article?

Other examples of security tokens include equity tokens and debt tokens.

Anyway, STOs are often highly reputable organizations that have met the strict regulatory requirements of a jurisdiction’s regulatory body.

Tokenized real estate assets are considered securities, so they can only be traded on platforms registered with the SEC, e.g., National stock exchanges and Alternative trading systems (ATSs). As such, trading them on decentralized exchanges (DEXs) is highly prohibited.

More so, you need to secure a broker-dealer license before you can be listed on these platforms. You’ll also need one before you can either sell or resell a security token and disburse proceeds to issuers.

However, there is a shortage of these compliant service providers, thus affecting the development of the real estate tokenization market.

The result?

An apparent higher entry barrier into the tokenization industry.

Limited Legal Precedents

A major factor influencing all the legal and regulatory barriers discussed above is the fact that real estate tokenization is a novel concept. It only started in 2018. Compared to the age-long real estate industry, it’s very clear that the concept is still in its infancy.

As such, there are little or no precedents to guide the activities and happenings in the field. Regulators, legislators, and market players have very little or no experience with past occurrences. This inexperience makes it difficult for legal practitioners and regulatory bodies to confidently give legal advice or resolve legal disputes that may ensue.

In response, many investors are skeptical about plowing money into tokenized real estate assets. In the same vein, legislators and regulatory bodies are trying to observe how the industry grows and reacts to daily occurrences before implementing permanent statutes.

This lack of legal precedents has stalled the implementation of advanced regulatory frameworks for the entire industry. In response, the industry has slowly advanced towards fulfilling the huge potential it clearly has.

Ready to Tokenize Your Real Estate Property?

Are you a property owner, investor, or real estate stakeholder looking to revolutionize your investment strategy? Our tokenization services are tailored just for you!

In Conclusion

Multiple legal and regulatory hurdles exist in real estate tokenization, from taxation and securities regulations to KYC and AML requirements.

What’s even worse?

There might still be more to come as the regulatory landscape is continuously evolving.

At the same time, the real-world benefits of tokenizing real estate properties are undeniable. That’s why it is important to stay abreast of these dynamic legal and regulatory hurdles so you know how to position on the right side of the law.

Frequently Asked Questions

The legality of real estate tokenization is a nuanced concept that varies from place to place. Different legal frameworks regulate real estate tokenization across jurisdictions. Investors should seek legal guidance to navigate this complex landscape effectively.

Tokenization of real estate requires the identification and evaluation of suitable real estate assets, establishment of compliant legal and regulatory infrastructures, selection of a suitable blockchain, and design of the token. In addition, it also requires the implementation of corporate governance mechanisms, implementation of investor verification protocols, and integration of relevant technologies.

Regulatory and legal uncertainty, fraud and security concerns, technological complexity, and management complications are some of the risks investors and developers need to be aware of before diving into real estate tokenization.

Real estate tokenization costs range from $5,000 to $50,000 depending on the property’s asset class, required level of regulatory and legal oversight, preferred blockchain, and other technological infrastructures.

Regulatory uncertainty, technological complications, and market acceptance are the major challenges faced when tokenizing real estate assets.

Talk With Our Expert

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment