Table of Contents

Home / Blog / Blockchain

Step-By-Step Guide To Launching a Real Estate Tokenization Platform

October 17, 2024

October 17, 2024

A real estate tokenization platform revolutionizes property investing, using blockchain to increase access and liquidity. By turning physical properties into digital tokens, platforms enable fractional ownership opportunities. This streamlined, transparent process appeals to a wide range of investors. It broadens the investor base and increases the liquidity of these tradable assets.

According to the latest market research by the CMI Team, the global Real Estate Tokenization Market is projected to grow at a compound annual growth rate (CAGR) of 21% between 2024 and 2033. The market size is estimated to reach $3.5 billion in 2024 and is anticipated to expand to $19.4 billion by 2033. This shift underscores the crucial role of tokenization platforms in real estate investments. It signals a significant transformation in asset management and investment strategies.

With real estate tokenization gaining traction, creators and investors need guidance navigating this terrain. This guide offers a step-by-step approach to developing a successful tokenization platform. It covers market research, legal compliance, technological deployment, and strategic market entry.

Understanding Real Estate Tokenization Platform

A real estate tokenization platform transforms property ownership into digital tokens using blockchain technology. These tokens represent fractional ownership of a property, enabling easier trading and investment. Through smart contracts, transactions are automated, improving transparency, security, and liquidity in the real estate market. Investors can buy and sell these tokens seamlessly, while property owners can access a broader investor base. Tokenization offers benefits like increased market accessibility and reduced investment barriers, but compliance with regulations is crucial for legal operations and investor security.

Ready to launch your own real estate tokenization platform?

Debut Infotech is here to help you build a top-notch tokenization platform to tap into new investment opportunities and transform your real estate assets!

The Benefits of Real Estate Tokenization Platforms

A real estate tokenization platform offers numerous benefits that can reshape the landscape of property investment and management. Tokenization opens new investment frontiers by digitizing real world assets.

Here are the key advantages:

1. Increased Liquidity

Tokenization turns real estate into digital tokens, similar to stock market shares. This fractional ownership model allows smaller investors easier market entry, enhancing asset liquidity. Real world asset tokenization enhances liquidity and market reach.

2. Global Accessibility

Tokenization platforms allow worldwide investors to access real estate markets without geographical or bureaucratic barriers. This broadens the investor base and boosts capital inflows into the sector.

3. Lower Transaction Costs

Tokenization platforms use smart contracts to automate transactions, significantly reducing costs associated with intermediaries such as agents, brokers, and legal advisors. This streamlined approach also reduces administrative overhead and improves transaction speed.

4. Enhanced Transparency and Security

Blockchain records all transactions on an immutable ledger, ensuring clear histories and reducing fraud risks. Smart contracts automate and enforce transaction terms, increasing trust among parties.

4. Portfolio Diversification

Investors can buy tokens representing parts of properties in different locations, diversifying risk. This contrasts with traditional real estate investment, where high entry costs may limit investors to fewer, larger transactions.

5. Regulatory Compliance

Many real estate tokenization platforms incorporate compliance measures directly into their platforms, handling complex regulations through programmed smart contracts that comply with jurisdictional laws regarding real estate transactions and investments.

These benefits make real estate tokenization platforms an attractive option for transforming property investments into more flexible, inclusive, and efficient opportunities.

What Blockchains Are Being Used to Tokenize Real Estate?

As the real estate tokenization market grows, choosing the right blockchain is crucial. This decision impacts transaction speed, cost, security, and scalability. Several blockchains have become popular choices, each offering unique strengths for the tokenization process.

The following blockchains are widely used for their robustness, flexibility, and compatibility with real estate tokenization requirements:

1. Ethereum

Ethereum is a top choice for real estate tokenization due to smart contracts. It supports ERC-20 and ERC-721 standards, enabling fungible and non-fungible tokens. This flexibility suits fractional ownership and unique property titles for various assets. Its decentralized and open-source nature encourages innovation and integration for DApps.

However, high transaction fees and network congestion are troubling issues for users. Ethereum 2.0 improves scalability, energy efficiency and attracts more large-scale projects. The ecosystem also offers many tools, like wallets and compliance solutions, for streamlined development.

2. Polygon

Polygon, a Layer 2 solution on Ethereum, offers cheaper but faster transactions. It is compatible with the Ethereum Virtual Machine (EVM), enabling easy project migration. This makes Polygon ideal for tokenization platforms leveraging Ethereum’s strengths without high fees.

Polygon is widely used for fractional property ownership projects worldwide. Lower transaction costs enable tokenization of lower-value properties, attracting smaller investors. Polygon’s interoperability with other blockchains and user-friendly interface boost its popularity.

3. Binance Smart Chain (BSC)

Binance Smart Chain (BSC) is popular for real estate tokenization due to low fees and fast transactions. Its compatibility with Ethereum-based tools simplifies project migration to BSC. Binance’s strong brand and ecosystem help attract a broad user base.

In real estate, BSC supports launching property-backed tokens and managing ownership transfers. Its scalability suits large token issuance, while low fees boost trading and liquidity. BSC’s active community and Binance’s support make it appealing to developers and investors.

4. Tezos

Tezos stands out for its self-amending governance, allowing upgrades without hard forks. This adaptability makes Tezos a stable, future-proof option for long-term tokenization projects. Its use of formal verification ensures smart contracts are secure and reliable.

Tezos is used for tokenizing luxury real estate and commercial buildings, prioritizing security and compliance. The network’s energy-efficient proof-of-stake (PoS) algorithm appeals to sustainability-focused projects.

5. Solana

Solana’s low fees as well as high throughput, make it perfect for real estate tokenization projects. It is capable of handling thousands of transactions per second, ensuring rapid processing and high scalability. Solana’s Proof of History (PoH) consensus mechanism guarantees quick and efficient transaction execution.

Real estate platforms on Solana benefit from real-time trading and near-instant property token settlements. This speed is beneficial for secondary market trading, providing stock exchange-like liquidity. Solana’s growing ecosystem and active developer community add to its appeal for new projects.

6. Avalanche

Avalanche’s consensus mechanism offers a high throughput and low latency, ideal for real estate tokenization. Its custom blockchains, called subnets, enable tailored solutions for specific use cases. This flexibility suits projects needing both public and private blockchain functionalities.

Avalanche supports tokenized real estate funds and investment vehicles, leveraging speed and scalability. Its interoperability with Ethereum and other networks adds versatility for integration with existing infrastructures.

7. Algorand

Algorand is ideal for real estate tokenization, offering high-speed transactions and low fees. Its pure proof-of-stake (PPoS) mechanism ensures top-tier security and decentralization.

The platform supports both fungible and non-fungible tokens, accommodating diverse real estate assets. Real estate tokenization platforms are leveraging Algorand’s robust infrastructure and transparency.

Projects tokenizing rental properties or commercial spaces often utilize Algorand for automated rental income distribution via smart contracts. Algorand’s commitment to compliance and partnerships with financial institutions make it a trusted platform for real estate tokenization.

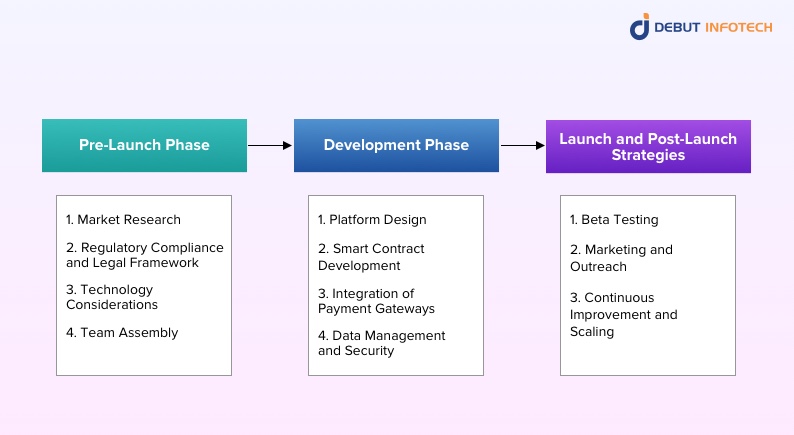

Preliminary Steps Before Launching Your Platform

Before you build a real estate tokenization platform, you need to take some crucial steps. Taking these steps will ensure the successful launch of the digital platform while avoiding legal trouble.

1. Pre-Launch Phase

This phase covers the following:

i. Market Research

Comprehensive market research is crucial before launching a real estate tokenization platform. Research should analyze market trends to gauge demand and identify emerging opportunities. Identifying the target audience, such as individual and institutional investors, is essential.

Understanding their investment habits, preferences, and tech skills shapes platform design and marketing strategies. This approach ensures the platform meets the needs of potential users effectively.

ii. Regulatory Compliance and Legal Framework

Navigating complex legal requirements is crucial for launching a real estate tokenization platform. It involves understanding securities, real estate, and digital asset regulations in each operating jurisdiction. Laws vary widely, making partnerships with specialized legal experts essential for compliance. These experts ensure adherence to regulations, avoiding legal issues and building user trust.

iii. Technology Considerations

Choosing the right blockchain is crucial for a successful tokenization platform. It must support smart contracts for automated transactions and offer strong security features. The technology should also be scalable to manage growth in users and transactions efficiently.

Security is critical to protect sensitive financial and personal data from cyber threats. Using advanced encryption and secure access protocols builds a resilient infrastructure. This is why choosing the right real estate tokenization company is crucial for success.

iv. Team Assembly

The final pre-launch step is assembling a skilled team to execute the project. This team should include blockchain developers, real estate experts, marketing professionals, and customer service staff. Each member must clearly understand their role, aligned with the platform’s objectives.

For example, developers handle technical infrastructure, while marketers attract and engage users. A cohesive team is essential to overcoming challenges and ensuring a successful launch.

These pre-launch steps build a solid foundation for a real estate tokenization platform. Addressing each area helps mitigate risks, tailor the platform to user needs, and succeed in a competitive market.

2. Development Phase

Once you’re done with the pre launch phase, you move onto the real estate tokenization platform development phase.

i. Platform Design: User Interface and User Experience Considerations

The design of a real estate tokenization platform heavily relies on its UI and UX. An intuitive UI boosts engagement and ensures smooth interactions, attracting and retaining investors. The platform must be visually appealing with a clear layout for seamless navigation. It should include responsive design for mobile users and accessibility features for a diverse audience.

UX considerations should simplify the investment process with clear property information and token structures. Highlight potential returns and include educational resources like FAQs and tutorials to build confidence. Testing with real users during development helps identify pain points and optimize the experience.

ii. Smart Contract Development

Smart contracts are crucial in real estate tokenization, serving as self-executing agreements encoded in code. They automate functions like token issuance, dividend distribution, and compliance checks. This reduces costs and human error, ensuring seamless, transparent transactions.

Developing and testing smart contracts requires caution and rigorous validation. Thorough testing ensures contracts function correctly and are free of vulnerabilities. Third-party audits provide additional assurance of contract integrity. Compliance with regulatory requirements is vital to avoid future legal complications.

iii. Integration of Payment Gateways

Integrating diverse payment gateways is vital for accommodating various users on the platform. Offering credit cards, bank transfers, and cryptocurrencies improves convenience and broadens platform appeal. Evaluate each gateway’s fees, processing times, and user experience for seamless transactions.

Security is paramount for transaction safety. Use end-to-end encryption, SSL certificates, and fraud detection systems to protect financial data. Regular audits and partnering with reputable processors enhance security and build user trust.

iv. Data Management and Security

Handling sensitive data is a crucial responsibility for the best real estate tokenization platform. Robust encryption, access controls, and secure storage solutions are essential for protecting user information. Clear data management policies ensure compliance with legal standards for handling sensitive information.

Compliance with regulations like GDPR and CCPA is mandatory for protecting personal data. These laws require transparency, user consent, and proper data-handling practices. Regular team training and a dedicated compliance framework help the platform adhere to legal requirements while safeguarding privacy.

Addressing these elements establishes a strong foundation for a successful tokenization platform. User-centric design, secure smart contracts, and stringent data management build a trustworthy investment environment.

3. Launch and Post-Launch Strategies

Here’s what you do when you get to this phase:

i. Beta Testing

Beta testing is crucial for launching a real estate tokenization platform, and identifying issues before release. A pilot test with select investors and property owners offers insights into usability and performance. This controlled environment simulates real-world conditions, ensuring all features function correctly.

Gathering feedback during beta testing is vital for refining the platform. Developers should focus on user suggestions related to navigation, transaction flows, and technical glitches. Addressing these concerns and re-testing ensures a polished, reliable platform upon launch.

Regular communication with testers fosters community involvement, increasing the likelihood of continued use and positive recommendations.

ii. Marketing and Outreach

Attracting investors and users to a real estate tokenization platform requires an extensive strategy. Begin by building a strong online presence with a professional website, including active social media. Utilize content marketing via blogs, videos, and webinars that explain real estate tokenization benefits. Engage with online communities in blockchain, real estate, and fintech to build credibility.

Forming partnerships and collaborations is another effective strategy. Partner with real estate blockchain companies, blockchain developers, as well as financial institutions to expand reach. Collaborate with industry influencers for co-branded campaigns, webinars, and conferences that increase visibility.

Targeted outreach to institutional investors, real estate firms, and high-net-worth individuals is essential. Offer early access and tailored content addressing their needs to drive adoption. Utilize email marketing, paid ads, and PR initiatives to spread awareness and attract a diverse user base.

iii. Continuous Improvement and Scaling

Continuous improvement is crucial post-launch to maintain user engagement and stay competitive. Regular updates based on user feedback ensure the platform evolves with user needs. Monitoring user interactions and resolving technical issues quickly keeps the platform user-friendly.

Then scaling becomes a priority as it involves expanding market reach and platform capabilities. This includes adding more real estate properties, entering international markets, and supporting multiple currencies. Investing in scalable infrastructure enables handling higher traffic and transaction volumes efficiently.

Regulatory expansion is essential as the platform grows. Compliance with local regulations in new jurisdictions is necessary for smooth market entry. Establishing a legal team ensures adherence to laws and avoids complications during expansion.

By applying these launch and post-launch strategies, the platform can achieve a strong initial impact and sustained growth. Regularly improving user experience, ensuring security, and expanding into new markets will establish a solid market presence. This approach positions your platform as a leader in real estate tokenization.

Looking to develop an innovative solution for real estate investments?

Debut Infotech leads in Blockchain innovation, specializing in bespoke real estate tokenization solutions. Contact us today for expert guidance and tailored Blockchain development services!

Conclusion

Launching a real estate tokenization platform involves thorough planning, strategic development, and continuous improvement. By understanding the technical and legal aspects, you can create a platform that revolutionizes property investments. Take the first step to capitalize on the future of real estate today.

Frequently Asked Questions

A real estate tokenization platform is a digital solution that divides property ownership into blockchain-based tokens. These tokens represent fractional ownership and are traded on the blockchain, ensuring secure, transparent, and automated transactions through smart contracts, improving liquidity and accessibility for investors.

Tokenizing real estate involves selecting a property, determining its legal compliance, structuring tokens, and developing smart contracts. Afterward, a marketing strategy is implemented to attract investors, tokens are distributed, and the property is managed through continuous updates to token holders, enhancing engagement and transparency.

Yes, real estate tokenization is legal, provided it adheres to regulatory frameworks like securities laws. Tokenized properties must comply with Know Your Customer (KYC), Anti-Money Laundering (AML), and local real estate regulations to ensure legal and financial protection for both issuers and investors.

The cost of tokenizing real estate typically ranges between $50,000 and $100,000. This includes expenses for legal compliance, platform development, token creation, smart contracts, marketing, and ongoing maintenance. The overall cost depends on the complexity of the project and the regulatory requirements involved.

The risks include regulatory uncertainty, security vulnerabilities in smart contracts, and market volatility. Tokenized assets must meet compliance standards, while strong cybersecurity measures and liquidity provisions are essential. Ensuring investor protection and reliable secondary markets also play a critical role in mitigating risks.

Talk With Our Expert

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment