Table of Contents

Home / Blog / Tokenization

Launch Your RWA Tokenization Project in 6 Weeks

October 25, 2024

October 25, 2024

Recent reports by Binance reveal that the value of RWA tokenization projects surpassed USD 12 billion in 2022. In fact, that value is expected to reach a staggering USD 16 trillion by 2030. This represents one of the revolutionizing impacts of blockchain technology on the financial landscape.

Launching your real world asset tokenization project provides liquidity to your assets, democratizes access to them, and increases transparency in its management processes.

However, there are so many things you need to consider to make it work.

If you’re looking to get a piece of this huge real-world tokenization pie, this article contains the exact information you need. Using Debut Infotech’s proven 6-step process, you can start issuing your tokens in just 6 weeks.

Let’s get straight into it.

Ready to Launch Your RWA Tokenization Project?

Our expert digital asset tokenization services provide you with all the tools and guidance you need to launch tokenized real-world assets that meet jurisdictional requirements and standards for trading and ownership.

What is Real World Asset (RWA) Tokenization?

Real World Asset tokenization is the process of converting ownership rights to smaller portions of tangible and intangible properties or resources into on-chain tokens that can be traded on the blockchain. It involves creating digital representations of these assets on the blockchain network. Consequently, individuals from around the world can trade them seamlessly on the blockchain or own fractions of these assets.

Examples of real-world assets that can be tokenized include:

- Real estate properties: These could be undeveloped lands, residential properties, or commercial buildings.

- Intellectual properties (IP): Music licenses, invention patents, and copyrights can all be token includeities. These are valuable resources like gold, diamond, and silver, as well as tangible agricultural products like livestock.

- Currencies: Popular and established examples include USDT, USDC, and CBDCs (Central Bank Digital Currencies).

- Financial assets: Common examples include stocks, bonds, and securities, etc.

- Art and collectibles: Antique collections, toys, fine arts, comic book collections, and toys can be tokenized as well

This novel process of digitizing real-world assets on the blockchain network may sound fantastical. However, using the 6-step process detailed below, you can launch your asset as a token on the blockchain in just weeks!

Eager to discover how?

Jump to the section below.

Related Article: Real Estate Tokenization: Legal and Regulatory Challenges to Consider

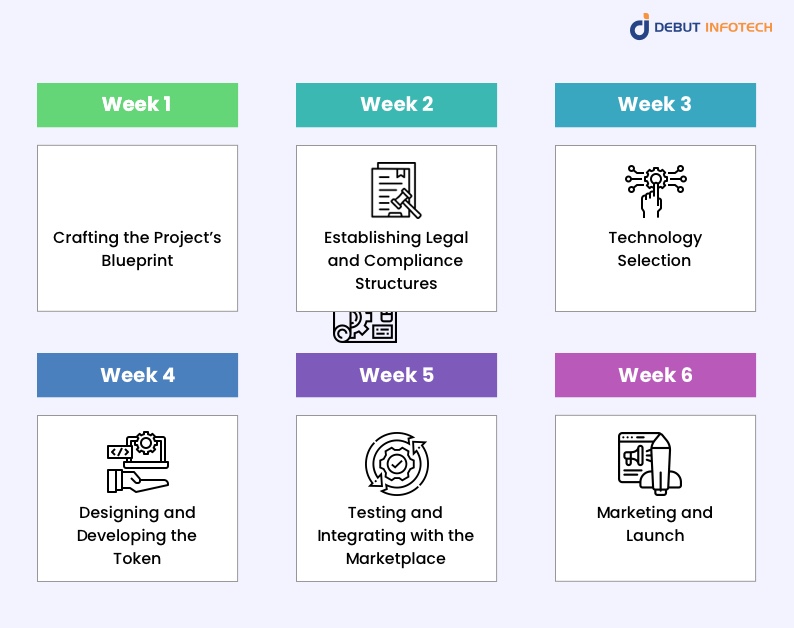

Debut Infotech’s 6-Step Process for Launching your RWA Tokenization Project in 6 Weeks

The following are the simplified high-level steps involved in tokenizing your physical assets in the next six weeks.

Week 1: Crafting the Project’s Blueprint

Tokenizing your RWAs is an exciting and rewarding project. However, a lot of things can go wrong if you take the wrong steps.

That’s why you have to skillfully and carefully map out the project’s blueprint during the first week. This involves visualizing a fairly complete picture of the outcome right from the start.

Crafting your tokenization project’s blueprint involves the following steps:

I. Asset Selection

This might sound basic, but “what asset, specifically, are you tokenizing?”

As we listed above, it could be a house, land, block of apartments, or a rare coin collection.

You have to state it clearly in week 1 before any other thing.

Why is this important?

Your choice of asset determines your project’s viability and your token’s appeal to potential investors.

More importantly, each token might have some unique peculiarities that must be factored into the token development process. For instance, the legal frameworks you have to consider for real estate tokenization are quite different from the ones involved when tokenizing stocks, bonds, and securities.

II. Project Goal Articulation

Now that you know what asset you’re tokenizing, the next question you need to answer is, “what do you intend to get out of this project?”

As with any other kind of project, goal setting provides direction and defined measures of success or failure.

Some common real world asset tokenization goals of issuers include:

- Enabling fractional ownership: This means democratizing access to high-value real world assets like real estate or exclusive fine art. Investing in these examples traditionally requires significant capital. However, tokenizing them makes them more accessible to both retail and institutional investors.

- Increasing liquidity: Issuers sometimes also want to be able to easily convert an asset or security to cash without affecting its market value. Converting the assets into tokens makes it easy for them to buy, sell, or trade these holdings.

- Managing assets effectively: Blockchain technology’s inherent transparency, security, and immutability features make it easy for asset owners to maintain better oversight over their properties. They get to handle transactions more efficiently and keep better records.

III. Market Research

So, “which investors are interested in your goals and asset type?”

That’s what market research is about — figuring out the target audience for your tokenization project.

It’s also about identifying the competitors with the same value proposition as yours.

Getting a good idea of these two factors will help you identify exploitable market opportunities. These include figuring out audience pain points that are not yet catered for and unique value offerings that no one else offers.

IV. Project Strategy and Milestone Planning

Wrap up week 1 by developing a strategic plan to achieve your set goals and objectives. Furthermore, you must map out key benchmarks to measure your progress.

Remember, we have to hit the markets by week 6.

Off to week 2!

Week 2: Establishing Legal and Compliance Structures

We hinted earlier that there were some differences between the legal requirements for issuing real estate tokens and those for security tokens. Week 2 is where you start structuring your project to comply with the laws and regulations that apply to your scope.

There are a number of financial regulations, securities laws, and even blockchain-specific statutes to consider.

The following are some vital considerations:

I. Tax Responsibilities

Real EstateTokenization platforms must structure their projects to accommodate their tax obligations and those of investors. They must also consider the possibilities of double taxation and taxes withheld.

These tax regulations vary across jurisdictions. Therefore, you should make appropriate accommodations for cross-border issuances and other likelihoods.

II. Legal Document Preparation

To solidify your project’s legitimacy, you’ll need to draft most of the following legal documents accurately. They are either structured for legal authorities or investors.

- Disclosure statements inform prospective investors about potential investment risks and critical factors they need to be aware of.

- Investment memorandum: This document provides relevant information about the project’s structure and details of the investment opportunity.

- White papers: These are outline plans for a platform’s tokenized economy leveraging the offered token. They also describe the project’s goals for investors, tokenomics, and overall project goals.

- Token purchase agreement: It provides the terms and conditions of the token sale.

III. KYC and AML Requirements

Both financial and blockchain-specific regulatory bodies expect tokenization platforms to implement industry-standard Know Your Customer (KYC) and Anti-money Laundering (AML) procedures. These requirements help to identify investors and prevent fraudulent activities accurately.

Establishing these requirements early on sets the frame for a complaint operation and confers legitimacy on your project.

Now, to the fun stuff!

Week 3: Technology Selection

By now, the corporate and legal stuff is out of the way.

You want to focus on selecting a tech stack capable of actualizing your vision for this tokenization project.

Some of the activities you should be involved in by week three include:

I. Choosing the Right Blockchain

Deciding your target audience and project goals will prove very pivotal at this stage.

Here’s why:

Different blockchains have varying features, pros, and cons. A clear idea of your project’s goals will make it easier to identify a blockchain that suits your requirements.

For instance, Ethereum is one of the most popular tokenization blockchain options due to its efficient smart contract functionality. However, due to network congestion, it is often associated with rising gas fees.

On the other hand, the BNB Smart Chain (BSC) blockchain network, which supports smart contracts and decentralized apps, has the lowest gas fees among all L1 blockchains.

Now, if you established your target audience in week one as retail investors with small investment capital, which of these would be a better choice for blockchain?

You should also consider factors like scalability and user-friendliness when selecting a blockchain for your RWA tokenization project. Your chosen blockchain needs to be capable of handling growth and easily navigable

Other popular blockchain choices include:

- Polygon

- BASE

- Bitcoin

- Ethereum

- BNB Smart Chain (BSC)

- Tezos

II. Selecting the Right Tools and Token Standards

This goes beyond just code and deployment. It’s about ensuring your blockchain can serve its intended purpose.

It’s about using suitable token standards and smart contracts that integrate seamlessly based on your project’s needs.

The following are some popular smart contract development tools:

- Solidity

- Vyper

- Tenderly

- Zenland

- Solidity sandbox, etc

Related Article: Real Estate Tokenization Investment Possibilities

Week 4: Designing and Developing the Token

Token design and development is the actual process of turning the RWAs into digital tokens representing fractional ownership. Doing this on your chosen blockchain involves using appropriate token standards and creating smart contracts with the tools chosen earlier.

I. Smart Contract Development

Smart contracts are self-executing digital contracts stored on the blockchain. They contain predetermined terms and conditions embedded in the code. Smart contracts determine and manage the token’s functionalities and govern the entire blockchain to a considerable extent.

Smart contracts comply with a set of rules known as smart contract standards to function as intended on the underlying blockchain. As a result, they help smart contracts perform their basic functions.

II. Token Standard Selection and Tokenomics

On the other hand, token standards are a significant category of smart contract standards. They are a specific set of rules relating to a token’s mode of operation that determine how new tokens on an RWA tokenization project are created, deployed, and issued.

Some popular token standards most RWA tokenization projects use include:

- ERC-20: ERC stands for Ethereum Request for Comment. The ERC-20 token is the set standard for creating fungible tokens (tokens that can be interchanged for one another) on the Ethereum blockchain.

- ERC-3643: A newer token standard specifically used for RWA tokenization projects

- ERC-721: A token standard used for the creation of non-fungible tokens (interchangeable tokens.)

- ERC-1155: An Ethereum blockchain token that supports the creation of both fungible and non-fungible tokens

- BEP-20: An ERC-20 equivalent for the BNB smart chain (BSC). It is a token standard for creating fungible tokens on the BSC.

You’ll also need to be concerned about another concept known as tokenomics during week four.

Tokenomics refers to the economic models, principles, and frameworks governing the demand and supply characteristics of your RWA tokens. In plain terms, it means you’ll have to map out sustainable principles that determine the value of your RWA tokens and their corresponding investment potential.

At this stage of the project, you’ll have to provide valid answers to questions like the following:

- How many tokens will be created?

- How will these tokens be shared?

- How many tokens will exist in the future?

- Will all the tokens be created now or later?

- Who owns these coins?

All these considerations help to ensure that you’re not just creating tokens or coins for the fun of it. They ensure that you’re actually building a sustainable financial ecosystem with continuous viability.

Week 5: Testing and Integrating with the Marketplace

By now, everything is almost set for your new tokenization project.

However, you have to ensure that everything is indeed working fine. Therefore, you need to:

I. Test the smart contracts

Smart contracts are immutable by nature. This implies that developers cannot alter their code or state once they have been deployed.

Therefore, you must rigorously and thoroughly check for potential vulnerabilities and exploits to ensure the security and functionality of your token. Doing this protects your project from malicious attacks and potential financial losses on the part of both investors and the project.

Smart contract testing is a technical process that expert developers take care of. Some of the processes involved include the following:

- Smart contract audit

- Unit tests

- Integration tests

- Bug bounty programs

- Peer review

- Load testing, etc.

II. Conduct a Security Audit

As the name implies, a security audit is a platform-wide process for checking potential security risks and vulnerabilities. Its aim is to ensure that organizational assets are secure, data is uncompromised, and the entire project complies with appropriate regulatory standards.

Remember those legal and regulatory statutes you outlined in week one?

You want to be sure all aspects of your project are in line with them now.

So, how do you go about this?

You already started with the smart contract audit above.

Next, you need also to make sure you’re meeting the standards for real-world asset handling.

Furthermore, take a second and thorough look at the KYC and AML requirements you set up in week one to ensure you’ve included everything.

At the end of the audit, you should have a certification and audit report that instills confidence in potential investors.

When all internal aspects are on point, the next and final phase is putting the word out.

On to week 6!

Related Read: Launching a Real Estate Tokenization Platform

Week 6: Marketing and Launch

Regardless of your target market, your project needs effective marketing and community engagement to get the required visibility. Creating an appealing brand message and connecting with your target market ensures that your project hits the ground running.

To achieve this, you need to:

I. Develop and Launch an Effective Marketing Campaign

What’s your token’s story?

It could be making art accessible to people who love it but aren’t rich enough to own it or creating a low-risk investment path into securities.

Whatever the case may be, you need to figure it out and sell that story aggressively to capture your audience. Focus on making them anticipate your launch. More importantly, this marketing campaign should align with the project goals you set in week one so that everything comes out authentically.

Social media platforms like X (formerly Twitter), Instagram, Telegram, and Discord are great for engaging with the audience. Find the one your target audience loves and use it aggressively.

II. Build a Community

It’ll take more than a fancy tagline and shiny media materials to get investors to purchase your tokens. They also need to feel like you get their pain points.

You can show them what you do by organizing Ask Me Anything (AMA) sessions. In these sessions, potential investors ask questions about the project, and your team provides satisfying answers.

Creating dedicated community channels on platforms like X and Discord has also been proven effective for community building.

III. Launch

Finally!

After ensuring that everything is in place, consider holding an exciting and engaging launching event, either live or virtually, depending on your audience. During this event, share your vision and enthusiasm for the project.

IV. Monitor and provide support

One last thing.

Stay after the launch to monitor the project’s performance and community engagement. Make useful observations and identify possible areas for improvement.

Furthermore, ensure the support team is on standby to respond to queries and solve investor complaints. This will further substantiate the project’s authenticity and legitimacy and ultimately lead to its long-term success.

By now, you should have a fully functional RWA tokenization project running smoothly.

Looking to develop your own RWA tokenization platform?

Debut Infotech is a pioneer in the blockchain industry, offering tailored solutions and a security-first philosophy that helps you fully utilize your assets.

Conclusion

Launching your RWA tokenization project in 6 weeks requires careful planning and impeccable execution if you want the project to be successful. You need to consider several factors, like your project goals, asset choice, and preferred blockchain. And when you have a clear picture of the kind of tokens you want to issue, you have to make sure you meet both the development and regulatory standards to offer them to the public.

This extensive process can be too much to handle if you have no prior experience. But, with the right help, completing it in 6 weeks becomes a piece of cake. We at Debut Infotech can hold your hands throughout the entire process as you turn your real-world or financial assets into digital tokens.

Frequently Asked Questions

Real-world assets are tangible physical assets such as real estate, commodities (like gold or oil), fine art, currencies, equities, and bonds. These assets exist outside of blockchain systems but can be tokenized to provide digital ownership and enable trading in a decentralized environment.

The cost of tokenizing assets can vary significantly, ranging from $30,000 to $300,000, depending on the project’s complexity, size, legal requirements, and platform integration needs. The price largely depends on the asset type and tokenization platform features.

To begin tokenization, select appealing real-world assets such as real estate or commodities and identify a blockchain that supports tokenization. Then, ensure legal compliance, structure smart contracts, and initiate the tokenization process for secure and transparent digital ownership.

Asset tokenization offers multiple revenue streams, such as trading tokens for profit, earning from the value increase of the tokenized asset, or generating income from the underlying real-world asset without selling the token, providing flexibility for investors and issuers.

RWA tokens, which represent real-world assets, can be purchased on decentralized exchanges where they are listed, such as PancakeSwap (v2). These platforms facilitate the trading of tokenized physical assets securely and efficiently.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Plot #I-42, Sector 101-A, Alpha, IT City, Mohali, PB 160662

9888402396

info@debutinfotech.com

Leave a Comment