Table of Contents

Home / Blog /

Cryptocurrency Arbitrage Trading Bot: Step-by-Step Process for Development

October 3, 2024

October 3, 2024

The emergence of digital assets has created creative financial possibilities; among the strategies used in this field is crypto arbitrage trading, which seems most exciting. Using price variations across several exchanges allows traders to make money without directly facing market swings.

The cryptocurrency arbitrage trading bot—a potent tool meant to automatically execute arbitrage transactions and enhance efficiency—is at the core of this approach. This comprehensive guide will walk you through a methodical procedure for creating a crypto arbitrage bot and clarify all you need to know.

Unleash the possibilities of automated crypto trading!

Are you ready to develop a state-of-the-art cryptocurrency arbitrage trading bot optimizing your gains? Our speciality at Debut Infotech is bitcoin arbitrage bot development catered to your company requirements.

Understanding Cryptocurrency Arbitrage

Before starting the development procedure, it is essential to understand cryptocurrency arbitrage. In cryptocurrencies, arbitrage is a trading strategy based on traders using price fluctuations in a coin across various exchanges. Arbitrage traders might profit by buying on one exchange at a lower price and selling on another at a higher price, as the volatility of bitcoin markets results in price fluctuations.

The great volatility and lack of synchronizing among platforms in the crypto market lead to common price differences between exchanges. Although arbitrage traders try to profit from these fluctuations, hand execution of such trades is typically too slow and useless. This is where the bitcoin arbitrage trading bot discovers is absolutely necessary.

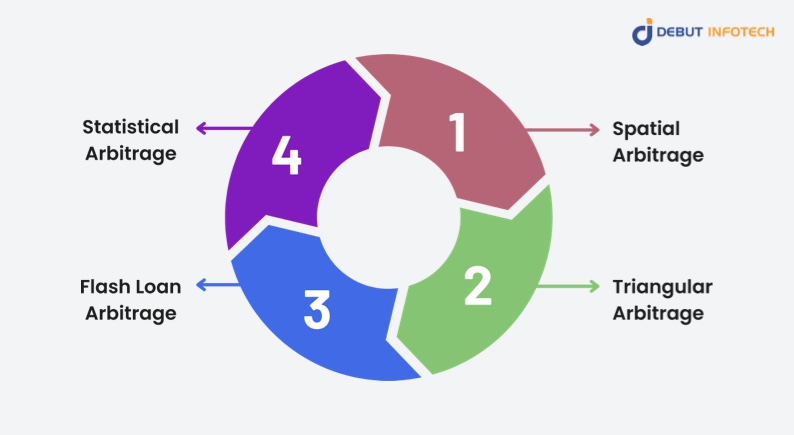

The Types of Cryptocurrency Arbitrage Trading Bot

You should know the several arbitrage techniques before creating your cryptocurrency arbitrage trading bot. The most frequently used ones are:

- Spatial Arbitrage: The simplest kind is spatial arbitrage, in which a trader buys and sells a coin across various exchanges depending on price variances.

- Triangular Arbitrage: Three distinct cryptocurrencies exchanged on one platform is known as triangular arbitrage. Using price fluctuations, three assets—Bitcoin, Ethereum, and Litecoin—are supposed to yield profit.

- Statistical Arbitrage: Statistical arbitrage—that is, the identification of arbitrage prospects—is achieved by means of mathematical models and algorithms. Since AI-based technologies allow one to develop this method, it is perfect for an artificial intelligence arbitrage trading bot.

- Flash Loan Arbitrage: Using DeFi flash loans, one may make arbitrage trades, borrow money, and pay back the loan all in one transaction. It lets the trader trade without any capital at risk.

Why Build an Arbitrage Bot?

Creating an arbitrage trading bot has many benefits over hand trading, such as:

- Speed: Crucial in unpredictable markets, bots can execute deals in milliseconds.

- Efficiency: Bots track several exchanges and trading pairs constantly, something human traders cannot do by hand.

- Automation: A bot runs around the clock free from continual monitoring.

- Precision: Bots guarantee every trade is based just on market data and pre-defined logic, therefore removing the emotional bias and human mistake typical in manual trading.

By working with a cryptocurrency exchange development company, you can ensure your arbitrage bot is optimized for efficiency, security, and profitability.

Key Features of an Cryptocurrency Arbitrage Trading Bot

A reliable crypto arbitrage bot must have several important characteristics:

- Speed and Efficiency: Price variances might only last temporarily. The bot needs to be fast in trading if it is to seize these passing chances.

- Multi-exchange Support: The bot should be able to search several exchanges in order to find arbitrage possibilities.

- Real-time Data Analysis: Real-time data analysis is necessary to constantly monitor price movements in order to guarantee quick recognition of arbitrage prospects.

- Risk Management: The bot should have tools to reduce risks like capital allocation methods, stop-loss tactics, and volatility control.

- Automated Execution: Once an arbitrage opportunity is found, the bot ought to be able to autonomously run buy and sell orders without human involvement.

- Fee Management: The bot should figure trading fees for every exchange and include them in the profit computation to guarantee profitability.

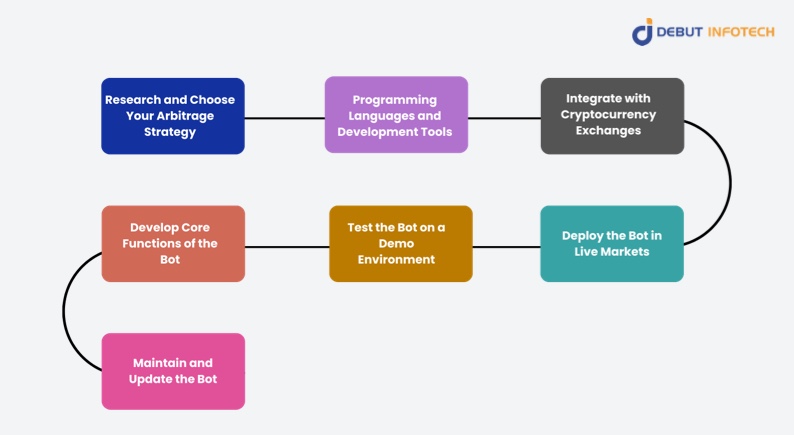

Step-by-Step Guide to Developing a Cryptocurrency Arbitrage Trading Bot

After we have discussed the principles of cryptocurrency arbitrage, let’s explore the detailed methodical process of creating your own cryptocurrency arbitrage trading bot.

Step 1: Research and Choose Your Arbitrage Strategy

A good cryptocurrency arbitrage trading bot’s core is choosing the suitable arbitrage technique. Whether you choose simple or more advanced techniques like triangle or flash loan arbitrage will determine the bot’s design and operation.

Integrating machine learning techniques will enable an artificial intelligence arbitrage trading bot to forecast and identify arbitrage prospects depending on past performance and market trends.

Step 2: Select Programming Languages and Development Tools

Selecting appropriate development tools and programming languages comes next. Several of the most often used programming languages for the development of crypto arbitrage bots are:

- Python: Python is quite favored because of its simplicity and the wealth of tools for trading cryptocurrencies, such CCXT, which provides connection with several exchanges.

- JavaScript: Often used for bots running in browser contexts or needing integration with Node.js-based systems.

- C++ or Rust: Faster execution times of these languages make them appropriate for bots stressing speed and performance.

Development Tools:

- Libraries for Exchange APIs: Connecting to several exchanges is made easier via CCXT, or CryptoCurrency eXchange Trading Library.

- Database: Store trade history, trade data, and price comparisons in a database such as MongoDB or Postgresional.

- Cloud Hosting: Using services like AWS or DigitalOcean, your bot can be housed on a cloud server for 24/7 trading.

Store trading history, bot performance data, and exchange prices, among other database management requirements by using MongoDB or Postgresional.

Step 3: Integrate with Cryptocurrency Exchanges

The bot has to be able to interact with several exchanges to identify arbitrage prospects. This means linking the bot to the API of every exchange you intend to trade on. Common interactions involving strong APIs include:

- Binance

- Kraken

- Coinbase Pro

- Bitfinex

To let your cryptocurrency trading bots make automatic trades, you will have to use the corresponding API keys from these exchanges. For every exchange, make sure you carefully review the API documentation to grasp rate restrictions, security criteria, and other required information.

Pro Tip: If you intend to include this advanced technique in your bot, be sure it is compatible with exchanges that allow flash loan arbitrage bots.

Step 4: Develop Core Functions of the Bot

Developing a cryptocurrency arbitrage trading bot requires coding the fundamental elements for the bot to function as intended. Working with a white label cryptocurrency exchange development company can streamline this process by providing expert solutions for price monitoring, order execution, and profit calculation, ensuring your bot is efficient and effective. These serves include:

- Price Monitoring: Create systems to track prices in real-time over several exchanges. API calls gathering pricing data every few milliseconds will help one to accomplish this.

- Arbitrage Detection: Based on a threshold you define—say, a 2% difference in prices between two exchanges—implement logic that can identify when a pricing discrepancy emerges.

- Order Execution: Once an arbitrage possibility is found, the bot should immediately post buy and sell orders on the relevant exchanges. Consider network delay and trade fees carefully.

- Profit Calculation: To guarantee that every trade is lucrative, your bot should provide a built-in profit calculator including all trading-related expenses (like slippage).

- Risk Management: Incorporate stop-loss systems to reduce possible losses should the market turn negatively prior to the trade being carried out.

Working with a crypto arbitrage trading bot development company could help you if you’re not sure how to handle these features since they can offer experience and ready-made answers.

Optional Step: Integrating Flash Loan Arbitrage (Optional)

Flash loan arbitrage requires you to link your bot with distributed finance (DeFi) systems. Flash loans let traders borrow money without collateral for arbitrage—that is, if the borrowed sum is returned inside the same transaction.

Creating a flash loan arbitrage bot calls for access to smart contracts available on Ethereum or the Binance Smart Chain. Although this procedure is more complicated than normal arbitrage, done right it presents zero-risk arbitrage possibilities.

Step 5: Test the Bot on a Demo Environment

Your bot should be tested in a risk-free environment before being put live on markets. Many exchanges provide paper trading alternatives or demo accounts that let you pretend to trade without real money risk. Watch the following throughout the testing phase:

- Latency Issues: Make sure your bot makes trades fast enough to seize temporary arbitrage prospects.

- Profitability: Run simulations to see whether the bot often trades profitably.

- Edge Cases: To guarantee the bot can manage several situations, test it under several market conditions (e.g., high volatility, low liquidity).

Step 6: Deploy the Bot in Live Markets

It’s time to start using the bot on live markets when you are sure it performs as expected. Start with little funds to reduce risk and keep a close observation of its activity. You can change the bot’s parameters over time to maximize performance.

Starting small helps you to reduce risk and compile important information about the operation of the bot in practical settings.

Step 7: Maintain and Update the Bot

The very dynamic nature of cryptocurrencies markets means your arbitrage bot must change with time. Maintaining optimal operation of your bot depends on regular maintenance. Examine the following maintenance chores:

- API Updates: Track changes in API from exchanges and update your bot.

- Security Enhancements: Frequent security enhancements for the bot help to guard against hacking and other hostile actions.

- New Exchange Integration: Add new exchanges often to increase the bot’s reach and identify more arbitrage chances.

Are Arbitrage Bots Profitable?

One of the often asked questions among traders is, are arbitrage bots profitable? The response relies on several elements, including market situation, fees, bot speed, and risk control. Though well-designed arbitrage bots can produce regular gains, it’s crucial to consider slippage, exchange fees, and possible dangers including liquidity shortages or market changes.

By guaranteeing the bot is optimized for performance, security, and efficiency, working with an expert crypto arbitrage trading bot development company can raise the profitability chances.

The Role of AI in Arbitrage Trading Bots

Arbitrage trading bots’ capacities can be much improved by including artificial intelligence (AI). Analyzing past data, forecasting price fluctuations, and making intelligent real-time decisions are some capabilities of an artificial intelligence arbitrage trading bot. By means of machine learning techniques, bot detection of arbitrage possibilities, trade strategy optimization, and risk reduction may all be strengthened.

Crypto Wallet Integration

Using an arbitrage bot calls for a safe crypto wallet for handling and storing your money. Working with a respectable crypto wallet development company will help to guarantee that your wallet interacts smoothly with your bot. Setting up private and public keys, applying security measures, and guaranteeing interoperability with several cryptocurrencies are the steps involved in how to create a crypto wallet for those wondering how to do so.

Cryptocurrency Market Making and Arbitrage

Sometimes cryptocurrency market making techniques are used with arbitrage bots. By putting buy and sell orders, market makers give the market liquidity; arbitrage bots can use these orders to profit from price variations. Profit margins can be quite effectively raised by this synergy between arbitrage and market making.

The Future of Crypto Trading and Arbitrage Bots

Advanced trading algorithms, artificial intelligence, and automation will probably play more roles in the future of crypto trading. Although the chances for arbitrage might shrink as the cryptocurrency markets develop, individuals who use modern technologies will always have an advantage. The popularity of flash loan arbitrage bots and other DeFi-based techniques is anticipated to increase, creating new profit-oriented opportunities.

Furthermore, the creation of increasingly complex tools from crypto trading bot development companies would democratize access to complicated arbitrage tactics, therefore enabling even inexperienced traders to engage in this market.

Let’s Bring Your Crypto Bot Vision to Life!

Have questions about building your own crypto arbitrage bot or need personalized assistance? Our team at Debut Infotech is here to guide you through every step of the process, from design to deployment.

Conclusion

Creating a cryptocurrency arbitrage trading bot calls for a thorough knowledge of trading techniques, technological know-how, and cautious risk control. Following this detailed approach will let you build a strong bot that makes profits by using market price variances. Whether you work with a crypto trading bot development company or are an individual developer, arbitrage trading has bright future prospects.

Innovations like AI arbitrage trading bots and flash loan arbitrage bots will keep changing the scene as the bitcoin ecosystem develops. Keeping ahead of the curve and always improving your bot will help you to succeed in the hectic realm of crypto trading.

Frequently Asked Questions

A cryptocurrency arbitrage trading bot is an automated software that detects price differences of the same cryptocurrency across multiple exchanges and executes trades to profit from those discrepancies. The bot continuously monitors prices and places buy and sell orders within milliseconds, capturing small price differences for a profit.

Developing a cryptocurrency arbitrage bot involves choosing a programming language (like Python), integrating with multiple exchange APIs (such as Binance and Kraken), setting up real-time price monitoring, and creating algorithms for automated trade execution. You can also include features like risk management, profit calculation, and fee management to ensure your bot is efficient and profitable. Partnering with a crypto arbitrage trading bot development company can streamline the process.

Flash loan arbitrage bots take advantage of decentralized finance (DeFi) by borrowing funds through a flash loan to execute arbitrage trades. These trades happen in a single transaction, and the loan must be repaid immediately, often within seconds. Unlike traditional arbitrage bots, flash loan bots allow traders to capitalize on opportunities without using their own capital, thus reducing risk.

Yes, arbitrage bots can be profitable, but success depends on several factors such as market conditions, exchange fees, latency, and how well the bot is designed. Proper risk management and continuous updates are essential to maintain profitability. Although the profits may be small per trade, consistent execution of many trades over time can lead to substantial returns.

Yes, AI can be integrated into an arbitrage bot to enhance its performance. An AI arbitrage trading bot can use machine learning to analyze market trends, predict price movements, and identify arbitrage opportunities before they fully develop. AI can also help in improving risk management strategies and refining decision-making algorithms.

Arbitrage bots, while effective, do carry risks. These include exchange fees, slippage (price changes during execution), latency issues (delays in executing trades), and liquidity problems (insufficient assets on exchanges to complete trades). Bots should also be secured against hacking attempts, as they involve the use of sensitive APIs connected to your funds.

Creating a secure crypto wallet involves generating private and public keys for your funds and using wallets that support multi-exchange integration. Wallet security is paramount, so it’s advisable to enable two-factor authentication (2FA), multi-signature features, and encryption. Working with a crypto wallet development company ensures your wallet is custom-built to your bot’s needs, providing optimal security and functionality.

Talk With Our Expert

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment