Table of Contents

Home / Blog / Tokenization

Future of Real Estate Tokenization: Predictions for 2025 and Beyond

November 18, 2024

November 18, 2024

The future of real estate tokenization is set to transform property ownership perceptions and practices. It uses Blockchain to turn real estate into digital shares or tokens, allowing global trading. By streamlining transactions and enhancing accessibility, tokenization fosters a more inclusive market. The future of tokenization is not only about technology but how it reshapes the entire economic environment of investing.

Recent statistics reveal a burgeoning interest in tokenized properties, with market projections suggesting a significant uptick in global participation. It is reported that the global Real Estate Tokenization Market will grow at a compound annual growth rate of 21 percent from 2024 to 2033. It is estimated to rise from $3.5 billion in 2024 to $19.4 billion by 2033.

Read on for a detailed exploration of technological innovations driving this growth. You’ll gain insights into implications for investors and global market trends in the coming years.

Ready to revolutionize your Real Estate Investments?

Unlock new opportunities and transform how you engage with property markets, using the power of real estate tokenization.

What is Real Estate Tokenization?

For newcomers, understanding what is real estate tokenization is the first step towards appreciating its transformative impact. Real estate tokenization converts property ownership rights into digital tokens on Blockchain. It merges traditional real estate investment with Blockchain, offering a new management approach. Tokenization turns physical assets into digital ones, dividing large properties into smaller shares. It democratizes real estate access, enabling both small and large investors to participate easily.

This method increases real asset liquidity, allowing quicker, more efficient transactions. Thus, tokenization modernizes property investment, expands the investor base, and improves market dynamics.

Advantages of Tokenization

Exploring real estate tokenization reveals its profound impact on transactions and investments. It streamlines processes and democratizes access, heralding a new era in real estate. Let’s examine its key benefits and how it’s revolutionizing the industry.

1. Accessibility

Tokenization reduces entry barriers by lowering the minimum investment amount. It opens the market to more investors, enabling investments in previously unaffordable high-value properties. This method allows retail investors to compete with institutional ones, offering similar returns.

2. Liquidity

Converting real estate into tradeable tokens increases liquidity and market activity. Investors can trade these tokens like stocks, allowing quicker and cheaper exits. Increased liquidity also draws more speculative investors, enhancing market dynamism.

3. Transparency

Blockchain ensures a transparent record of ownership and transactions, reducing fraud. Each transaction is publicly recorded, increasing trust among investors. This transparency eases due diligence, helping investors verify property details and history.

4. Efficiency

Smart contracts automate investment management, like dividend payouts and settlements, reducing costs. This automation processes transactions quickly and error-free, streamlining property management. It also lessens intermediary needs, decreasing fees and transaction times.

5. Global Reach

Tokenization enables easier cross-border transactions, attracting international investors to foreign markets. It diversifies portfolios and spreads risk across regions. It also opens markets to investors previously hindered by regulatory or logistical issues, potentially increasing foreign investment in real estate.

Leading real estate tokenization platforms are now offering tools that simplify the investment process, making it accessible even to novice investors.

Predictions for 2025 and Beyond

Looking ahead to 2025, the trajectory for real estate tokenization shows promising developments. The future of tokenization in real estate will continue to accelerate.

The following are predictions of what to expect in this industry for 2025 and beyond:

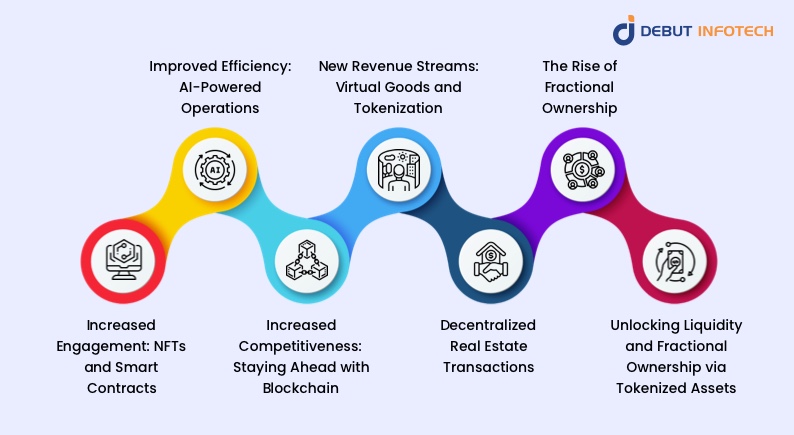

1. Increased Engagement: NFTs and Smart Contracts

NFTs are set to expand beyond digital art into real estate customer engagement. Imagine owning a virtual NFT of your dream home or exclusive property experiences. Properties with digital assets have seen a 30 percent rise in customer inquiries, reports Redfin. By 2025, 20 percent of real estate transactions may involve NFTs, Forrester predicts.

Smart contracts on platforms like Ethereum will automate real estate transactions, removing intermediaries. This automation is expected to increase trust and adoption. Gartner forecasts a 50 percent rise in smart contract use in real estate by 2025, managing over $5 billion in transactions.

2. Improved Efficiency: AI-Powered Operations

AI is crucial for increasing operational efficiency in real estate. Nvidia and Microsoft develop AI tools for automating tasks like property management. AI-powered virtual assistants manage inquiries and schedule viewings around the clock.

Nvidia notes that real estate firms using AI may see a 25% EBITDA increase. KPMG predicts AI automation will save the industry $100 billion annually by 2025. These tools boost efficiency and enhance customer experiences, serving clients faster and more effectively.

3. Increased Competitiveness: Staying Ahead with Blockchain

Blockchain ensures a secure, transparent real estate market. IBM and Google invest heavily in Blockchain to secure real estate transactions. Real estate firms adopting Blockchain gain efficiency, security, and customer trust advantages. PWC predicts that by 2025, Blockchain will cover 30% of all real estate transactions.

4. New Revenue Streams: Virtual Goods and Tokenization

The overlap of physical and virtual real estate is growing. Tokenization opens access to high-value properties, offering fractional ownership. Propy is at the forefront of this trend, with Goldman Sachs forecasting a $1 trillion industry by 2025. Bain & Company predicts tokenized real estate will generate $200 billion in new revenue by then.

Virtual real estate sales are surging, with companies like Meta pioneering digital properties. Goldman Sachs predicts that virtual real estate sales in the Metaverse could hit $500 billion by 2030.

5. Decentralized Real Estate Transactions

Platforms like Propy and Binance remove intermediaries, reducing costs and enhancing transparency. This decentralization trend is expanding, with Blockchain set to handle $1 trillion in transactions by 2030, per Coinbase. Decentralization will speed up transactions, boost security, and reduce reliance on traditional intermediaries.

6. The Rise of Fractional Ownership

Tokenization allows fractional ownership of high-value properties, democratizing real estate investment. It enables smaller investors to access previously unreachable markets. Platforms specializing in fractional ownership will greatly simplify diversifying real estate portfolios.

7. Unlocking Liquidity and Fractional Ownership via Tokenized Assets

Tokenization transforms illiquid real estate into tradable digital tokens, enhancing market liquidity. Investors can now easily trade property fractions.

Platforms like RealT and Lofty AI provide these investment opportunities, anticipating significant market growth. Security Token Market predicts that tokenized real estate will achieve a market cap of $1.4 trillion by 2025.

Challenges and Considerations of Real Estate Tokenization

As real estate tokenization continues to gain momentum, it’s crucial to acknowledge the challenges and considerations that accompany this innovative investment structure.

Here’s a detailed look at some of the key hurdles and areas of concern that stakeholders need to address as they navigate this evolving landscape:

1. Regulatory Framework

The legal landscape for tokenized properties is still evolving. Different jurisdictions may have varied regulations regarding Blockchain and securities, affecting how tokens can be issued, traded, and recognized as ownership. This uneven regulatory environment creates a complex tapestry where legal compliance can vary significantly from one country to another, possibly hindering global scalability.

As policymakers shape laws for digital assets, uniform regulations may create a better environment for tokenization to thrive.

2. Market Adoption

The concept is new, and wider adoption hinges on overcoming skepticism. Educating investors about the benefits and risks is essential. The mix of traditional real estate and Blockchain technology may intimidate many.

Therefore, increased efforts in transparency, case studies demonstrating successful implementations, and educational outreach are essential to sway public and institutional opinion in favor of this innovative approach to real estate.

3. Technical Issues

The success of tokenization heavily depends on the underlying Blockchain technology. Issues like scalability, interoperability, and smart contract security are vital for real estate tokenization development. Overcoming these barriers requires advances in Blockchain for faster transactions, improved security, and better platform compatibility.

As these technological enhancements are implemented, the reliability and attractiveness of real estate tokenization are likely to increase, driving further adoption. Tokenization prediction models suggest a surge in adoption rates over the next decade, driven by advancements in Blockchain security and functionality.

Embracing The Potential Of Real Estate Tokenization

Embracing real estate tokenization involves recognizing Blockchain’s transformative impact on the property market. This approach streamlines transactions and opens new investment and management opportunities. It shifts how properties are bought, sold, and managed, increasing efficiency and accessibility. Ongoing token development efforts are crucial for enhancing the robustness of digital asset markets.

Integrating Blockchain eliminates bottlenecks like long verification times and legal paperwork, speeding up transaction lifecycles. This transition boosts operational efficiency and fosters ongoing innovation in real asset management.

Here’s a deeper look into how embracing this technology can reshape the real estate universe:

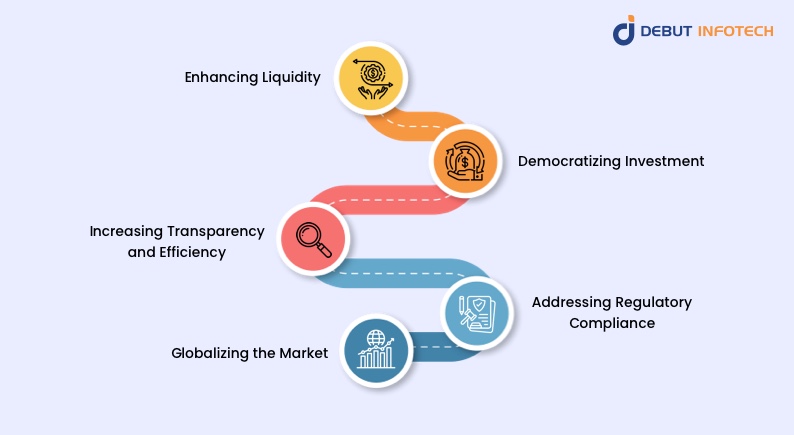

1. Enhancing Liquidity

Tokenized real estate significantly boosts liquidity. Traditional investments are illiquid, with high costs and slow sales, deterring investors. Tokenization fractionalizes property into affordable units, enabling stock-like trading ease and speed. This liquidity attracts more investors, potentially raising market activity and property values.

2. Democratizing Investment

Tokenization lowers entry barriers, making real estate investment more accessible. It enables broader participation by fractionalizing properties into affordable segments. This global market opening creates a more inclusive investment environment. Investors diversify by acquiring stakes in multiple properties, spreading risk and enhancing returns. The principles of tokenization are not limited to real estate but extend to various real world assets, enhancing their liquidity and marketability.

3. Increasing Transparency and Efficiency

Blockchain ensures every transaction is secure and verifiable, reducing fraud and building trust. This transparency simplifies compliance checks. Smart contracts automate escrow and title transfers, reducing costs and delays.

4. Addressing Regulatory Compliance

Growing interest in real estate tokenization encourages regulators to clarify frameworks. Collaborating with regulatory bodies shapes policies that support innovation. Evolving regulations are key for the acceptance and growth of tokenized real estate. Choosing a competent real estate tokenization company is crucial for ensuring that your digital assets are managed securely and compliantly.

5. Globalizing the Market

Tokenization removes geographical barriers, enabling global access to real estate investments. Investors from anywhere can easily engage in foreign markets, avoiding usual costs and logistics. This expansion broadens opportunities and stabilizes markets by diversifying investment sources.

New tokenization platforms are continually emerging, each designed to cater specifically to the diverse needs of global real estate markets. But to fully embrace the potential of tokenized real estate, stakeholders must address these challenges through innovative solutions, effective policy-making, and continuous technological advancement.

Real Estate Tokenization and the Future

The future of real estate tokenization is set for significant growth, driven by key trends. As industries realize Blockchain’s efficiency and scalability, innovation in real estate is expected to surge. This technology will streamline processes, cut costs, and increase transparency, revolutionizing global property ownership and investment.

1. Increased Market Adoption and Integration Worldwide

Tokenizing real estate is increasingly popular, promising wider adoption across the industry. As Blockchain technology improves and global regulatory frameworks evolve to support tokenized assets, broader adoption is expected. Benefits like liquidity, fractional ownership, and global access are becoming well-known, positioning tokenization as a standard real estate practice.

This expansion will make more properties available in tokenized form, attracting a diverse group of investors. Especially, small and medium-sized investors will access markets previously beyond their reach due to high costs.

With clearer regulations likely on the horizon, regulatory clarity will protect investors, mitigate risks, and stabilize the tokenized real estate market. Industry experts remain bullish, as standard tokenization protocol price predictions anticipate robust growth, reflecting broader market confidence.

2. Integration with Traditional Markets

Tokenization is set to integrate more with traditional real estate practices and financial markets. Hybrid models where traditional and tokenized transactions coexist could emerge, enhancing each other.

For example, real estate investment trusts (REITs) may adopt tokenization to offer fractional ownership more liquidly and accessibly. Further integration with financial markets and digital assets platforms could also boost the visibility and usability of real estate tokens.

Exploring the future scope of tokenization reveals its potential to integrate seamlessly with other financial sectors, enhancing the fluidity of capital.

3. Expansion of Use Cases

Future developments will likely broaden real estate tokenization beyond simple equity transactions. Tokens might soon support complex financial structures like debt issuance, and derivatives, or serve as collateral in financial transactions.

Additionally, tokenization could extend to leasing, revenue management, property maintenance, and urban planning, enhancing the legitimacy and security of tokenized assets as investment options. Real world asset tokenization is becoming a cornerstone of modern investment strategies, heralding a new era of asset management.

4. Innovative Investment Structures

Tokenization’s flexibility enables innovative investment structures, such as dynamic ownership shares, development project tokens, or portfolio-representing tokens. These tailored solutions can cater to diverse investor needs and risk preferences, potentially attracting new capital to the real estate sector.

5. Impact on Global Real Estate Markets

Tokenization can democratize access to global real estate, enabling worldwide investor participation in previously inaccessible markets. This accessibility may diversify portfolios and redistribute investment flows internationally, potentially stabilizing markets by spreading risk more evenly.

Conclusion

The future of real estate tokenization is not a fleeting trend but looks promising. It is a transformative movement set to redefine real estate investment. It is definitely on a trajectory to fundamentally transform how property investment and management are conducted.

Leveraging Blockchain technology enhances liquidity, transparency, and accessibility in real estate. As technology and regulations evolve, tokenization will likely become fundamental to global real estate transactions. This shift promises to dissolve traditional barriers, introducing fluidity into a historically illiquid market. For investors and stakeholders, the exploration of tokenized real estate is just starting, heralding a future of more democratic, accessible, and efficient real estate investments.

Harness the innovative power of Blockchain technology for your real estate investments

We provide cutting-edge solutions to elevate your property dealings into the digital age. Let’s help you leverage the benefits of Blockchain for real estate.

Frequently Asked Questions

Tokenization was introduced in 2001 by TrustCommerce for their client, Classmates.com. Its primary goal was to reduce the risks of storing cardholder data. TC Citadel emerged from this development, enabling customers to use tokens instead of sensitive card data.

Tokens make money this way: let’s say tokens are issued on a public ledger like Hedera Hashgraph, allowing free exchange trading. You can sell as many tokens as you need in order to raise funds, with unlimited investors able to buy. Each token purchase represents 0.0002% ownership of the asset.

The cost to tokenize real estate varies. This process may require legal and regulatory consultants to handle the complex landscape. However, costs depend on jurisdiction, asset class, and required regulatory oversight. But it typically ranges from $5,000 to $50,000.

REITs (Real Estate Investment Trusts) traditionally offer stable returns, primarily through dividends from rental income, making them a less risky investment in real estate. In contrast, tokenized real estate offers higher potential returns due to improved efficiency and reduced costs. To explore the differences further, read more about tokenized real estate vs. REITs.

In 2022, the real estate tokenization market was valued at $2.7 billion, and it’s projected to reach $16 trillion by 2030, according to a Boston Consulting Group report.

Talk With Our Expert

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment