Table of Contents

Home / Blog /

The Future of eWallets: Transforming Digital Payments and Beyond

September 26, 2024

September 26, 2024

The era of advancement is reshaping our relationship with money significantly. Transitioning from wallets filled with cash and cards to smartphones equipped with payment applications illustrates a key aspect of contemporary society. At the core of this change lies the emergence of eWallets – a groundbreaking concept that has transformed the way we make purchases and handle transactions.

The upcoming advancements of eWallets are set to bring about transformations as our world moves towards cashless transactions. With the shift towards digital payment systems gaining traction worldwide, wallets have taken center stage as indispensable tools for daily living beyond mere money storage convenience.

What is an eWallet?

A digital wallet or eWallet is a platform that securely stores a user’s payment details and passwords along with cryptocurrency. This is done digitally, for easy access and secure transactions without the hassle of carrying cash or cards when making purchases online or at brick-and-mortar shops.

EWallet stands out from other payment methods due to its flexibility and seamless integration with modern technological advancements. With various types available, such as wallets for digital currencies and those integrated with SuperApps for diverse financial tasks, eWallet has become a vital element of the contemporary digital landscape.

An electronic wallet serves as a version of your everyday wallet; however, its functions extend beyond just storing credit cards and money notes. It can hold flight tickets and event passes alongside loyalty rewards and digital currencies. The true strength of an eWallet lies in its capability to facilitate secure transactions seamlessly on various systems and gadgets. Whether you’re purchasing a latte at a café shop, sending funds to a pal, or investing in cryptocurrency, an eWallet is equipped to manage all these tasks.

By incorporating e-wallets for transactions into their operations, businesses not only unlock fresh income opportunities but also improve customer experience satisfaction levels significantly. With the growing number of individuals embracing these digital payment methods, organizations that embrace this trend are poised to outperform their competitors as we move towards a digitally driven society.

Transform Your Business with Our eWallet Development Services!

Explore how Debut Infotech’s tailored eWallet solutions can help your business leverage the latest in digital payment technology.

The Evolution of eWallets

The development of eWallet technology started over twenty years ago, which marked the beginning of a shift towards digital payments, through eWallet platforms becoming more commonly used today.

The Early Years (1997-2010)

Mobile payments gained attention back in 1997 when Coca-Cola rolled out a system in Helsinki that enabled customers to buy items from vending machines through SMS messages. This early system may have been basic, but it set the stage for the mobile payment advancements we see today.

The digital payments landscape saw a shift when PayPal was introduced back in 1999 as a groundbreaking development that transformed online transactions with its secure payment platform tailored for e-commerce needs without requiring users to disclose their financial details—a move that paved the way for further advancements within the realm of digital wallets.

In 2009, a major event took place when Bitcoin was introduced. This led to the emergence of crypto wallets on the scene. The decentralized payment system of Bitcoin shook up the financial order and paved the way for wallets that are tailored for handling cryptocurrency transactions.

The Rise of Mobile Wallets (2011-2015)

In 2011 came a significant advancement came with Google Wallet that enabled individuals to save their payment details on their phones and conduct contactless transactions through near field communication (NFC). The notion of swapping a wallet for a virtual one appeared groundbreaking at the moment but faced challenges in terms of compatibility and acceptance before gaining widespread popularity over time.

In 2014, Apple also introduced Apple Pay, enabling iPhone users to make payments with NFC technolog,y and this move boosted the popularity of mobile wallets in the US.

Mainstream Adoption (2016-2020)

From 2016 to 2020, mobile wallets gained popularity in Asia. In places like China, where traditional credit card systems were not as common, digital wallets became the go-to choice for payments. Apps like WeChat Pay and Alipay were widely used in China, managing transactions from person-to-person transfers to paying bills. In 2020, more than 85% of transactions in China were carried out through mobile wallets.

In this era there were notable progressions in cryptocurrency wallets, which became crucial instruments for overseeing digital currencies such as Bitcoin, Ethereum, and various alternative coins. These wallets granted users authority over their keys and facilitated safe transactions within the expanding decentralized finance (DeFi) environment.

The New Era of eWallets (2021-2024)

The development of eWallets has progressed swiftly to encompass a range of features beyond just facilitating transactions. The upcoming 2024 will witness a greater integration of eWallets into various facets of everyday life, like healthcare services, public administration, and smart home innovations.

Related Read: Best Crypto Wallet Companies

Digital Wallet Trends in 2024

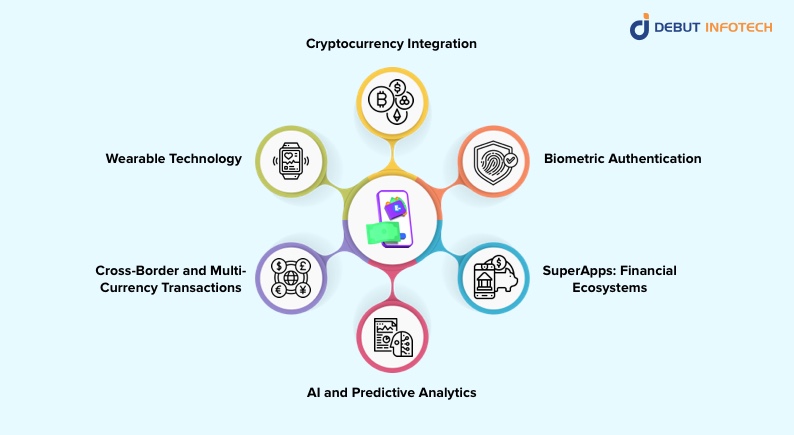

The landscape of wallets is poised to undergo significant changes by 2024 compared to just a few years back with several key trends influencing the evolution of eWallets moving forward, including:

1. Cryptocurrency Integration

Cryptocurrency has played a role leading to the development of digital wallets, and its impact is expected to increase further by 2024, as more companies and individuals embrace digital currencies such as Bitcoin and Ethereum. Thereby making crypto wallets a staple feature across most electronic wallets.

Furthermore, companies that specialize in developing cryptocurrency wallet applications are striving to guarantee that these apps can accommodate a range of digital assets, such as non-fungible tokens (NFTs). By incorporating cryptocurrencies into used financial instruments, it will become more convenient for individuals to oversee both conventional fiat currencies and digital currencies within a single platform.

Businesses providing services for developing cryptocurrency wallets are breaking ground in innovation by creating secure and easy-to-use wallets that make managing digital assets simpler for users. This advancement is expected to encourage acceptance of cryptocurrency as a legitimate and convenient payment option.

2. Biometric Authentication

It’s probable that biometric authentication will take over from traditional passwords in the majority of digital wallets on the market today. Biometric authentication involves using traits, like fingerprints or facial and voice recognition, to confirm a user’s identity.

The progress in security not just enhances user satisfaction by removing the necessity for passwords but also provides an extra level of defense against deceit and unauthorized entry into accounts or systems. With the integration of features in smartphones and other gadgets, on the rise digital wallets can utilize this technology to boost security measures and deliver a smooth user experience without any hassle.

3. SuperApps: Financial Ecosystems

In 2024, we’ll see a trend in digital wallets with the emergence of SuperApps. Comprehensive platforms enabling users to handle tasks like financial transactions to shopping all in one place. Think WeChat Pay or Alipay, in China, which offer a variety of services under a single digital umbrella.

With this trend going, more companies specializing in eWallet app development will likely start building similar platforms across different regions. These all, in one SuperApps are set to revolutionize how users manage their tasks by providing a seamless experience and enhanced integration.

Developers face the task of maintaining the security and usability of these platforms while ensuring they can scale effectively. Success in overcoming these obstacles will position companies at the forefront of the transformation journey.

4. AI and Predictive Analytics

By integrating intelligence (AI) technology into electronic wallets (eWallets) the level of personalization and security will be significantly enhanced. It will provide a more tailored user experience. With AI capabilities embedded within wallets, users can expect personalized guidance on budgeting, spending habits, and saving strategies based on their individual behavior. For example, an eWallet powered by AI could assess your spending trends. Recommend ways to optimize savings or investments for better financial management.

5. Cross-Border and Multi-Currency Transactions

Money transfers are gaining significance, especially for companies with a global presence. It is projected that by 2024, digital wallets will enable affordable cross-border payments. This results in lessening the need for conventional banking institutions and external payment service providers.

Multi-currency wallets allow people to hold and use currencies like cryptocurrencies without having to convert them or pay hefty fees for transactions. This shift is expected to be advantageous not only for companies but also for travelers and expats who often handle various currencies.

The need for services that develop cryptocurrency wallets is expected to rise due to the increasing demand from both businesses and individuals who are looking for efficient tools to facilitate cross-border payments effectively. Leading companies such as Debut Infotech are paving the path by offering these solutions with integrations, for businesses aiming to enhance their global payment capabilities seamlessly.

6. Wearable Technology

The growth of the Internet of Things (IoT) and wearable gadgets will make wearable technology an important aspect of the development of eWallets now and in the future. Wearable devices like smartwatches and fitness trackers will provide fast access to payment platforms. Visualize a scenario where you can effortlessly pay for your shopping by tapping on your smartwatch or conducting a transaction using a smart ring.

By the year 2024, it is anticipated that eWallets will be completely incorporated into these gadgets, enabling smoother and hands-free transactions. Wearables are set to evolve into an extension of the eWallet experience, simplifying financial management for users while they are on the move.

The Future of eWallets and Payments

The outlook for wallets looks promising as they play a pivotal role in reshaping how we handle our finances and make transactions; this trend is only at its inception stage. To the year 2024 and beyond, as we are moving forward, eWallets are expected to develop into multifaceted platforms that not only facilitate payments but also oversee our digital profiles and investments, among other functions.

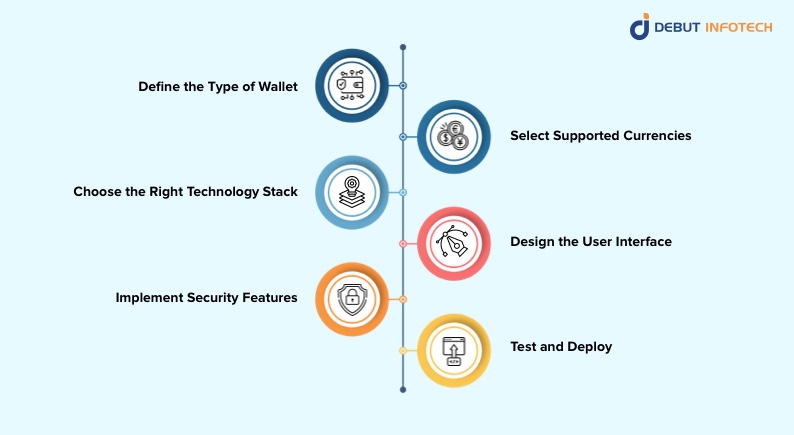

How to Create an eWallet: A Step-by-Step Guide

Creating a wallet from the ground up might appear challenging at first glance; however, with proper direction and knowledge, it can turn into a seamless and fulfilling endeavor. Here is a detailed roadmap on crafting a wallet that aligns with the demands of enterprises and individuals:

Related Read: How to Create a Crypto Wallet

1. Define the Type of Wallet

When starting out, making a wallet of your choice is the initial stage you need to consider. There are primarily two kinds of wallets you can opt for: custodial and non-custodial. Custodial wallets are overseen by a third-party entity such as a bank or an exchange. They safeguard the user’s private keys. The non-custodial wallets grant the user complete authority over their key,s resulting in enhanced security albeit with greater responsibility.

To create a wallet for their business needs and compliance standards effectively meet user expectations and legal guidelines requires collaborating with a reputable eWallet app development company such as Debut Infotech.

2. Select Supported Currencies

Choosing which currencies to include in the wallet is a decision to make. Do you plan for the wallet to deal exclusively with currencies, or will it also accommodate cryptocurrencies? An increasing number of businesses are selecting currency wallets that enable users to hold and conduct transactions using various traditional and digital currencies. This offers users a versatile and adaptable interaction.

When incorporating cryptocurrency functionalities into your project, don’t forget the importance of partnering with a crypto wallet app development company to guarantee both security and scalability.

3. Choose the Right Technology Stack

Selecting the right technology stack plays a role in how well a wallet functions and stays secure in various scenarios. Exemplifying this is the importance of technology for a cryptocurrency wallet’s core functionality. For wallets dealing with currencies (fiat), it is advisable to prioritize cloud-based infrastructure that guarantees scalability and immediate transaction processing.

The selection of the technology stack should align with the characteristics and operational needs of the wallet in terms of features and performance criteria, as well as functionality considerations. Collaborating with firms specializing in crypto wallet development guarantees the establishment of a robust groundwork for your wallet.

4. Design the User Interface

Creating a user experience is essential for eWallets to thrive successfully. The design of the interface plays a role as it impacts users’ willingness to embrace the wallet’s functionality, regardless of its advanced features. To ensure user adoption and satisfaction, it is imperative to craft an interface that’s straightforward, intuitive, and user-centric, enabling users to execute transactions effortlessly while keeping track of their balances and adjusting settings with ease.

5. Implement Security Features

Ensuring security is key when developing a wallet; it’s essential to incorporate elements such as encryption methods and multiple layers of authentication, like biometrics and multi-factor authentication (2FA). When it comes to wallets, specifically safeguarding private keys from potential hacking threats is of utmost importance.

Certain wallets utilize cryptographic methods such as Shamir’s Secret Sharing to divide the private key into several segments that must be combined to restore the wallet fully. This feature enhances security by making it harder for individuals to access the wallet.

6. Test and Deploy

Prior to releasing the wallet to the public, sufficient testing is crucial. This encompasses security checks to pinpoint weaknesses and performance evaluations to guarantee the wallet’s ability to manage transaction loads and user trials to refine the user interface and experience. Finishing the testing phase and deploying the wallet successfully does not mark the end of the process; it is essential to provide updates and patches to tackle security risks and maintain compatibility with emerging technologies and regulatory adjustments.

Ready to Elevate Your Digital Payment Strategy?

Connect with Debut Infotech to discuss your specific needs and find the best eWallet solution for your business.

Conclusion

Digital wallets are advancing rapidly. They are expected to become increasingly more important for handling finances efficiently and securely moving forward. The outlook for eWallets appears promising as advancements such as integrating cryptocurrency options and implementing security measures alongside AI-driven data analysis take the lead. Businesses must embrace digital wallet technologies to remain competitive in a society that favors cashless transactions and prioritizes convenience.

Here at Debut Infotech, we have a knack for assisting businesses in maneuvering through this terrain. If you’re aiming to create a wallet incorporating cryptocurrency functionalities or delve into the possibilities of blockchain technology, our team of seasoned professionals stands ready to support you at each juncture.

FAQs

Implementing an eWallet can streamline your payment process, reduce transaction times, and enhance the customer experience. eWallets also provide increased security through encryption and biometrics, helping businesses stay competitive in the digital marketplace. Additionally, they support loyalty programs and integrate multiple payment methods, including cryptocurrency.

A secure eWallet typically includes encryption, biometric authentication (fingerprint or facial recognition), and multi-factor authentication (2FA). It also employs fraud detection systems and offers secure storage of sensitive data, such as private keys for cryptocurrencies. These features help safeguard transactions and prevent unauthorized access.

Yes, many eWallet solutions now support cryptocurrencies like Bitcoin and Ethereum. By integrating cryptocurrency, businesses can offer customers more payment options, handle cross-border transactions easily, and tap into the growing crypto market. Ensure you work with a provider that offers secure crypto wallet development.

Emerging trends include the integration of cryptocurrencies, biometric authentication for added security, multi-currency and cross-border payment capabilities, and the development of SuperApps. SuperApps allow users to manage financial transactions alongside other services, such as shopping and bill payments, all in one platform.

The timeline for developing a custom eWallet depends on the complexity of the features and integrations required. Basic eWallets can take a few months to develop, while more advanced solutions with cryptocurrency support, biometric security, and AI integration may take longer. Consult with an expert eWallet development company for precise timelines.

To ensure a user-friendly eWallet, focus on intuitive design, clear navigation, and streamlined transaction processes. Include features such as quick access to transaction history, easy fund transfers, and seamless integration with loyalty programs. Additionally, offering biometric authentication will provide added convenience for users.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment