Table of Contents

Home / Blog / Blockchain

A Comprehensive Guide to DeFi Sniper Trading Bots

September 12, 2024

September 12, 2024

Many trading possibilities in the fast-paced space of decentralized finance (DeFi) might appear and vanish in the blink of an eye. One such chance presents itself with the release of fresh tokens on PancakeSwap and Uniswap, two leading decentralized exchanges (DEXs). Often causing price swings, these events are a treasure for smart traders. Traders have turned to DeFi sniper bots—automated systems meant to quickly spot and seize these volatile opportunities—to maximize possible earnings.

DeFi sniper bots offer a strategic advantage in a very competitive market regardless of whether your targets are freshly minted tokens or use of price differences.

Ready to revolutionize your DeFi trading strategy?

Partner with our expert team for custom DeFi sniper bot development. Maximize your gains in real-time!

What Is a DeFi Sniper Trading Bot?

Using direct blockchain protocol interaction, a DeFi sniper trading bot is a specialized program used to execute trades on decentralized exchanges (DEXs) quickly. The bot’s capacity to “snipe” a trading opportunity in seconds—taking advantage of temporary events like newly issued token listings or liquidity occurrences—helps to define the word “sniper.”

Trading possibilities on DEXs, including Uniswap, PancakeSwap, or SushiSwap, can be somewhat time-sensitive. Token values often change drastically in a few seconds; by the time a human trader responds, the greatest chances could have passed. DeFi snipers instantly execute transactions according to predefined criteria like price thresholds or liquidity levels, therefore removing this wait.

The bots can target particular coins, track liquidity pools, and even automatically sell tokens once a preset profit margin is attained. Given the increasing number of DeFi systems and protocols, having a dependable bot can make all the difference between missing out completely and making significant gains.

How DeFi Sniper Bots Work

A DeFi sniper bot’s primary purpose is to track the blockchain for particular trading signals and carry them out faster than human traders could. These bots are seen in great detail here:

- Blockchain Scanning: The bot constantly searches the blockchain for pertinent information, including price swings, changes in liquidity pool, or token listings. It tracks distributed exchanges (DEXs) where these opportunities present themselves.

- Predefined Rules: Operating under predefined rules and conditions, the bot might search for a token that has recently been listed, attained a specific price, or satisfies a minimum liquidity criterion.

- Execution of Trades: The bot files the trade straight to the blockchain once the requirements are satisfied. Since it is automated and interacts directly with smart contracts, the bot can finish deals far faster than human trading platforms.

- Post-Trade Actions: Following a trade, the bot can monitor the blockchain for post-trade activities. For example, it might automatically sell a token should its price reach a set objective.

Traders have an advantage since this automation dramatically lowers the time between spotting an opportunity and making a deal. Crypto trading bot development can optimize these bots to suit particular trading approaches and tastes.

Key Features of DeFi Sniper Bots

Not all trading bots are made equal, and some characteristics of DeFi sniper trading bots seem necessary for success. The following distinguishes the best DeFi trading bots:

- Ultra-fast Execution: In trading, fortune favors the fast. DeFi trading depends on speed, particularly for tokens with great demand or fresh token launches. To compete with others, the best trading bots must be able to run in milliseconds.

- Configurable Parameters: Users should be able to define their criteria, such as slippage tolerance, target prices, liquidity thresholds, and petrol fee settings. The more customizable the bot, the more precisely it will fit a trader’s approach.

- Cross-Platform Compatibility: A good DeFi sniper bot should be interoperable with several DeFi platforms and protocols, like Uniswap, SushiSwap, or PancakeSwap. This adaptability lets dealers spread out over several blockchains and exchanges.

- Security: Strong security is vital since DeFi sniper bots directly deal with smart contracts and users’ funds. Among best-in-class bots are those with cold wallet compatibility, multi-signature support, and safe private key storage.

- Gas Fee Optimization: In DeFi trading, gas fees can be a significant outlay of funds. The best sniper bots use algorithms to reduce gas costs and guarantee trades are made before prices change.

By creating a DeFi sniper bot with all these capabilities, the right DeFi development services can guarantee that traders have a tool fit for the best performance and safety by using the correct DeFi protocols.

The Role of Smart Contract Development in DeFi Sniper Bots

DeFi sniper trading bot development depends much on smart contract integration. Smart contracts are self-executing agreements directly written in code terms of the agreement. They let DeFi snipers do independent transactions and engage with decentralized exchanges (DEXs).

When it makes a trade, a bot engages the smart contracts controlling the decentralized exchange. These agreements define the token swaps, the liquidity source, and the computation of fees. Operating straight on the blockchain, the bot may avoid the typical delays connected with user interfaces and centralized systems.

For instance, when a token is issued, the smart contract in charge of trading will manage the matching of buyers and sellers. A DeFi sniper bot monitoring the smart contract and acting with a buy order as soon as the token becomes available has a major advantage over human traders.

Developing a sniper bot that interacts well with these smart contracts requires a thorough understanding of smart contract development. To guarantee flawless execution, developers must grasp the inner workings of DeFi systems and how to maximize bot interactions with them.

Why Speed Matters in DeFi Sniper Trading

Among the most crucial considerations for DeFi sniper bots is speed. Bot users have a significant edge over human traders because they can conduct trades within milliseconds. Timing is essential in a fiercely competitive environment where token values could change in seconds.

DeFi sniper bots provide multiple speed benefits:

- Blockchain Interaction: These bots interact directly with the blockchain by bypassing DEX user interfaces, which can be laggy or encounter lag during instances of great demand.

- Instant Monitoring: The bot runs transactions when pre-defined criteria are satisfied while constantly observing market circumstances. This removes the lag connected with human reaction speeds.

- Gas Wars: DeFi sniper bots can win “gas wars.” Gas wars arise when several traders bid high gas rates to guarantee the first processing of their transaction. Programming a sniper bot to strategically bid gas fees helps to ensure the transaction passes without overpaying.

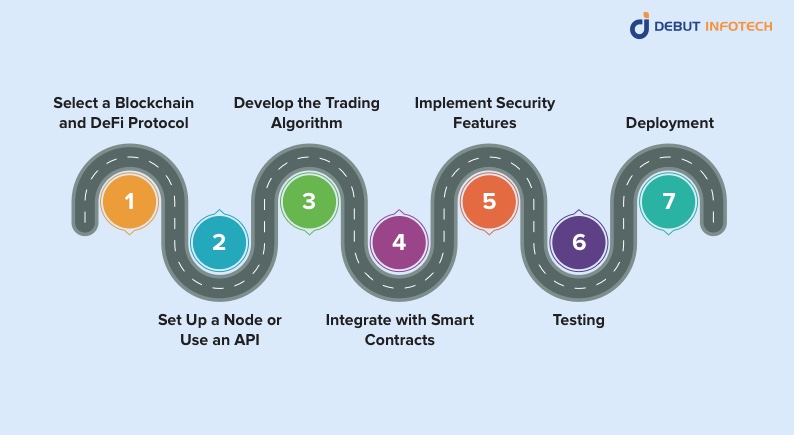

How to Develop a DeFi Sniper Trading Bot

Creating a decent DeFi sniper bot is not easy. It requires knowledge of smart contracts, blockchain technology, trading strategies, and decentralized exchanges. This is a detailed walk-through guide for creating a sniper bot.

- Select a Blockchain and DeFi Protocol: Choose a blockchain and DeFi protocol for which you wish to build your bot. Although Binance Smart Chain (BSC), Solana, and Avalanche are popular choices, Ethereum is among the most often used blockchains for DeFi trading.

- Set Up a Node or Use an API: Your bot must engage the blockchain. Access blockchain data and do transactions using your own node or APIs like Infura or Alchemy.

- Develop the Trading Algorithm: This is a fundamental tool. This system must be able to rapidly search the blockchain for prospects, evaluate gas costs, and run trades based on set parameters.

- Integrate with Smart Contracts: The sniper bot must integrate with smart contracts on the DEX. Writing code that lets the bot track liquidity pools, spot fresh token releases and run token swaps will help it to monitor.

- Implement Security Features: When handling financial transactions, security is vital. Protect user money with features like two-factor authentication, multi-signature wallets, and private key encryption.

- Testing: The bot must be completely tested in a virtual environment before deployment. This helps eliminate flaws and guarantees that the bot operates as planned in several market environments.

- Deployment: Once the bot passes tests, it may be uploaded to the blockchain. Frequent updates and optimizations could be required to fit evolving market conditions or improvements in the DeFi ecosystem.

Risks and Challenges in DeFi Sniper Trading Bots

DeFi sniper bots have several risks and obstacles despite their benefits:

- Gas Fees: Particularly in times of great network congestion, bigger gas fees can rapidly eat into earnings. Bots not tuned for gas prices could either overpay or fail to perform on trades.

- Front-running: Front-running is the term for a situation in which some sophisticated algorithms can spot upcoming transactions on the blockchain and make their own trades before they occur.

- Slippage: Price slippage is the difference between a trade’s predicted and actual price at which it is executed. Should the bot trade too late, it could be paying more for a token than expected.

- Smart Contract Bugs: Since DeFi sniper bots interact with smart contracts, any vulnerabilities in these contracts can pose a risk. For example, if the smart contract governing a token has a bug, it could lead to losses for the bot’s user.

- Regulatory Concerns: Although DeFi is still a relatively uncontrolled area, there are growing questions about the regulatory environment around crypto trading and DeFi systems. DeFi sniper bots should be used by traders who are aware of any changing rules affecting their capacity to trade or the legality of particular trading methods. In suspected market manipulation or unfair behaviors like front-running, governments, and regulatory authorities may impose new restrictions limiting or supervising automated trading bots.

Legal and Ethical Considerations of DeFi Sniper Bots

Legal and ethical issues still hold relevance even if DeFi is meant to be a decentralized, permissionless technology. Regarding legality, DeFi sniper bots fall in a hazy area, particularly given that DeFi itself is still developing in terms of control. Often viewed as immoral, front-running—using bots to preload trades based on unverified blockchain events—may be prohibited in some places.

Apart from any legal issues, traders and developers should also pay close attention to ethical issues. Sometimes, the employment of bots to exploit market inefficiencies results in an unfair marketplace whereby human traders—especially beginners—are greatly disadvantageous. Although most governments do not forbid DeFi sniper bots, their use raises ethical questions, especially in competitive token launches.

Moreover, traders should keep updated about the most recent legal needs as the environment of regulations for DeFi platforms and crypto trading bot development changes. Working with a crypto trading bot development company that follows the rules helps lower bot use risks.

Advantages of Using DeFi Sniper Bots

The benefits of using DeFi sniper bots are clear, and many experienced traders have adopted them as part of their trading strategy. Some key advantages include:

- Speed and Efficiency: DeFi sniper bots can run transactions in seconds, considerably faster than any human trader could. This speed is vital in fast-moving DeFi marketplaces, where token prices can change significantly in a few milliseconds.

- Automation: Bots let traders automate their methods around the clock, saving the human interaction requirement. This continual attention guarantees that no trade possibility is lost.

- Maximizing Profits: DeFi sniper bots greatly raise the likelihood of profiting from market inefficiencies by sniping recently introduced tokens or leveraging liquidity shifts.

- Customizable: Bots can be customized to particular strategies. To provide exact control over their transactions, users can establish limits for gas expenses, slippage, liquidity criteria, and more.

- Bypassing Lag: DEXs may have notable lag during high-traffic events, which may cause failed or delayed trades. Bots provide speedier execution by directly engaging with smart contracts, therefore avoiding this.

The Future of DeFi Sniper Bot Development

DeFi sniper trading bots are developing along with DeFi’s expansion and inventiveness. Advances in artificial intelligence (AI), blockchain interoperability, and growing attention to user security will probably define future trends in bot development.

- AI-Enhanced Trading Bots

The development of DeFi sniper bots will rely heavily on artificial intelligence (AI). AI will enable bots to learn from prior market data, instantly modify their trading plans, and even project market moves depending on trends. By lowering the risk of mistakes, enhancing decision-making, and foreseeing market shifts, AI-enhanced bots can maximize trading performance.

- Cross-Chain Compatibility

The demand for bots that can run across several chains is growing as new blockchains create DeFi ecosystems outside Ethereum. Bots that can snipe deals on platforms beyond Ethereum, such as Binance Smart Chain, Solana, or Avalanche, will appeal to traders.

- Enhanced Decentralization

For speed and efficiency, many sniper bots now depend on centralized infrastructure. Still, fully decentralized bots running on decentralized nodes will probably surface and provide even more security and transparency.

- AI and Predictive Trading

As AI-powered bots keep becoming smarter, they will offer real-time decision-making powers and superior predictive analytics. This will enable bots to spot possibilities more precisely and quickly, hence improving their efficacy.

- DeFi-Specific Bots

Bots specifically designed for DeFi: More bots catering to particular DeFi use cases—such as yield farming, Defi staking, or liquidity provision—will probably come. On DeFi systems, these bots will automate a greater spectrum of financial tasks than only token trading.

- Compliance and Regulation

Bots that can guarantee adherence to different legal criteria will be needed when governments start closely controlling DeFi. This can entail including compliance audits into the bot’s decision-making process.

Do you need specialized answers or have questions about your DeFi sniper bot? Speak with our staff right now to go over the details of your project!

Conclusion

For traders trying to have an advantage in the cutthroat and fast-paced realm of decentralized finance, DeFi sniper trading bots have grown to be a necessary tool. Leveraging new token launches, liquidity events, and other transient possibilities, these bots let users virtually immediately make trades. But, building and deploying a successful sniper bot requires a thorough knowledge of blockchain, smart contracts, and DeFi systems.

Working with a seasoned crypto trading bot development company guarantees your bot is reliable, safe, and built to stay. Features like cross-platform compatibility, gas optimization, and artificial intelligence-powered decision-making help today’s sniper bots to be stronger than ever.

The technology underlying these bots will also change as DeFi develops, providing ever more advanced capabilities for developers and traders. DeFi sniper bots give you a chance to remain competitive and profit in the dynamic world of distributed finance regardless of your level of trading experience.

Frequently Asked Questions

A DeFi sniper trading bot is an automated tool that quickly conducts transactions on distributed exchanges (DEXs), usually during events like new token listings or liquidity injections, acquiring a competitive edge.

These bots run transactions in milliseconds, faster than human traders, and constantly search blockchain data for particular criteria, such as new token introductions or price thresholds.

DeFi sniper bots are lawful but operate in an essentially uncontrolled environment. Local restrictions should be kept under constant awareness since governments might impose policies about DeFi and automated trading.

Faster trade execution, the ability to trade 24/7, and the possibility of seizing ephemeral opportunities in volatile markets, such as during fresh coin launches, constitute the critical advantages of sniper bots.

If you possess technical skills in blockchain, smart contracts, and algorithmic trading, you can create your own DeFi sniper bot; alternatively, you can pay a crypto trading bot development company to develop one for you.

Risks include high gas prices, price slippage, smart contract flaws, and a competitive market in which other bots could fight for the same possibilities.

Search for bots with configurable settings, cross-chain compatibility, and security features, including multi-sig wallets and gas charge optimization to guarantee you maximize revenues while lowering risks.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment