Table of Contents

Home / Blog /

DeFi Security: Protect Your Platform from Hacks and Exploits

March 20, 2025

March 20, 2025

Eliminating middlemen, offering open, permissionless financial services, and the rise of decentralized finance (DeFi) have changed the financial industry. Still a big problem, though, is DeFi security, considering the market has witnessed multiple well-publicized hacks, smart contract problems, and protocol attacks. Strong security practices being guaranteed as DeFi grows will help to maintain platform integrity, protect user cash, and increase blockchain ecosystem confidence.

Strong governance processes, smart contract audits, and a safe coding approach are all layered together on a safe DeFi platform. From rigorous DeFi security audits to adding innovative blockchain security tools, projects must employ best practices to lower risks. This article explores the main security vulnerabilities in DeFi, useful security solutions, and how blockchain consultants and development businesses may help produce safer decentralized apps (dApps).

Build a Secure and Resilient DeFi Ecosystem

Strengthen your DeFi platform with top-tier security measures, from smart contract audits to price oracle protection. Partner with our blockchain consultants to implement the best security solutions.

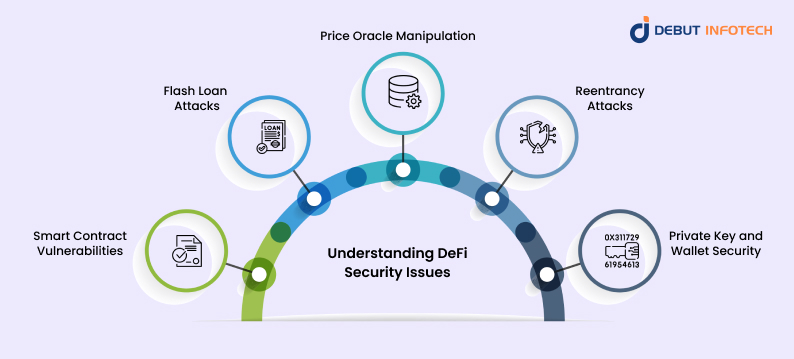

Understanding DeFi Security Issues

DeFi systems eliminate middlemen by using blockchain technology to provide decentralized financial services, facilitating open transactions. DeFi’s open and permissionless character, however, presents security issues that malevolent players might take advantage of. DeFi security concerns can cause major user confidence loss, protocol breakdowns, and financial losses. Developers, investors, and consumers should be aware of the following most urgent DeFi security concerns:

1. Smart Contract Vulnerabilities

DeFi platforms are built on smart contracts, which automate financial transactions straightforwardly without middlemen. Still, poorly constructed or unaudited smart contracts can be a serious security hazard. Typical weaknesses include:

- Reentrancy bugs – Fund drains result from allowing hostile contracts to communicate constantly with a vulnerable contract before the first execution is finished.

- Integer overflows/underflows – Errors in numerical calculations can allow attackers to manipulate contract behavior.

- Unchecked external calls – Smart contracts interacting with other contracts may unintentionally execute malicious code if external calls are not properly validated.

The 2016 hack, where an assailant used a reentrancy weakness to siphon money, resulting in a controversial Ethereum hard fork, is a well-documented incidence of smart contract vulnerabilities. Finding and reducing such hazards before starting a protocol depends on doing a complete DeFi security audit

2. Flash Loan Attacks

Provided the loan is returned within the same transactions, flash loans let customers borrow large amounts of cryptocurrencies without collateral. Although this invention has many reasonable applications, it has also become a weapon for hackers to control DeFi systems. Usually, flash loan attacks call for

- Price oracle manipulation – Attackers use flash loans to inflate or deflate asset prices on DEXs, exploiting the manipulated prices to drain liquidity pools.

- Governance attacks – Some DeFi projects allow token holders to participate in governance decisions. Attackers can use flash loans to acquire large voting power, pushing malicious proposals through temporarily.

- Exploiting arbitrage opportunities – Attackers use flash loans to exploit inefficiencies between different liquidity pools or exchanges, draining assets at an unfair advantage.

One example is the bZx protocol attack, in which an assailant might control asset values and drain money using a flash loan vulnerability. Using rate-limiting systems or time-weighted average pricing (TWAP) oracles will help to reduce these types of attacks.

3. Price Oracle Manipulation

DeFi platforms get real-time asset values from outside sources using price oracles. Determining lending rates, collateralization ratios, and token swaps requires these oracles. On the other hand, improper security of an oracle allows attackers to manipulate price data, causing significant financial effects. Common Oracle manipulation techniques include:

- Low liquidity pool attacks – Attackers manipulate the price of an asset by making large trades on low-liquidity DEXs, tricking oracles into reporting false prices.

- Single-source dependency – Oracle’s relying on a single data source can be compromised if that source is manipulated.

- Timestamp attacks – If price updates are delayed or influenced by miners, attackers can exploit outdated price feeds to execute profitable trades.

For instance, the Harvest Finance exploit in 2020 involved a price oracle attack that allowed an attacker to drain over $24 million by artificially manipulating stablecoin prices. Integrating decentralized oracles such as Chainlink, Band Protocol, or API3 can mitigate these risks by aggregating data from multiple sources and enhancing Oracle reliability.

4. Reentrancy Attacks

It is common for smart contracts to make external calls to other contracts before concluding their own state changes; this practice is known as a reentrancy attack. If the external contract often calls back into the main contract, it can withdraw more money than expected. This weakness lets attackers drain money without causing the expected balance updates in the contract to change.

Example of a Reentrancy Attack:

- A user deposits funds into a smart contract.

- The contract sends a withdrawal request to another contract.

- The external contract calls back into the original contract before finalizing the withdrawal process.

- The attacker exploits this recursive interaction to drain all funds.

One noteworthy example of a reentrancy attack is the hack on the Ethereum DAO. Using the weakness, the attacker withdrew about $60 million worth of Ether from the DAO’s treasury.

Preventing Reentrancy Attacks

- Using Checks-Effects-Interactions (CEI) pattern – Ensuring state variables are updated before external calls.

- Implementing reentrancy guards – Using Solidity’s reentrancyGuard modifier to prevent multiple function calls.

- Conducting rigorous smart contract audits – Identifying and fixing reentrancy vulnerabilities before deployment.

5. Private Key and Wallet Security

Unlike traditional financial systems, DeFi operates without centralized intermediaries, meaning users have full control over their assets through private keys. However, poor key management can lead to irreversible losses. Some key risks include:

- Phishing scams – Attackers trick users into revealing their private keys through fake websites or emails.

- Malware and keyloggers – Malicious software can record keystrokes and steal credentials.

- Compromised custodial wallets – Users storing assets on centralized platforms risk losing funds if the service provider is hacked.

A major private key security breach occurred with the KuCoin exchange hack. Due to compromised private keys, attackers stole over $280 million worth of crypto assets.

Strengthening Wallet Security

- Using hardware wallets – Cold storage wallets like Ledger and Trezor keep private keys offline, preventing online attacks.

- Enabling multi-signature authentication – Multi-sig wallets require multiple approvals before transactions can be executed.

- Implementing two-factor authentication (2FA) – Adding an extra layer of security when accessing DeFi platforms.

DeFi Security Solutions: Best Practices for Protection

Ensuring strong DeFi security requires a combination of robust coding practices, advanced security tools, and continuous monitoring. DeFi projects must implement multiple layers of protection to defend against hacks, exploits, and fraud. Here are some essential best practices:

1. Conduct Regular DeFi Security Audits

A DeFi security audit is a crucial step in identifying vulnerabilities before attackers exploit them. Smart contract audits, penetration testing, and security assessments help detect flaws in the platform’s code. Engaging reputable blockchain consultants and security firms ensures thorough and effective audits.

2. Implement Multi-Signature Wallets and Secure Key Management

Using multi-signature wallets enhances security by requiring multiple approvals for transactions. This prevents unauthorized fund transfers and reduces the risk of a single point of failure. Proper private key management, including cold storage solutions, also protects funds from cyber threats.

3. Strengthen Smart Contract Security

Developers should follow secure coding standards and conduct rigorous testing before deploying smart contracts. Formal verification techniques can be used to mathematically prove contract behavior, minimizing the risk of logic errors. Regular updates and security patches help prevent vulnerabilities from being exploited.

4. Use Reliable and Decentralized Oracles

Since price oracles play a critical role in DeFi, ensuring their security is essential. Platforms should integrate decentralized Oracle networks that pull data from multiple trusted sources. This prevents price manipulation and enhances accuracy in financial transactions.

5. Mitigate Flash Loan Attack Risks

Flash loans can be exploited if not properly secured. DeFi protocols should implement rate limits, collateral requirements, and time-weighted price oracles to prevent manipulation. Continuous monitoring of unusual transaction patterns can help detect and respond to suspicious activities in real time.

6. Improve User Security Measures

Educating users about security best practices is just as important as securing the platform. Encouraging hardware wallets, two-factor authentication, and secure password management reduces the risk of phishing attacks and wallet compromises.

7. Implement Robust Access Control and Monitoring

DeFi platforms should enforce strict access controls to limit administrative privileges and prevent insider threats. Real-time monitoring systems can track unusual activity, enabling quick responses to potential security breaches. Automated alerts can help detect threats before they escalate.

By following these best practices, DeFi projects can significantly reduce security risks and build a more secure blockchain ecosystem. Implementing strong security measures protects assets and increases user trust and adoption.

Role of Blockchain Consultants in DeFi Security

Blockchain consultants play a crucial role in strengthening DeFi security by offering expert guidance on best practices, risk management, and technology implementation. Their deep understanding of blockchain technology, security protocols, and decentralized finance allows them to help projects build secure and resilient platforms.

One of the key responsibilities of blockchain consultants is conducting comprehensive security assessments. They analyze the smart contract architecture, identify potential vulnerabilities, and recommend improvements to prevent exploits. By leveraging their expertise in DeFi security audits, they ensure that projects follow secure coding standards and implement necessary updates before deployment.

In addition to audits, consultants assist in the integration of security-focused blockchain platforms and tools. They help DeFi projects implement decentralized oracles, multi-signature wallets, and robust authentication mechanisms to minimize risks. Their knowledge of blockchain ecosystem protocols enables them to recommend suitable security solutions tailored to a project’s needs.

Regulatory compliance is another area where blockchain consultants add value. As DeFi operates in a rapidly evolving regulatory environment, consultants help businesses navigate legal requirements, ensuring that security measures align with compliance standards. This reduces the risk of regulatory penalties and enhances trust among users and investors.

Furthermore, blockchain consultants provide continuous monitoring and incident response strategies. They implement real-time security monitoring tools that detect suspicious activities, preventing unauthorized access and potential hacks. Their expertise in enterprise blockchain development allows them to design scalable and secure infrastructure for DeFi applications, reducing vulnerabilities over time.

Engaging with experienced blockchain development companies reduces the risk of security breaches and enhances platform credibility.

Blockchain Integration for Secure DeFi Platforms

Seamless blockchain integration ensures that DeFi protocols leverage the strengths of different blockchain platforms to enhance security and efficiency. Enterprise blockchain business development helps in:

- Building cross-chain security mechanisms.

- Implementing permissioned blockchain layers for additional security.

- Reducing transaction costs and congestion.

Choosing the right blockchain network can significantly impact DeFi security and overall platform performance.

Blockchain Use Cases for DeFi Security

Blockchain technology enhances DeFi security by introducing decentralized frameworks, cryptographic techniques, and interoperability features that mitigate risks. Below are key blockchain use cases that strengthen DeFi security:

- Zero-Knowledge Proofs (ZKPs) – Enable secure and private transactions by allowing one party to verify information without revealing sensitive data. This helps maintain user privacy while ensuring compliance with regulations.

- Multi-Chain Security Solutions – Reduce risk by allowing DeFi platforms to operate across multiple blockchains. This prevents single points of failure and ensures continuous functionality even if one network experiences issues.

- Decentralized Identity Management – Improves KYC and AML compliance without exposing personal data. Users can verify their identities using blockchain-based authentication methods while retaining control over their credentials.

- Smart Contract Auditing and Formal Verification – Automates the security analysis of smart contracts to detect vulnerabilities before deployment. Formal verification mathematically proves the correctness of the contract’s logic, reducing the risk of exploits.

- Decentralized Oracles – Secure external data feeds for DeFi applications, preventing price oracle manipulation and ensuring smart contracts rely on accurate and tamper-proof market data.

- Multi-Signature Wallets and Threshold Cryptography— Require multiple transaction approvals to enhance fund security. This prevents unauthorized withdrawals and reduces the risk of insider threats.

Integrating these blockchain-based security measures allows DeFi platforms to protect user assets, improve transparency, and foster greater trust within the ecosystem.

Secure Your DeFi Platform Today

Don’t let vulnerabilities put your DeFi project at risk. Our expert DeFi security audits and blockchain integration services ensure your platform stays protected from exploits.

Conclusion

DeFi security remains a critical factor in ensuring the sustainability and adoption of decentralized finance. As the industry continues to evolve, DeFi platforms must implement strong security frameworks, conduct regular DeFi security audits, and collaborate with blockchain consultants to mitigate risks. Secure smart contract development, reliable oracle integration, and user-friendly security features can prevent hacks and exploits.

By prioritizing DeFi security solutions, DeFi projects can protect user funds, maintain trust, and contribute to the long-term success of the decentralized financial ecosystem. Businesses seeking secure DeFi development services should work with an experienced blockchain development company to build robust, future-proof platforms.

Frequently Asked Questions

DeFi security refers to the strategies and technologies used to protect decentralized finance platforms from vulnerabilities and cyber threats. Since DeFi platforms operate on blockchain technology without centralized control, they are more exposed to risks like smart contract exploits, flash loan attacks, and oracle manipulation. Strong security measures ensure platform stability, protect investor funds, and foster long-term trust within the ecosystem.

The most prevalent DeFi security issues include smart contract bugs, flash loan exploits, price oracle manipulation, reentrancy attacks, and wallet security breaches. Poorly coded smart contracts can create loopholes that hackers exploit, while insecure oracles can distort asset pricing. To minimize these risks, DeFi projects must conduct thorough security audits, implement multi-layered protection, and continuously monitor their protocols for potential threats.

A DeFi security audit systematically evaluates a platform’s smart contracts and infrastructure to identify vulnerabilities and prevent potential exploits. The audit process includes automated scanning, manual code reviews, and penetration testing to detect security flaws. Regular security audits strengthen platform resilience and assure users and investors that the project adheres to best security practices.

To prevent flash loan attacks, DeFi platforms can integrate time-weighted price oracles to counter sudden price manipulation and impose collateralization requirements to reduce risks. Additionally, rate-limiting mechanisms can help restrict rapid, large-scale transactions that could be used for exploits. Frequent smart contract audits and proactive security upgrades further help safeguard against these attacks.

Price oracles play a crucial role in DeFi by supplying real-time asset values for trading, lending, and liquidity pools. If an oracle is compromised, attackers can manipulate asset prices, causing users to suffer significant financial losses. DeFi platforms should use decentralized oracles that aggregate data from multiple sources to prevent this, ensuring accurate and tamper-resistant pricing information.

Users can enhance their security by utilizing hardware wallets to store their assets securely, enabling two-factor authentication (2FA) for added protection and thoroughly verifying the legitimacy of DeFi platforms before connecting wallets. Additionally, reviewing smart contract permissions, avoiding suspicious links, and keeping wallet software updated help reduce the risk of hacks and phishing attacks.

The cost of blockchain development with integrated security features varies based on project complexity, smart contract development, and security requirements. Basic DeFi development can range from $10,000 to $50,000, while platforms with advanced security features such as formal verification, multi-signature authentication, and regular audits may exceed $100,000. Investing in security from the outset minimizes the risk of future financial losses due to exploits.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment