Table of Contents

Home / Blog / Cryptocurrency

Cryptocurrency Exchange Architecture: Building a Secure and Scalable System

October 12, 2024

October 12, 2024

Cryptocurrency Exchange Architecture ensures efficient, secure transactions on digital asset platforms. As the market grows, this architecture must evolve for speed, security, and user-friendliness. The pressing need for robust crypto platforms that can handle increasing volumes of transactions efficiently keeps growing day by day.

In fact, statistics reveal that the daily cryptocurrency trading volume is practically the same daily volume the New York Stock Exchange undergoes. According to research, the global volume in cryptocurrency markets has exceeded $50 billion. This is very close to the average turnover on the New York Stock Exchange.

This blog post explores key crypto exchange architecture aspects, focusing on security and scalability. It discusses essential components for efficiency and robust protocols to protect user assets. Understanding these elements enhances appreciation for crypto exchange mechanics and their economic impact.

Understanding Cryptocurrency Exchange Architecture

Cryptocurrency exchange architecture is the technical and strategic basis of digital asset platforms. It influences platform efficiency, security, and scalability, which affect user trust and longevity. Essential to this architecture are high transaction volumes, fast processing times, and strong security against cyber threats and failures. Stability from a solid architecture is vital for ongoing operations and maintaining user confidence, given digital currency volatility.

Key Components of Crypto Exchange Architecture

To build a reliable and efficient cryptocurrency exchange, certain core components are essential to its architecture. Understanding and integrating these components effectively can significantly enhance the performance and security of the exchange.

1. Trading Engine

The trading engine is the core of any exchange, matching orders with minimal delay. It must efficiently handle large order volumes quickly to maintain liquidity and speed transactions. A well-structured crypto exchange system design is essential for ensuring smooth operation and quick execution of trades, especially during periods of high market activity.

2. User Interface (UI)/User Experience (UX)

The UI and UX design should be intuitive and user-friendly, facilitating seamless navigation and trading. A well-designed interface boosts user satisfaction and retention, accommodating novice and experienced traders alike.

Only a top-tier cryptocurrency exchange development company can provide seamless and intuitive UI and UX design.

3. Wallet Integration

Secure wallet integration allows users to store, send, and receive cryptocurrencies safely. Wallets must support multiple currencies and include robust security features like multi-signature authentication and encrypted private keys.

4. Security Measures

Implementing advanced security protocols is essential. These include two-factor authentication, end-to-end encryption, cold storage for most funds, and regular security audits to address vulnerabilities.

5. Database and Order Management System

A reliable database is crucial for managing user data, transaction histories, and order books. It should ensure data integrity and quick access to historical data for users and administrators.

6. API Integration

Well-documented APIs enable smooth integration for third-party services and partners, enhancing exchange functionality and accessibility. Seamless crypto exchange API integration allows third-party apps to offer enhanced trading features.

7. Scalability Solutions

As the exchange grows, its architecture must scale, involving upgraded hardware, optimized software, and employing cloud services or distributed servers to handle increased loads.

The white label crypto exchange cost can vary significantly based on factors like customization level, technical support, and additional features required to meet business needs.

8. Database and Network Architecture

A well-functioning crypto exchange must handle high trade volumes and data without lag or downtime. It requires scalable databases and a network architecture that manages traffic surges effectively.

9. Legal Compliance

Adhering to regulatory requirements in operating jurisdictions is critical. This includes implementing KYC and AML protocols to prevent illegal activities.

10. Liquidity Management

Ensuring there is enough liquidity on the platform to execute trades without large price fluctuations is vital. This can involve creating partnerships with other exchanges or using liquidity providers.

These components are interconnected, each vital for the exchange’s functionality and success. By carefully designing and refining these aspects, exchanges can offer a secure, efficient, and user-friendly trading environment. This approach attracts and retains a broad user base, from individual traders to large institutions.

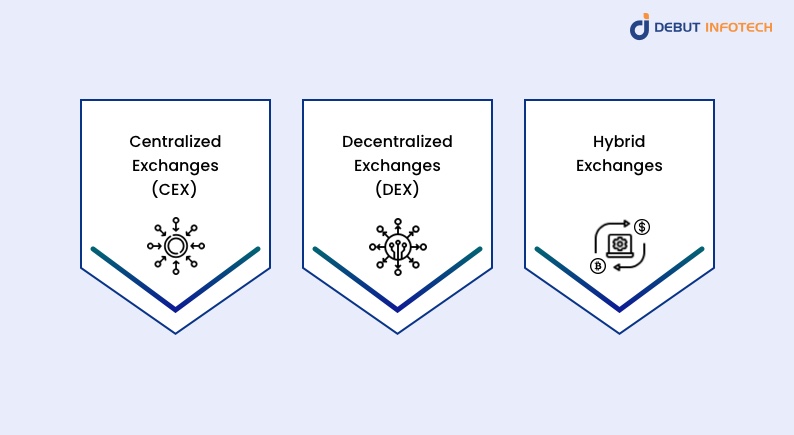

Types of Crypto Exchange Architecture

The following are the unique crypto exchange architectures you should know:

1. Centralized Exchanges (CEX)

Centralized Exchanges (CEXs) are managed by a central authority that handles transactions and holds user funds. This centralization enhances transaction speed and user experience, making CEXs the most common type of crypto exchange. The central authority processes trades, secures assets, and provides customer support and dispute resolution.

However, this control concentration also introduces risks, such as making the authority a prime target for cyber-attacks and exposing user assets to vulnerabilities if security is breached.

2. Decentralized Exchanges (DEX)

Decentralized Exchanges allow direct transactions without intermediaries, using blockchain-based smart contracts. This method increases security by avoiding central points of failure and keeping users in control of their private keys and funds. However, DEXs often struggle with lower liquidity, slower trade execution, and less intuitive interfaces compared to CEXs.

3. Hybrid Exchanges

Hybrid Exchanges attempt to combine the best features of both CEXs and DEXs to provide optimized performance. These platforms operate a centralized matching engine to facilitate fast and efficient trade execution, akin to CEXs, while maintaining the custody of funds decentralized, akin to DEXs.

This means that while the exchange can quickly process orders, the users’ funds remain in their control, reducing the risks associated with central custody. Hybrid exchanges aim to provide the security benefits of a DEX without compromising on the speed or ease of use that users expect from a CEX.

Offering a crypto derivatives exchange can attract advanced traders by providing access to futures, options, and other derivative products for diversified trading strategies.

Each type of exchange architecture offers distinct advantages and comes with specific trade-offs in terms of speed, security, user experience, and control. The choice between these depends largely on the users’ priorities, whether they value speed and simplicity over control and security, or a balance of both.

Essential Features of Crypto Exchanges

To ensure a cryptocurrency exchange platform meets user expectations and secures their transactions, several essential features must be effectively implemented:

1. User Interface (UI) and User Experience (UX) Design:

Considerations for Ease of Use

The UI/UX of a cryptocurrency exchange significantly influences user satisfaction and retention. An effective interface is clean, intuitive, and responsive, facilitating easy navigation.

It must assist both new users and experienced traders efficiently. Key features include streamlined navigation, clear call-to-action buttons, and visually appealing layouts. Information must be easily accessible with minimal clicks, and the platform must be optimized for various devices to facilitate mobile trading.

2. Security Measures:

Importance of Robust Security Frameworks to Prevent Breaches

Security is critical in crypto exchange design due to the valuable digital assets. Exchanges need robust security frameworks to protect assets and personal information. They must implement multi-factor authentication, end-to-end encryption, and cold storage options. Regular security audits help identify and address vulnerabilities. Additionally, anti-phishing measures and educating users on security best practices are essential.

3. Multi-Currency and Payment Support:

Enhancing User Experience by Accommodating Various Cryptocurrencies and Payment Methods

Crypto exchanges must support multiple currencies and payment methods to attract a global audience. This enhances user convenience and expands market reach. Supporting various cryptocurrencies allows trading in a wide asset range, attracting diverse users.

Integrating payment gateways like bank transfers, credit cards, and e-wallets caters to users worldwide. Seamless currency conversion can greatly improve the trading experience and boost user engagement.

Each feature is crucial for a crypto exchange’s success in a competitive market, ensuring accessibility, security, and meeting diverse user needs.

Challenges in Crypto Exchange Development

Developing a cryptocurrency exchange involves navigating numerous challenges that can affect the platform’s security, user experience, and compliance with legal norms.

1. Security Challenges and the Role of Smart Contracts in Enhancing Security

Ensuring robust security is a key challenge in cryptocurrency exchange software development to prevent breaches and attacks. Smart contracts automate transaction conditions, reducing manipulation or error risks. They run on blockchain technology, creating a transparent, immutable ledger that builds user trust. However, smart contract code must be carefully written and audited to avoid exploitable vulnerabilities.

2. UX Challenges and Strategies to Improve User Engagement and Satisfaction

From a UX perspective, designing interfaces for both novice and experienced traders is challenging. It requires balancing comprehensive functionality with simplicity. Enhancing UX involves conducting user research, iterative testing to refine interfaces, and using feedback for continuous improvements. Additionally, ensuring consistent platform performance under different loads and providing effective customer support can significantly improve user satisfaction and retention.

3. Legal and Regulatory Challenges Across Different Jurisdictions

Legal and regulatory compliance is vital in the cryptocurrency sector due to diverse and changing global regulations. Crypto exchanges need to proactively implement strong KYC and AML protocols and keep abreast of financial regulations.

Engaging legal experts and adapting to new laws is essential for maintaining operations and expanding internationally. Non-compliance can lead to fines, legal issues, or shutdowns, making it a priority for exchange development.Understanding the cost structure of a white label crypto exchange solution is essential for determining the total investment required, covering areas such as customization, licensing, and technical support.

4. Integration with Existing Financial Systems

Integrating cryptocurrency operations with traditional financial systems presents technical and operational challenges. Exchanges need robust mechanisms to allow seamless fiat-to-crypto transactions, which involve working with banks and payment processors that may have varying degrees of blockchain familiarity and regulatory concerns.

This integration must be secure, efficient, and compliant with financial regulations, requiring sophisticated backend solutions and constant updates to adapt to changing financial landscapes.

5. Technology and Infrastructure Maintenance

Keeping up with the rapid pace of blockchain technology developments necessitates ongoing updates and maintenance of the exchange infrastructure. This involves not only software updates and feature enhancements but also monitoring hardware performance and security infrastructure to guard against evolving cyber threats.The technological foundation of an exchange must be both robust and flexible enough to integrate new advancements in blockchain, security, and data processing technologies. Choosing a white label crypto solution reduces development time and costs, enabling quick platform launches.

6. Scalability Issues

Cryptocurrency exchanges must handle large fluctuations in trading volume without performance loss. As user numbers grow, scalability challenges include managing more transactions, data throughput, and connectivity without latency.

Building an architecture that can dynamically scale resources based on demand, using technologies like cloud services and scalable databases, is crucial to maintaining smooth operations and customer satisfaction.

7. Market Liquidity Management

Ensuring sufficient liquidity on a cryptocurrency exchange is crucial for trading without major price slippage. Strategies to maintain liquidity, like market maker systems or partnerships for shared liquidity pools, can be complex.

Additionally, managing the financial risk associated with holding and trading diverse cryptocurrencies requires advanced analytics and risk management tools.

8. Customer Service and Support

As exchanges grow, they must also scale their customer support operations to handle an increasing number of inquiries and issues. Providing comprehensive support—ranging from troubleshooting trade issues to handling security concerns—is vital to user retention.

Exchanges must develop efficient, scalable customer service solutions that can include automated systems like chatbots and detailed FAQs, supplemented by human support for more complex queries.

Addressing these challenges demands careful planning, expert knowledge, and ongoing adaptation to develop and sustain a secure, user-friendly, and compliant cryptocurrency exchange.

Future Trends in Cryptocurrency Exchange Architecture

Looking ahead, emerging trends in technology and user demands will shape cryptocurrency exchange architecture.

1. The Evolving Role of AI and Blockchain in Crypto Exchanges

AI is enhancing operations and user experiences in cryptocurrency exchanges. It automates compliance checks, fraud detection, and customer service, boosting efficiency and accuracy. AI algorithms also refine trading strategies and offer predictive analytics based on market trends. The synergy between AI and blockchain technology is creating a more secure and intelligent transaction infrastructure.

2. Increasing Adoption of Decentralized Finance (DeFi) Applications

DeFi is gaining traction, offering more autonomy without traditional financial intermediaries. Cryptocurrency exchanges are integrating DeFi for lending, borrowing, and earning interest directly. This integration boosts user engagement with DeFi protocols, driving innovation and liquidity. DeFi adoption is transforming exchanges into hubs for diverse financial activities.

3. Innovations in Security Protocols and Trading Algorithms

As threats to digital assets intensify, protective measures are advancing in response. Cryptocurrency exchanges are adopting robust security options such as multi-factor authentication and biometric logins. Additionally, they’re enhancing data and asset protection with comprehensive end-to-end encryption.

New trading algorithms, powered by machine learning, enhance both trade efficiency and price discovery. These innovations attract users by ensuring investment safety and maintaining a fair trading environment.

Above all trends highlight the dynamic nature of cryptocurrency exchange architecture, continually adapting to technological advancements. As these trends develop, they promise to shape the future of cryptocurrency trading on digital platforms.

Conclusion

A successful cryptocurrency exchange architecture depends on key elements: robust security to protect assets, scalable infrastructure for user and trading volume fluctuations, intuitive interfaces for user engagement, and thorough regulatory compliance. Although, these components are essential for attracting users and maintaining their trust and loyalty. Building a crypto exchange for startups requires balancing cost-efficiency, scalability, and robust security features. By prioritizing these areas, developers can prepare their exchanges to meet the evolving demands of the digital currency landscape.

Frequently Asked Questions

The cryptocurrency exchange architecture refers to the structural and technological framework that facilitates the trading of digital assets. However, The architecture of a crypto exchange has several core components. Each of these components are primarily responsible for specific processes. The components include the user interface, the wallet system, the trading engine, the order book, etc.

The system architecture of cryptocurrency consists of each node connected to every other node. Nodes are known to store the whole history of a Blockchain network. Also, Full nodes, which function in a similar fashion with attendance registers used in schools, maintain an account of each transaction. This includes which blocks are being replaced by new ones and which blocks have been added.

The components of a crypto exchange include the trading engine, user authorization, admin panels, push notifications, as well as security system.

The three major types of crypto exchanges are decentralized exchanges (DEX), centralized exchanges (CEX), and hybrid exchanges. Moreover, Cryptocurrency exchanges are the gateways to purchasing, selling, and trading digital currencies.

Many exchanges provide margin trading that specifically allowing users to borrow funds to leverage positions and charge interest on these loans. Additionally, some platforms offer crypto lending services, enabling users to lend their assets to earn interest, with the exchange taking a percentage.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment