Table of Contents

Home / Blog / Cryptocurrency

How to Build Your Bitcoin Exchange – An In-Depth Roadmap

November 22, 2024

November 22, 2024

The cryptocurrency market is booming. With over 560 million users globally and an estimated market capitalisation exceeding $2 trillion, it’s highly likely that the demand for crypto assets will only increase. As demand for digital assets grows, crypto exchanges play a crucial role in facilitating transactions, investments, and trading. Because of this, many investors are considering building a crypto exchange. However, If you’re planning to build a bitcoin exchange, understanding its essential components and the development process is critical.

In this article, we will explore what bitcoin exchange is, its key features, and types and why you need to build your own crypto exchange. We will also provide a detailed roadmap to successfully create a Bitcoin exchange that is secure, user-friendly, and scalable.

What is a Crypto Exchange?

A cryptocurrency exchange is a digital platform enabling users to buy, sell, and trade cryptocurrencies. Exchanges serve as intermediaries, offering liquidity, a user-friendly interface, and essential trading tools. Some exchanges support fiat-to-crypto transactions, while others operate exclusively within the crypto ecosystem.

Most people often mistake a crypto wallet for a crypto exchange. However, to close the crypto wallet vs exchange debate, Crypto exchanges enable the buying, selling, and trading of cryptocurrencies. In contrast, crypto wallets focus on securely storing and managing digital assets.

Turn Your Vision into Reality with a Bespoke Crypto Exchange

Take the lead in the digital currency revolution with a custom-built crypto exchange. Our experts are here to craft a platform tailored to your goals.

Types of Crypto Exchanges

1. Centralized Exchanges (CEXs)

Operated by a company, these platforms offer high liquidity and robust features but require users to trust the operator.

2. Decentralized Exchanges (DEXs)

Peer-to-peer platforms without intermediaries, prioritising privacy and user control.

3. Hybrid Exchanges

Combining features of CEXs and DEXs, they offer liquidity and decentralized elements.

Key Features of a Crypto Exchange

Here are the key features of most white label crypto exchange:

- User Authentication and Security: Multi-factor authentication (MFA), encryption, and Know Your Customer (KYC) procedures ensure safety.

- Intuitive User Interface: A clean, responsive, and intuitive interface to cater to diverse user expertise levels.

- Order Matching System: Facilitates transactions by pairing buy and sell orders.

- Liquidity Management: Ensures smooth trading by integrating APIs from liquidity providers.

- Wallet Integration: Supports secure storage and transactions of digital assets.

- Robust Admin Panel: Helps manage operations, users, and trading activities efficiently.

- Regulatory Compliance: Adherence to local and global regulations to avoid legal pitfalls.

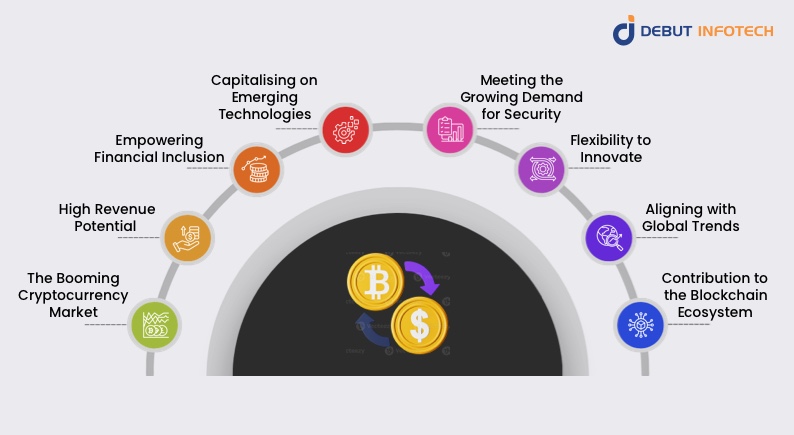

Why You Need to Build a Bitcoin Crypto Exchange

Here’s why launching your own crypto exchange is a lucrative and impactful venture:

1. The Booming Cryptocurrency Market

The cryptocurrency market has experienced exponential growth over the past decade, with new tokens, blockchain applications, and financial instruments continually emerging. This growth is driven by factors such as:

a) Increasing Adoption

Governments, corporations, and individuals are embracing cryptocurrencies as legitimate assets.

b) Expanding Use Cases

Beyond trading, cryptocurrencies are used for remittances, decentralized finance (DeFi), non-fungible tokens (NFTs), and more.

Demand for Reliable Platforms: With the surge in adoption, users seek trustworthy platforms to manage their transactions.

By partnering with a top-rated cryptocurrency exchange development company to build your own crypto exchange, you can position yourself at the heart of this thriving market and cater to the rising demand.

2. High Revenue Potential

Bitcoin exchanges generate significant revenue through various streams, including:

- Trading Fees: Earn fees on each transaction made on your platform.

- Withdrawal and Deposit Fees: Charge users for transferring funds to and from their wallets.

- Listing Fees: Collect payments from token developers seeking to list their projects on your exchange.

- Premium Features: Offer subscription plans for advanced analytics, API access, or priority support.

The scalability of these revenue streams ensures a steady income flow, making crypto exchanges one of the most profitable ventures in the digital economy.

3. Empowering Financial Inclusion

A crypto exchange can empower underserved populations by providing access to financial services. Traditional banking systems often exclude individuals due to geographic, economic, or regulatory barriers. With a crypto exchange:

- Users can trade and invest without needing a traditional bank account.

- Cross-border transactions become seamless, reducing remittance costs.

- Communities gain access to decentralized financial tools, promoting economic growth.

Your exchange can play a pivotal role in democratising finance and fostering economic empowerment.

4. Capitalising on Emerging Technologies

Building a crypto exchange allows you to harness cutting-edge technologies:

- Blockchain: Offers transparency, security, and decentralisation.

- Artificial Intelligence: Enables predictive analytics, fraud detection, and personalised user experiences.

- Smart Contracts: Automate processes like escrow and settlement, reducing operational overhead.

By leveraging these innovations, your platform can offer advanced features that attract users and establish a competitive edge.

5. Meeting the Growing Demand for Security

Crypto users prioritise security when choosing an exchange. Many existing platforms have suffered breaches, leading to massive losses and eroded trust. By building your crypto derivatives exchange, you can:

- Implement robust multi-factor authentication (MFA).

- Secure funds with cold wallets and encryption protocols.

- Conduct regular security audits to ensure system integrity.

Providing a secure platform protects your users and enhances your reputation, driving user loyalty.

6. Flexibility to Innovate

As the owner of a crypto exchange, you have the freedom to innovate and customise your platform to cater to niche markets. For example:

- Create a region-specific exchange tailored to local regulations and preferences.

- Develop a DeFi-focused platform offering staking, yield farming, or liquidity pools.

- Introduce unique trading tools, such as AI-driven market insights or automated bots.

This flexibility allows you to differentiate your exchange in a crowded market and attract a dedicated user base.

7. Aligning with Global Trends

Governments and institutions are gradually acknowledging cryptocurrencies, with many launching frameworks for regulation and adoption. This shift underscores the longevity of the crypto ecosystem and provides a favourable environment for entrepreneurs.

By building your exchange now, you can align with these global trends and position your platform for long-term success.

8. Contribution to the Blockchain Ecosystem

A crypto exchange is more than a business—it’s a critical infrastructure in the blockchain ecosystem. By launching your platform, you:

- Enable the growth of new cryptocurrencies and projects.

- Foster innovation by supporting token developers and blockchain entrepreneurs.

- Promote awareness and education about digital assets.

Your exchange can become a hub for blockchain activity, driving progress within the industry.

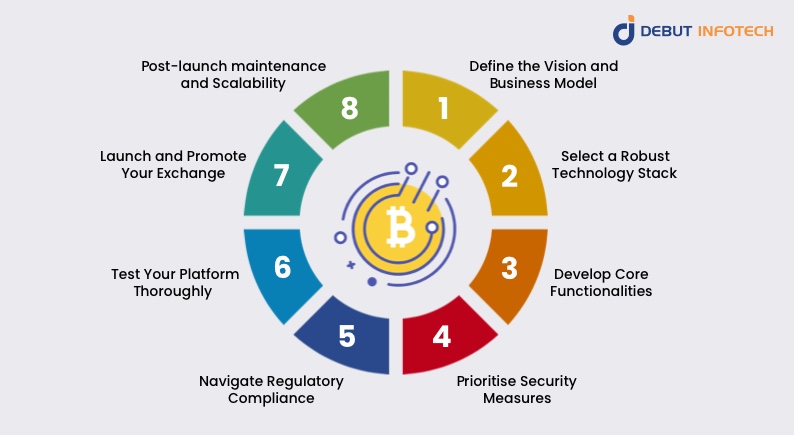

How to Build a Bitcoin Cryptocurrency Exchange

Creating a cryptocurrency exchange is a multifaceted process that demands technical expertise, strategic planning, and adherence to security and compliance standards. Below is a step-by-step guide to building a successful crypto exchange:

1. Define the Vision and Business Model

The first step in building a cryptocurrency exchange involves defining its purpose and operational strategy. This requires identifying your target market, understanding user needs, and establishing a unique value proposition.

The type of exchange plays a central role in shaping the business model. Centralized crypto exchange (CEX) often preferred for their speed and user-friendly interfaces. These platforms act as intermediaries, holding users’ funds and facilitating transactions. On the other hand, a decentralized crypto exchange (DEX) prioritises user privacy and operates without intermediaries by enabling peer-to-peer trading directly through blockchain technology. A hybrid exchange combines the strengths of both models, offering greater flexibility and control.

Revenue generation strategies should also be carefully outlined. Most exchanges earn through trading fees, which are charged per transaction, and withdrawal fees for transferring funds. Additional revenue streams may include listing fees from token projects seeking market exposure and subscription fees for premium services like analytics or advanced trading tools.

2. Select a Robust Technology Stack

The technology stack forms the backbone of any cryptocurrency exchange, ensuring its functionality, scalability, and security. Choosing the right tools and platforms for development is critical.

The frontend layer focuses on user experience and interface design. Frameworks like React.js, Angular, or Vue.js are commonly used to create interactive dashboards, trading charts, and easy-to-navigate menus. The backend manages data processing, user authentication, and transaction handling. Scalable frameworks such as Node.js, Django, or Ruby on Rails are preferred for their flexibility and performance.

Blockchain integration is essential for enabling cryptocurrency transactions. Developers typically choose networks such as Ethereum, Binance Smart Chain, or Solana, depending on the platform’s goals. Wallet integration, another key component, requires support for both hot wallets (connected to the internet for immediate transactions) and cold wallets (offline storage for enhanced security). Databases like MySQL or PostgreSQL are often employed to store user data securely.

3. Develop Core Functionalities

A cryptocurrency exchange must include essential functionalities to attract and retain users. These features form the operational core of the platform.

The user account management system facilitates registration, authentication, and identity verification through KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols. Security measures like two-factor authentication (2FA) and biometric verification are implemented to protect user accounts.

The order matching engine is a critical component, ensuring that buy and sell orders are executed seamlessly. This engine must operate with minimal latency to provide a smooth trading experience, especially during high market activity. Advanced order types such as limit, market, and stop-loss orders enhance the platform’s functionality.

Liquidity management is another crucial aspect. An exchange must ensure that users can execute trades without significant price slippage. This is achieved by partnering with liquidity providers, integrating market makers, or creating internal liquidity pools. A trading dashboard further enriches the user experience by offering real-time charts, order books, and tools for technical analysis.

4. Prioritise Security Measures

Security is a non-negotiable element of a bitcoin exchange, given the risks associated with digital assets. A robust security framework protects both the platform and its users from threats like hacking, phishing, and fraud.

Encryption protocols safeguard sensitive information, ensuring that user data and transactions remain confidential. The use of cold wallets for storing the majority of user funds minimises exposure to cyber threats, as these wallets are not connected to the internet. Anti-DoS (Distributed Denial of Service) systems are essential for preventing disruptions caused by malicious traffic surges.

Regular security audits and penetration tests help identify vulnerabilities before they can be exploited. Adopting industry standards such as ISO/IEC 27001 for information security management demonstrates a commitment to best practices, further enhancing user trust.

5. Navigate Regulatory Compliance

Operating a Bitcoin exchange requires strict adherence to regulatory frameworks. The legal landscape varies across jurisdictions, making it essential to understand local and international requirements.

Securing operational licenses is often the first step. For instance, top decentralized crypto exchanges in the United States may need to register with the Financial Crimes Enforcement Network (FinCEN). At the same time, those in Singapore require approval from the Monetary Authority of Singapore (MAS). Compliance with KYC and AML regulations ensures that the platform identifies users and monitors transactions to prevent illicit activities.

Data privacy laws like the General Data Protection Regulation (GDPR) in Europe or the California Consumer Privacy Act (CCPA) mandate the secure handling of user information. Bitcoin exchange must implement data encryption, user consent mechanisms, and protocols for data breach notifications to meet these requirements.

6. Test Your Platform Thoroughly

Testing is integral to the development process, ensuring that the exchange functions smoothly and securely. Different testing methodologies are employed to evaluate various aspects of the platform.

Functional testing examines the core features, including account creation, order matching, and wallet integration. This ensures that all components work as intended. Performance testing assesses the platform’s ability to handle high traffic volumes, a crucial factor during market peaks. Security testing involves penetration testing and vulnerability scanning to identify and address weaknesses in the system.

Involving beta testers can provide valuable feedback on usability and highlight areas for improvement in cryptocurrency exchange app development. This iterative process helps refine the platform before its official launch.

7. Launch and Promote Your Exchange

The deployment phase involves rolling out the platform and executing a marketing strategy to attract users. A soft launch or beta release allows for final adjustments based on real-world feedback.

A comprehensive marketing campaign is essential for building brand awareness and trust. This includes digital advertising, influencer partnerships, and community engagement through forums and social media. You can also organise an initial exchange offering to raise capital. Not just that, offering promotional incentives like reduced trading fees for early adopters can drive user acquisition.

8. Post-launch maintenance and Scalability

Launching the exchange is only the beginning. Continuous maintenance is required to keep the platform secure, stable, and competitive.

Regular updates introduce new features, address bugs, and enhance performance. Providing 24/7 customer support ensures user issues are resolved promptly, fostering trust and loyalty. Scalability planning is crucial to accommodate growth, including expanding server capacity and integrating support for additional cryptocurrencies.

Ready to Build a Top-Notch Crypto Exchange?

Partner with our expert team to create a secure, scalable, and feature-rich crypto exchange platform. Let’s bring your vision to life today!

Conclusion

Building a Bitcoin exchange is a rewarding but demanding process that requires meticulous planning, technical expertise, and an unwavering commitment to security and compliance. By following these steps, entrepreneurs can create a platform that not only meets market demands but also sets new standards in the rapidly evolving world of digital assets. With the right approach, your exchange can become a cornerstone of the blockchain ecosystem.

FAQs

Building a Bitcoin exchange can cost anywhere from $50,000 to over $500,000, depending on how sophisticated you want it to be. Crypto exchange software price isn’t fixed. If you’re aiming for a basic platform with essential features, it’ll lean toward the lower end. But if you’re thinking about advanced tools, robust security, and compliance with regulations, that’ll bump up the price. Don’t forget ongoing expenses like licensing, server costs, and marketing. It’s a big investment, but if done right, it can pay off in the long run.

The “best” crypto exchange really depends on your needs. For beginners, Coinbase is a popular pick because of its easy-to-use interface. If low fees are your priority, Binance is hard to beat. Want to keep things decentralized? Uniswap might be your go-to. It’s also worth considering the security track record and the range of coins offered. Always check reviews and compare features to find the exchange that fits you best.

Starting a crypto exchange company involves a few big steps. First, research and pick your niche—will you focus on beginners or advanced traders? Next, get legal with licenses and compliance (think KYC and AML). Then, decide if you’ll build your exchange from scratch or use white-label software. You’ll also need to secure funding, choose a tech stack, and prioritise security features like encryption and cold storage. Finally, launch it with a solid marketing plan and strong customer support.

Absolutely! You can swap your Bitcoin on exchanges for cash in several ways. The easiest option is using a crypto exchange like Coinbase or Binance—they let you sell Bitcoin directly and transfer the money to your bank account. Peer-to-peer platforms like Paxful or LocalBitcoins connect you with buyers who pay you in cash or via bank transfer. Even Bitcoin ATMs let you cash out, although they usually charge higher fees. Just double-check fees and processing times before choosing your method.

The Bitcoin exchange rate is basically how much one Bitcoin is worth in your local currency—like dollars, euros, or yen. It’s similar to currency exchange rates when you’re swapping dollars for euros. The value fluctuates constantly based on demand, supply, and market sentiment. If more people want Bitcoin on exchanges, the rate goes up; if there’s less demand, it drops. Always check a reliable source, like a crypto exchange, for the latest rate before trading.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment