Table of Contents

Home / Blog / Blockchain

Blockchain KYC: Key Benefits, Challenges, and Implementation

November 6, 2024

November 6, 2024

In 2023 alone, over $3 trillion in illicit funds flowed through the global financial system. These funds were the proceeds of heinous crimes such as human trafficking, drug trafficking, fraud scams, bank fraud, and terrorism financing.

To curb and combat these criminal activities and ensure the safety of financial assets, regulatory bodies worldwide have been mandating organizations to implement robust Know Your Customer (KYC) procedures. However, traditional KYC processes are often plagued by inefficiencies, high costs, and security vulnerabilities.

To address these challenges, financial institutions are adopting Blockchain KYC, which offers decentralized and transparent systems for managing customer data. This novel technology can help companies ensure safer, faster, and user-centric KYC processes. However, despite its immense capabilities and growing adoption rates, blockchain technology is still in its infancy, and many organizations are still learning how it works.

If you fall in this category, this article serves as a comprehensive introduction to Blockchain KYC. After reading it, you should have a clear understanding of how Blockchain KYC works, why it is better than traditional KYC, and how to implement it to optimize your KYC processes.

Let’s dive in!

Ready to improve your KYC process with Blockchain Technology?

Partner with proven blockchain consultants at Debut Infotech today for a fast, scalable, and tailored KYC solution.

Understanding Traditional KYC Processes

Money makes the world go round, even for those involved in criminal activities. To curb these unlawful acts, governments require institutions to verify their customer identities, monitor transactions, and report suspicious activities. They also make it compulsory for organizations to accurately identify their customers so law enforcement agencies can track them down if necessary.

KYC makes the processes possible by ensuring that individuals prove that they are who they claim to be. It also ensures that customers verify their activities and prove that they are legitimate.

While KYC is effective in reducing the flow of illicit funds, traditional KYC processes are far from perfect.

Typically, customers must submit personal documents–such as passports, utility bills, and social security numbers–for manual verification. Then, regulatory institutions perform several checks to validate the customer’s identity.

This process is generally cumbersome and comes with several challenges, including:

- High Costs: Repetitive identity checks across various platforms increase operational costs. According to KPMG, financial institutions spend an average of $150 million yearly on KYC processes alone.

- Time Inefficiency: Identity verification is laborious and often takes several days to complete. This is frustrating for users and slows down onboarding.

- Security Risks: Traditional KYC processes often store customer information in centralized databases, which are vulnerable to data breaches. For example, the 2019 Capital One breach exposed the personal information of over 100 million customers.

- Redundancy: Customers have to provide their personal information to different institutions for verification, which is repetitive and frustrating.

Because of these inefficiencies, institutions now seek a more efficient and secure approach to identity verification–and Blockchain technology is stepping in to meet that need.

What is BlockChain KYC?

To understand Blockchain KYC, you first have to understand Blockchain.

For starters, a Blockchain is a digital ledger where information can be stored across various computers (called nodes) in real-time. This decentralized technology allows customer information to be stored more securely and improves transparency.

This is very different from traditional KYC, where customer data are stored in a centralized system controlled by a single institution, which is typically less secure and transparent.

How Blockchain KYC Verification Works

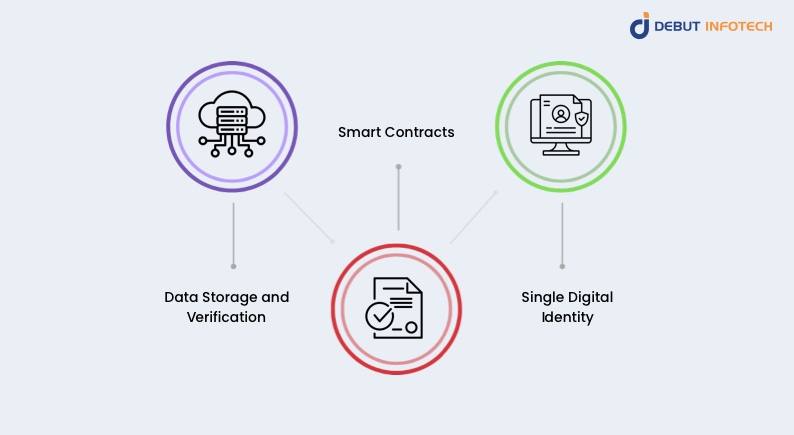

Blockchain KYC typically uses these procedures to optimize the KYC process

1. Data Storage and Verification

At this phase, customers submit identity documents that are encrypted and stored on the Blockchain. Once the information is verified by a trusted authority, it is locked into the ledger.

2. Smart Contracts

Smart contracts automate compliance processes. With smart contracts, customers gain access to financial services once they meet the requirements for identity verification.

3. Single Digital Identity

Using blockchain systems for KYC processes eliminates redundancy. With Blockchain KYC, customers can create a single, reusable digital identity, reducing the need for multiple submissions across different platforms.

This way, regulatory institutions or private organizations only need to verify the identity once, after which other organizations can access the verified data with the customer’s consent.

Effective, right?

Benefits of Blockchain KYC

Here are some benefits that Blockchain KYC verification can offer your business:

1. Enhanced Security and Privacy

According to a 2023 Statista survey of US adults, a staggering 88% of customers are concerned about their data privacy when interacting with brands digitally.

To ensure data safety, institutions are opting for decentralized data storage, which is less prone to breaches than centralized databases.

Decentralization means no single entity holds complete control over the information. Additionally, data encryption protects sensitive details and grants customers alone control of customer data.

Furthermore, with Blockchain KYC, customer data cannot be altered without consensus from the network. This reduces the likelihood of identity theft by a mile.

2. Increased Efficiency

With KYC Blockchain solutions, various companies can access customer data with the customer’s permission.

There is no need for redundant verifications and long onboarding processes. This is because they don’t need to conduct their own independent verifications, collect data individually, or manage individual verification systems.

More importantly, smart contracts speed up the process and minimize error margins by enabling automated compliance.

3. Improved Regulatory Compliance

Blockchain ensures transparency and traceability, two major requirements in regulatory compliance.

Transactions recorded on the Blockchain cannot be deleted, making it hard for criminals to cover their tracks. Blockchain also facilitates swift adaptation to changing regulations.

By utilizing smart contracts, institutions can adjust compliance workflows to comply with recent standards.

Challenges and Limitations of Blockchain-based KYC

While Blockchain-based KYC offers considerable benefits, it also comes with unique challenges and limitations that discourage institutions from rapidly adopting it.

Some of these include the following:

1. High Implementation Costs and Legacy System Overhaul

Adopting Blockchain for your KYC requires substantial financial investment, especially if you’re implementing the systems in-house on your own.

As such, smaller companies are not able to implement this technology because of financial constraints. On the other hand, bigger corporations that can afford it may face difficulties integrating it into their existing legacy systems.

However, using a custom blockchain development company like Debut Infotech is a more cost-effective approach, as our experts have the required know-how to give you a headstart.

2. Data Storage And Privacy Techniques

Even though Blockchain is effective for securing customer data, it doesn’t make sense to keep all KYC data on-chain. Off-chain storage ensures improved security and greater privacy. However, storing data off-chain may lead to data fragmentation.

Today, new technologies like Zero-Knowledge Protocol (ZKPs) aim to address privacy concerns by verifying information without revealing sensitive data. However, these technologies are still emerging and need more development to become scalable.

3. Scalability and Performance Issues

Blockchain networks, particularly public ones, often experience scalability challenges with increased transaction volumes.

These challenges can threaten the efficiency and security of a KYC process.

How to Implement KYC Using Blockchain:

Debut Infotech’s Enterprise-grade Blockchain Development Process

Implementing a successful KYC process on Blockchain requires careful planning, collaboration with stakeholders, and the seamless integration of multiple technologies.

Here are some key steps to build and deploy a KYC Blockchain solution using our native development process.

1. Requirement Analysis and Planning

Before implementing a blockchain-based KYC solution, you should first understand your problem and set clear goals. This step involves identifying your business’s objectives, technical needs, and compliance requirements.

To do this, follow these easy steps

I. Identify Inefficiencies in the Current Kyc Process

Ask yourself what problems you are having.

Are you looking to reduce onboarding time, improve security, or cut costs?

Identifying the problem will help you know the solution to choose.

II. Define the Target Audience

Are you developing solutions for banks, fintech companies, or government services? Understanding your target audience helps you tailor your offerings to the specific needs of your customers

IiI Decide on The Scope of the Implementation.

Will the data you collect be used only within your organization or shared across multiple institutions?

IV. Choose the right Blockchain platform

Once you have a clear understanding of your problems, the next step is to choose a Blockchain platform. The right platform should be able to meet your business and technical needs.

Here are some things to consider when choosing a Blockchain:

Is it a private or public Blockchain?

This is a major consideration when setting up a Blockchain KYC process. Both Blockchain types offer unique benefits. Your choice depends on factors such as your target audience, security, privacy, scalability, etc.

Public Blockchains don’t require permissions; anyone can join the network, become a validator, and access information stored on the platform. You may prefer a public Blockchain if you are looking to increase trust and ensure data security, transparency, and interoperability.

But public blockchains are not a bed of roses. They also come with their own challenges, including privacy concerns, scalability issues, regulatory compliance, and energy consumption.

On the other hand, private Blockchain allows for enhanced security, faster transactions, customizable governance, and regulatory alignment. However, the use of centralized databases may introduce the risk of manipulation or data censorship. This is counterintuitive and will result in distrust.

Additionally, private Blockchains are not built for interoperability and are generally less transparent. Finally, they are prone to vendor lock-in, which will eventually limit flexibility and innovation.

The consensus mechanism

To ensure fast and secure KYC processes, you need to choose a consensus mechanism that balances security and speed, such as Proof of Authority (PoA) or practical Byzantine Fault Tolerance (PBFT) for permission access.

Smart contract compatibility

Your Blockchain platform of choice should support smart contracts. This makes automated verification and compliance possible.

2. Design and Architecture

Once you have set your goals and requirements, you need to develop a scalable and modular architecture capable of achieving them.

This phase involves designing the KYC process workflow.

Designing the KYC workflow involves planning out the steps for the KYC process, which typically starts at customer registration and terminates after compliance is reached.

Here is an example of a Blockchain-based KYC workflow:

- Customer registration: a user submits their identity documents to your institution

- Data encryption and storage: You encrypt the data and upload a hash of the identity document to the Blockchain. The hash is an encrypted reference that helps Blockchain users identify customer documents.

- Verification by trusted authorities: A trusted authority verifies the documents and updates the Blockchain with the verification status.

- Smart contracts for compliance: Smart contracts automate compliance checks. They give or withhold access based on regulatory requirements.

3. Development and Integration

After designing your preferred architecture and itemizing the essential components required, you can now develop the blockchain KYC solution.

This is where you integrate the necessary core elements, such as smart contracts, consensus mechanisms, and APIs. All of the activities in this phase should align with the architecture designed earlier.

4. Customization and Implementation

By now, you already have the backbone of your blockchain KYC solution.

However, you need to ensure it aligns with other aspects of your entire business.

The customization and implementation phase involves implementing little tweaks, incorporating specific functionalities your target audience needs, and making sure the solution integrates seamlessly with other parts of your existing operational workflows.

5. Testing and Quality Assurance

Before going live, you should test the system to make sure there are no hitches. You should carry out the following tests as a standard

- Functional testing: Check that all the components, such as the Blockchain, smart contracts, and off-chain storage, are performing optimally.

- Security testing: check for security risks such as data leaks, unauthorized access, and network breaches.

- Pilot projects: Have your friends and partner institutions try out the KYC process to obtain real-time information and identify potential challenges.

After ensuring that your blockchain KYC solution is capable of handling complex verification processes, you must also ensure that it matches appropriate standards. This majorly includes ensuring data privacy and compliance.

While data on a Blockchain is safe, it is also permanent; as such, it is important to handle personal information with care.

In handling customer data, make sure you:

- Keep only essential data on the chain: store only hashes or references to identify documents, but the sensitive data should be kept offline.

- Comply with data regulations: Follow data protection laws such as GDPR and CCPA. Give users control over their data. Additionally, implement “right-to-forget” solutions that delete off-chain data when your customer requests it.

- Protect data using encryption and access control: Employ advanced encryption techniques to keep data safe on and off-chain. Use access control to ensure that only people with permission have access to the data.

6. Deployment and Support

Once you have completed testing and are satisfied with the results, the next step is to launch fully. After launching, you should continue to monitor the system to see how smoothly it runs. If there is any hitch, address it immediately to avoid customer dissatisfaction.

Finally, provides resources to help customers understand how to manage their digital identities effectively.

Debut Infotech’s custom blockchain app development services can make your KYC processes more efficient, transparent, and economical. Our expert consultants are just a message away.

Conclusion

Blockchain KYC is an upgrade to traditional KYC procedures. Blockchain-based KYC adequately addresses common challenges with traditional KYC, such as high costs, time inefficiencies, redundancy, and data security risks. However, while Blockchain KYC addresses most of these challenges, it also comes with unique challenges, such as high implementation costs, privacy concerns, and scalability concerns.

Overcoming these challenges requires careful planning from the start. One sure way to ensure success involves working with Blockchain consultants with years of experience under their belt. With Debut Infotech, you get unrestrained access to experts who will help develop custom solutions to meet your unique KYC needs.

Frequently Asked Questions

For Bitcoin, KYC usually entails confirming a user’s identification before allowing them to transact on wallets or exchanges. This process also involves obtaining evidence of address, government-issued identification, and personal data.

Blockchain technology creates a shared, unchangeable ledger for recording verified identity information, it helps expedite KYC and AML procedures. Blockchain KYC minimizes duplication of effort and enables several financial institutions to access and rely on the same data.

HSBC, Deutsche Bank, and JPMorgan are among the institutions testing blockchain for KYC. These organizations have piloted or are working on projects that employ blockchain technology to transfer KYC data between banks while safely reducing redundancy.

Yes, Blockchain has the potential to serve as the basis for a KYC tool. Through a common Blockchain-based KYC system, multiple financial institutions would have access to a single, verified data repository. This would speed up the onboarding process for clients across several banks and platforms, eliminate redundancy, and guarantee consistency. However, for such a system to succeed, industry collaboration and regulatory alignment are essential to address privacy and data security challenges.

Because blockchain increases transparency and allows regulators to track the movement of funds, it can help prevent money laundering. Blockchain networks make it simpler to identify trends of illicit conduct since they preserve an unchangeable record of every transaction. Nevertheless, malicious actors may still try to get around these safeguards by using privacy coins or decentralized exchanges, which calls for constant oversight and control.

Blockchain enhances the KYC verification process by offering a secure, decentralized platform for storing and sharing user data. It ensures data immutability, reduces duplication efforts across institutions, streamlines verification, enhances transparency, and improves user privacy while lowering compliance costs.

Talk With Our Expert

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment