Table of Contents

Home / Blog / Blockchain

Blockchain in Mortgage Industry- Redefining the Status Quo

August 2, 2023

August 2, 2023

The mortgage industry has traditionally grappled with chronic challenges, including inefficiencies, extensive paperwork, slow processing times, and risk of fraud. These issues contribute to a high average cost per mortgage origination, which stood at $8,957 in Q4 2022 according to the Mortgage Bankers Association.

However, there’s a game-changing technology on the horizon—blockchain. This transformative technology, projected by MarketsandMarkets to reach a market size of $39.7 billion by 2025, is already reshaping businesses across various industries.

With the implementation of blockchain in mortgage industry has the potential to streamline processes, reduce fraud, and enhance transparency. A recent study by Deloitte reported that 40% of surveyed mortgage firms are either embracing or planning to adopt blockchain technology within their operations.

With its inherent capacity for creating transparent, secure, and efficient processes, blockchain technology harbors the potential to completely reinvent the mortgage industry, setting the stage for unprecedented advancements in the years to come.

Following this, we provide comprehensive insights into the imminent disruption that blockchain is poised to bring to the mortgage industry. Our expertise delves into the specific sectors primed for transformation, elucidates the advantages of integrating blockchain into mortgage business practices, and showcases real-time examples of its practical application.

Blockchain and The Mortgage Industry: A Perfect Match

The prospect of a hyperledger blockchain-powered mortgage industry holds great promise, bringing transformative values to this traditionally complex sector.

Primarily, blockchain technology promises unparalleled efficiency. Through simplifying traditionally laborious procedures, it has the potential to drastically reduce the current 47-day average mortgage approval time as per the Federal Reserve’s data.

Moreover, the innate transparency of blockchain technology can foster increased trust among parties. Each transaction on a blockchain is visible to all stakeholders, thus mitigating fraud risks and enhancing overall confidence in the process.

Importantly, the robust security inherent to blockchain’s decentralized design and cryptographic safeguards can greatly decrease the risk of data breaches, a critical consideration in the data-sensitive mortgage industry.

Furthermore, the potential for cost savings is significant. According to a Capgemini study, the use of blockchain could potentially save mortgage lenders up to $1.7 billion annually by reducing processing costs. In essence, a blockchain-driven mortgage industry could usher in substantial improvements in efficiency, transparency, security, and cost savings.

Having a look at the blockchain-driven mortgage industry allows a deeper understanding of the value it offers to your enterprise, though this value can differ across banks and businesses. As we proceed, this article aims to highlight areas within the mortgage industry that stand on the precipice of transformation with the integration of blockchain technology.

Related read- Hyperledger Fabric – An All-Inclusive Guide

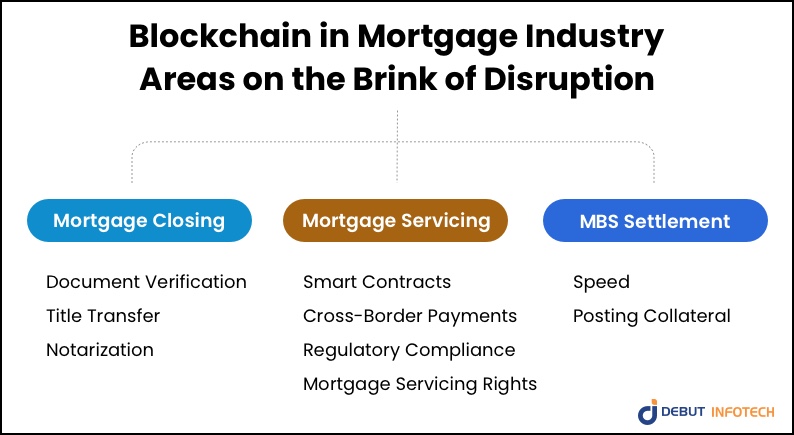

Blockchain in Mortgage Industry: Areas on the Brink of Disruption

Blockchain technology promises to bring significant change to the mortgage industry. From streamlining document verification to enhancing cross-border transactions, its potential for disruption is tremendous.

Mortgage Closing

The conventional mortgage closing process, with a timescale of 30-90 days, has been known for its complexity and time-consuming nature. This process, especially for properties associated with contingencies like financing, appraisals, and title security, involves multiple face-to-face meetings, extensive document handling, and numerous verification stages, which cumulatively add to both the duration and cost of the process.

Document Verification

As blockchain gains traction, it is expected that more lenders will resort to this technology for validation checks. Blockchain will enable the certification of information in a single step, after which the data can be disseminated securely, reliably, and instantaneously to all authorized parties.

Title Transfer

Likewise, title companies are projected to employ blockchain technology more extensively to ascertain and validate titles. This shift is set to enhance both the accuracy and efficiency of the process, and could potentially eliminate the need for title insurance altogether.

Notarization

As we transition into the era of e-notarization and e-mortgages, blockchain is forecasted to play a pivotal role in assuring the accuracy of information and thwarting any attempts at data tampering and fraud.

The promise held by blockchain for the mortgage closing process is significant, given its potential to increase transparency, speed up transactions, and reduce fraud. The path to the successful integration of this technology, however, necessitates carefully planned implementation, collaboration among stakeholders, and a fitting regulatory response.

Mortgage Servicing

Mortgage servicing stands to gain enormously from the incorporation of blockchain and distributed ledger technologies. These innovations could facilitate considerable time and cost savings, while simultaneously easing the operational load associated with regulatory compliance. The elimination of document tracking and information reconciliation, coupled with the digitization of payments and payment reports complete with inbuilt credit, compliance, and risk alerts, are among the significant benefits.

Smart Contracts

The employment of smart contracts, underpinned by blockchain and fortified with AI and security capabilities, could fully digitize and automate the loan application process. Such automation at the initial stage can unveil multiple avenues for downstream process improvements for servicers.

Cross-Border Payments

The application of blockchain technology presents the possibility of digital payments that could be seamlessly exchanged on the platform without any human intervention.

Regulatory Compliance

Given that servicers constantly operate under regulatory scrutiny, they must regularly provide evidence of following proper servicing protocols. The indelible nature of records maintained on a blockchain could mitigate manual errors, enhance the efficiency of regulatory audits, and diminish instances of regulatory non-compliance.

Mortgage Servicing Rights

The application of blockchain technology could boost the transferability of Mortgage Servicing Rights, thereby potentially injecting more liquidity into the market.

Blockchain promises to be a transformative force in the mortgage servicing industry. However, for these benefits to be realized, it will require the careful orchestration of implementation strategies, the cooperation of all stakeholders, and the formulation of responsive regulatory frameworks.

MBS Settlement

Certain institutions have maintained dominance over the Mortgage-Backed Securities (MBS) clearing and settlement process for an extended period.

However, the advent of blockchain technology is beginning to unsettle this long-standing equilibrium.

As blockchain technology demonstrates its capacity for safeguarding the integrity of this market, as evidenced through small-scale pilot trades, we can anticipate an expanded role for it in facilitating securities trading without the need for a clearinghouse.

Speed

The use of blockchain technology for trading MBS securities could expedite the settlement process from a matter of days to mere hours. This accelerated transaction timeline could potentially diminish the associated costs and exposure to margin volatility.

Posting Collateral

The marked reduction in transaction timeframes achieved through blockchain technology could render the posting of margins redundant, effectively mitigating the risk of trade failures.

Despite the significant potential that blockchain presents for the MBS settlement process, its successful integration will demand thoughtful implementation, collaborative efforts among stakeholders, and appropriately adjusted regulatory frameworks.

Having gained insights into the sectors ripe for transformation through the application of blockchain technology, let’s now proceed to explore the advantages this innovation can yield for your enterprise.

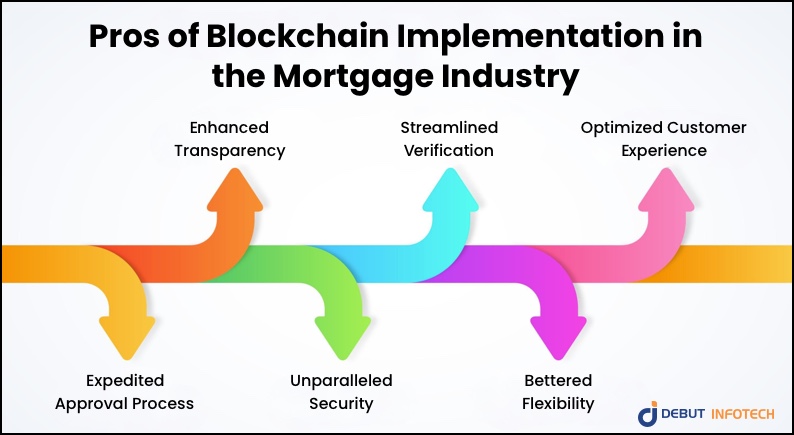

Pros of Blockchain Implementation in the Mortgage Industry

Enterprises that adopt blockchain technology benefit from enhanced efficiency in the distribution and execution of their financial transactions. Furthermore, they foster shared ecosystems that create improved collaborations with customers, partners, suppliers, and regulatory bodies.

Expedited Approval Process

The journey to secure a loan today necessitates engagement with an array of intermediaries – spanning financial, legal, real estate, and governmental sectors. These intermediaries introduce additional time and cost to each stage of the process, costs which are ultimately borne by you. From pre-approval to final settlement, the entire process can take an average of two months per application.

Blockchain offers the potential to supplant this intermediary-dependent model with a system of decentralized records that provides a traceable history of each transaction.

Given that, each record is interconnected with the one before and after it, a lender’s system can reference the blockchain ledger for information validation. Post-verification, the transfer will be evident through the addition of a new data entry on the chain.

Utilizing Distributed Ledger Technology (DLT), lenders could authenticate identity proofs and property appraisals without the need for third-party involvement. This shift could lead to faster approval and settlement.

Likewise, borrowers could get tokens to execute large payments, thereby avoiding the substantial transaction costs associated with traditional methods. In essence, blockchain could potentially curtail the total transaction time by 25%.

Enhanced Transparency

The lack of transparency within the mortgage sector was a significant contributor to the Global Financial Crisis of 2008. This crisis spurred the US Treasury to seek effective solutions to prevent similar future upheavals, particularly with the advent of online marketplace lending.

Even though Australia did not suffer a recession, it did endure a severe downturn by the end of 2008, suggesting the relevance of these principles to the Australian home loan sector.

Through Distributed Ledger Technology (DLT), blockchain unifies all market participants on a single platform, thereby addressing both the Treasury’s recommendations. By documenting, sharing, and transacting loan data on the blockchain, lenders could empower it to act as a custodian, ensuring transparency by automating loan validation and payment processes.

Moreover, blockchain assists investors with the ability to navigate an immutable audit trail and generate forecasts based on real-time, verified data. With access to a comprehensive view of loan-level data across markets, businesses & investors would be better equipped to make well-informed decisions.

Unparalleled Security

The mortgage loan-origination protocol of today predominantly relies on paper documentation, a method that presents numerous opportunities for privacy and security vulnerabilities. The risk of exposure to non-public and personally identifiable information heightens every time mortgage-related documents are generated, copied, or disseminated.

Moreover, the existing document-oriented system inherently contains the potential for manual errors and delays, aspects that cannot be effectively combated by even outdated digital applications, which necessitate stringent management of the chain of custody. Even in instances where a lender employs electronic systems, the security of your data is fundamentally only as robust as the lender’s server.

Within the structure of a blockchain, blocks are systematically added in a linear fashion, with the latest one positioned at the end of the chain. This configuration makes it exceedingly difficult to modify the content of any block without achieving agreement from the rest of the network.

To evade detection, an ill-intentioned actor would need to alter all the blocks linked to the manipulated one, an endeavor that becomes increasingly unlikely as the size of the network grows.

On top of this, the utilization of cryptography allows each participant access only to the sections of the ledger relevant to their activity, thus making it virtually impossible for an individual to illicitly acquire someone else’s personal information.

The integration of decentralization, cryptography, and consensus mechanisms positions blockchain to offer unparalleled security capabilities, especially when considering the substantial safety and privacy gaps evident in the traditional home loan process.

Also Read: How to Create a Crypto Wallet: A Comprehensive Guide

Streamlined Verification

Applying for a loan typically entails a rigorous examination by the lender of all original property-related documents, encompassing no-objection certificates, title deeds, and other pertinent ownership data.

Lenders also employ surveyors to conduct technical price evaluations to determine the appropriate loan amount. These activities introduce legal and financial intermediaries into the verification procedure, thereby rendering an already extensive administrative process even more complex and time-intensive.

Blockchain, through its capabilities of private keys, presents a solution to circumvent the paper-based bureaucracy characteristic of traditional lending institutions.

Transactions and information on the blockchain necessitate your digital signature, generated using private keys that, due to the power of cryptography, are virtually impossible to counterfeit. Each transaction you conduct on the blockchain is securely linked to your identity, enabling lenders to consult the ledger for proof of ownership.

Blockchain technology holds the capacity to store critical information, such as property address and valuation, which lenders can access, verify, and process in real time.

Indeed, the Bank of China has already commenced the use of blockchain for property evaluations, with 85% of the bank’s mortgage-related real estate valuations processed via its private blockchain.

Furthermore, the integration of smart contracts with verification and approval criteria will enable the automatic execution of the approval process. This simplification of operations could potentially reduce processing costs, saving banks between US$3 billion and $11 billion annually.

Bettered Flexibility

A study conducted in 2018 suggests that the opaque pricing strategies employed by lenders in the loan market tend to inhibit mortgage price competition, leading to inflated costs for borrowers. These expenses could potentially be reduced through effective negotiation.

The crux of the problem lies in the discretionary pricing models employed by major lenders, models that often favor the lenders and are difficult to challenge in a market characterized by limited competition.

The introduction of blockchain technology in the home loan sector could catalyze the emergence of peer-to-peer lending (P2P) involving networked investors. This shift could instigate a competitive environment among lenders, ultimately benefitting borrowers through lower costs, improved services, and a broader array of options.

Optimized Customer Experience

Loan borrowers tend to prioritize certain aspects that assure a satisfactory experience. Key among these are flexible repayment options, interest rates, minimized overhead fees, streamlined approvals, and simplified documentation procedures.

While leading Australian banks have seen a rise in customer satisfaction due to their commendable response to the pandemic, refinement is still needed in these crucial areas. Institutions adhering to traditional lending models often fall short in this regard, thereby detracting from the overall customer experience.

The integration of blockchain technology is poised to reinforce customer satisfaction by addressing these critical areas. Blockchain has the potential to minimize intermediary and transaction costs by eradicating the need for trusted third parties and reducing operational overheads through real-time visibility of loan status for all parties involved.

The immutable audit trail facilitated by blockchain simplifies document verification, recording, safekeeping, and reassessment. Moreover, as blockchain paves the way for P2P lending, heightened competition among lenders can lead to a wider array of interest rates and repayment options for borrowers.

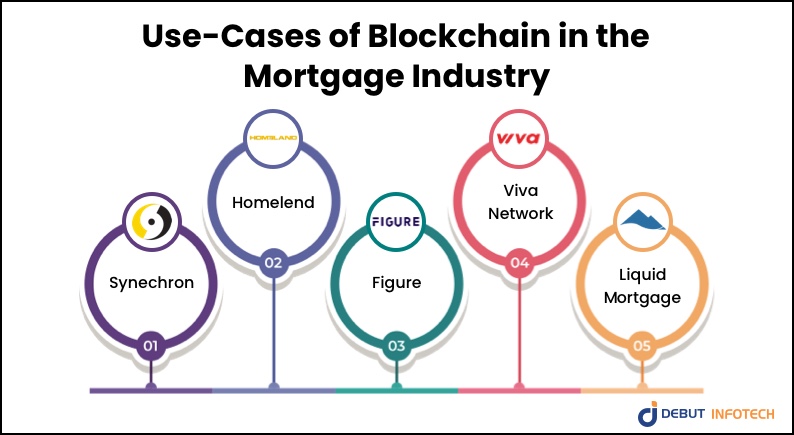

Use-Cases of Blockchain in the Mortgage Industry

Many companies have already leveraged blockchain technology within the mortgage industry, constructing reliable blockchain-enabled mortgage solutions. These solutions encompass a wide range of functions, from establishing credit identities and scores to facilitating lending and mutual insurance, all under one roof.

Now, we delve into several real-world examples of mortgage businesses powered by blockchain technology.

Synechron

Synechron aims to provide enhanced value throughout the lending process, simplifying proceedings for both parties via limited automation. Despite their efficacy in hastening the process, these solutions do not tackle the root issue—a convoluted, multi-layered process.

Homelend

Homelend is fully embracing technology-based solutions centered on the blockchain. Its Peer-to-Peer (P2P) network establishes direct connections between lenders and borrowers, eliminating many steps in the process—legal, underwriting, and more—and substituting them with artificial intelligence and machine learning technology. This approach can reduce the duration of the pre-qualification and approval process by nearly half.

Figure

Figure amalgamates artificial intelligence and blockchain to facilitate members’ access to lines of credit and home loans. Figure’s Crypto Mortgage Plus platform enables borrowers to secure home loans within minutes. After filling out a brief application and achieving pre-qualification, borrowers are presented with payment options and a video call with a notary to officiate all documents.

Liquid Mortgage

The Liquid Mortgage platform fosters direct connections between borrowers and lenders. Borrowers gain access to a single blockchain platform that assists them in tracking and managing payments while safeguarding their data using encryption. Concurrently, lenders benefit from smart contract capabilities and real-time transaction data.

Viva Network

Viva Network’s offering is a decentralized crowd-lending platform promising to eliminate intermediaries and foster a more open home loan marketplace. These platforms leverage ledger technology’s robustness to establish a system underpinned by accountability and the impossibility of fraudulent activity due to smart contracts. This approach significantly reduces the friction typically associated with mortgage applications.

After having detailed insights on the companies harnessing the blockchain in mortgage industry, If you are also considering making the transition towards digitalization by investing in next-generation technologies, let’s proceed further.

How Can Debut Infotech Help Adopt the Blockchain in Your Mortgage Businesses?

Debut Infotech, a leading Web3 development company, has collaborated with numerous enterprises facing challenges in optimizing their mortgage business operations. From the adoption and integration of emerging blockchain technology to enable businesses to become proactive and predictive, we have assisted SMEs and MSMEs in enhancing profitability through our blockchain development services.

Contact our team of seasoned blockchain developers today to elevate your enterprise to unparalleled new heights.

Frequently Asked Questions : Blockchain technology in the mortgage

A. Blockchain technology’s role in the mortgage industry can be profound. It allows for a decentralized and transparent platform where all transactions are recorded in a secure and immutable manner. This can make the entire mortgage process more efficient, reducing the need for middlemen and increasing trust between parties.

A. Blockchain can enhance the efficiency and security of mortgage transactions by streamlining the process. With blockchain, all parties involved can access the same information in real time, reducing delays and miscommunications. The security of blockchain comes from its decentralization and encryption, which protects against fraud and unauthorized alterations.

A. Some potential challenges in implementing blockchain in the mortgage industry include regulatory hurdles, lack of technological infrastructure, and the need for widespread adoption by all parties involved in the mortgage process. Additionally, the complexity of the technology itself could be a barrier to adoption.

A. Blockchain technology can radically change the way mortgage documents are verified and managed. The use of smart contracts can automate much of the process, making it faster and less prone to human error. Every document and transaction can be recorded on the blockchain, providing an auditable trail and making it easier to verify the authenticity of documents.

A. Yes, blockchain technology can potentially reduce costs in the mortgage industry. By eliminating the need for intermediaries, speeding up the process, reducing errors and fraud, and lowering operational costs, the overall cost of mortgage transactions could be significantly reduced.

A. In the mortgage approval process, blockchain can be used to create a decentralized database of trusted information. This database can streamline the process by eliminating the need for intermediaries to verify transactions, which can save time and reduce costs. Blockchain’s immutable nature ensures that once information is recorded, it cannot be tampered with, adding trust and security to the process. Also, smart contracts, an integral part of the blockchain, can automate several tasks in the mortgage approval process, such as validation checks and transfer of ownership.

A. Yes, blockchain has the potential to revolutionize mortgage lending. It can drastically reduce the time it takes to process a loan by automating many of the steps involved in the mortgage process. It can provide greater transparency for all parties involved, from the borrower to the lender to the secondary market investors. By reducing fraud and error, it can also bring down costs. Furthermore, blockchain can enable the tokenization of loans, creating a more liquid and efficient market for mortgages.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

[email protected]

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

[email protected]

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

[email protected]

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

[email protected]

Leave a Comment