Table of Contents

Home / Blog / Blockchain

Blockchain in FinTech: Catalyzing the Future of Financial Innovation

December 28, 2023

December 28, 2023

The fintech sector is increasingly leveraging the transformative potential of blockchain technology to drive revenue growth, enhance the end-user experience, optimize delivery processes, improve efficiency, and mitigate operational risks.

In sync with the dynamic evolution typical of tech-oriented industries, fintech is currently in its progressive phase. A myriad of innovative finance apps are surfacing daily, introducing advanced approaches to payment processing and management.

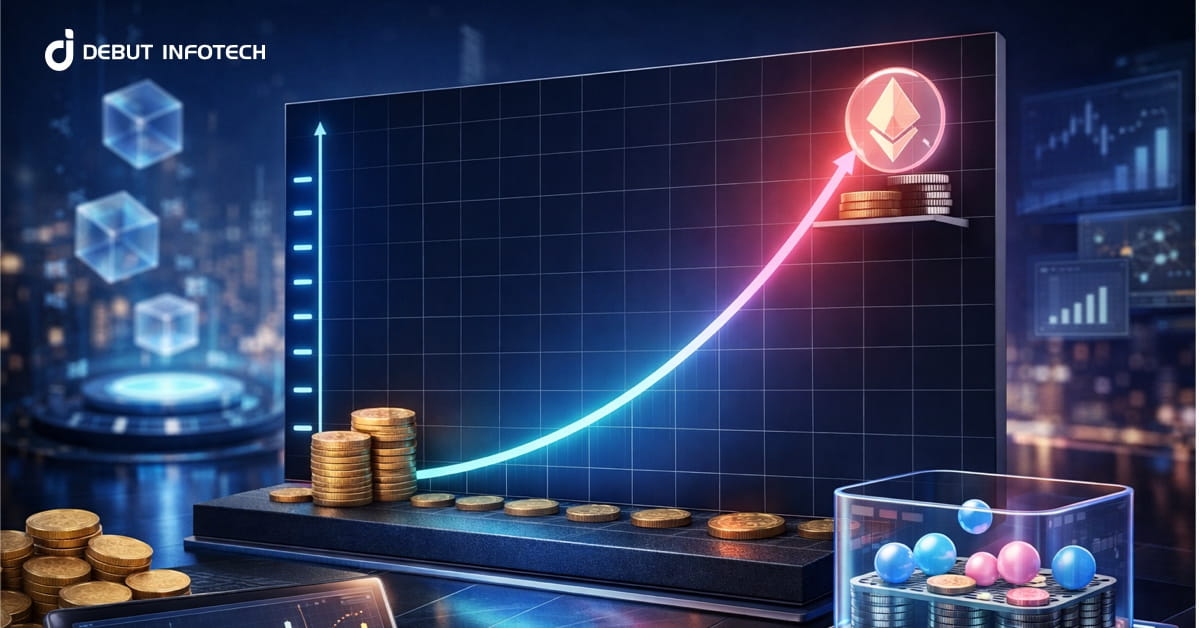

Dominating a significant portion of the blockchain market, fintech’s prominence is well-founded. As per the Mordor Intelligence report, projections indicate a staggering valuation of increasing from $3.17 billion in 2023 to an estimated $21.67 billion by 2028.

This growth is anticipated to be underscored by a robust average annual growth rate of 46.92%. One of the emerging trends within this landscape is Decentralized Finance (DeFi), a blockchain-based financial technology that challenges the traditional control exerted by banks over financial services and currency.

Anticipating a multi-decade shift, we can expect digital ledgers to undergo a revolutionary transformation in how we receive, transmit, store, and manage our finances.

Intrigued? Buckle up because we’re diving into how blockchain technology is reshaping finance as we know it!

Comprehending the Blockchain in Fintech Industry

The landscape of 2023 is undeniably dominated by fintech, marking an era where numerous companies have flourished by integrating modern technology and customer-centric approaches to address challenges within existing financial systems. While the rise of fintech companies dates back to the early 20s, recent years have witnessed substantial success stories.

A pivotal evolution in this trajectory is the emergence of Decentralized Finance (DeFi), leveraging decentralized smart contracts. Notably, major financial institutions have embarked on research and development ventures involving blockchain in finance, signaling a convergence between finance and blockchain technologies.

Resulting to this collaboration underscores a symbiotic relationship, dispelling the notion that these entities are inherently at odds and emphasizing their potential to mutually enhance success.

The essence of DeFi lies in the fusion of fintech with blockchain. While the two are distinct, there exists significant overlap in their applications within the financial sector. Blockchain, renowned for its attributes of decentralization, distribution, immutability, and transparency in digital ledger technology, introduces a novel paradigm of security and freedom.

Moreover, DeFi entities incorporating blockchain elements provide an open alternative to conventional financial components, eliminating the need for intermediaries and enabling the utilization of stablecoins.

For an in-depth exploration of enterprise blockchain technology in the fintech landscape, delve into this blog to gain a comprehensive understanding of its principles and applications.

Blockchain’s Role in Overcoming Fintech Industry Challenges

In the fintech sector, challenges like failing to achieve targets, extended fundraising cycles, and mounting losses are frequent occurrences, often attributed to mismanagement. Here is a compilation of the difficulties that blockchain technology has the potential to alleviate within the fintech industry.

Reducing Reliance on Centralized Systems

A significant challenge faced by many financial institutions is the necessity for a centralized headquarters. Most financial calculations are concentrated in a single location, often on a cluster of servers. This approach comes with significant drawbacks, such as the high hosting costs of servers and, more critically, the constant risk of potential disasters disrupting the long-term stability of the financial sector.

Notably, large-scale hacker attacks have previously caused extended disruptions in financial service operations. Blockchain technology provides a comprehensive solution to this issue.

The majority of activities within the blockchain are decentralized, enabling the distribution of calculations among multiple users, thus mitigating the risk of a single server disruption rendering a service unusable.

With blockchain, clients can access reliable fintech services from any location, presenting a resilient solution for disaster management, an endorsement shared by IBM.

Elevated Operational Expenses

Blockchain technology within the fintech industry can lead to a reduction in transaction expenses. In the conventional system, even a simple credit card transaction entails multiple parties, with the transaction passing through the merchant, bank, and credit card network, each of which levies a fee for its services.

The situation becomes even more complex for cross-border payments and foreign exchanges, as they involve a broader network of financial institutions. In such cases, a client may incur fees from conversion, intermediaries, correspondents, and receiving banks for a single transfer.

Blockchain, on the other hand, leverages peer-to-peer (P2P) transactions and decentralized protocols to eliminate the need for third-party intermediaries in banking operations. This streamlined approach enhances processing efficiency and reduces transaction costs, benefiting both fintech companies and their clients.

Limitations in Access to Fintech Services

Access to fintech services can face constraints in specific scenarios. For instance, regulatory constraints or a company’s technological limitations might hinder a user’s ability to access an application while traveling. Additionally, some companies may not have physical branches or remote support staff available.

Blockchain technology provides a solution by enabling fintech companies to operate without the constraints associated with traditional financial systems. Through decentralized applications, cryptocurrencies, and smart contracts, clients gain the flexibility to conduct financial operations from any location they choose.

In essence, this means that financial services can be accessible globally around the clock.

Challenges in Establishing a Clear Audit Trail

Traditional financial systems pose challenges when it comes to establishing a clear audit trail for fintech companies. As previously mentioned, even straightforward operations involve multiple intermediaries, introducing complexity in tracking and verification processes.

Furthermore, traditional systems are characterized by high centralization, giving rise to transparency issues and heightened risks of tampering.

In contrast, blockchain technology employs a distributed, decentralized, and publicly accessible ledger that offers unparalleled traceability. Utilizing intricate algorithms and consensus protocols, blockchain diligently records and verifies each transaction.

Consequently, users can scrutinize any transaction within the network, and auditors can readily verify fintech activities.

Sluggish Processes in Traditional Fintech Systems

In traditional fintech systems, settlement times can vary from several hours to several days. This delay stems from the requirement for manual processing and the participation of numerous intermediaries and clearinghouses.

Blockchain technology, in contrast, is engineered for swiftness. It significantly reduces the time necessary for transaction processing and payment confirmation while enabling companies to streamline verification and authorization procedures, ultimately leading to shorter settlement times.

For customers, this translates to faster and more cost-effective financial operations. Similarly, banks can process payments almost instantaneously, resulting in reduced operational overhead and the elimination of the need for extensive and costly infrastructure.

Blockchain’s Transformational Impact on the Financial Technology Industry

When addressing the ramifications of blockchain technology within the realm of fintech, the most effective method involves directing our attention to the pivotal sectors of the economy. Consequently, let’s now shift our focus to these individual components.

Financial Banking and Peer-to-Peer Transactions

When addressing the ramifications of blockchain technology within the realm of fintech, the most effective method involves directing our attention to the pivotal sectors of the economy. Consequently, let us now shift our focus to these individual components.

In the realm of banking and peer-to-peer payments, prevalent issues arise from bureaucratic inefficiencies and ambiguous competencies, particularly within the clearing and settlement aspects of the banking sector. These gaps, which stem from the archaic nature of traditional banking practices and hierarchical structures, could be circumvented through the implementation of a decentralized system utilizing various consensus algorithms to expedite transactions—thus integrating blockchain technology into financial services.

Accenture’s estimations suggest that blockchain technology’s role in the clearing and settlement segments of banking could potentially yield savings of nearly $10 billion for the largest investment banks.

Furthermore, the Australian Securities Exchange has already undertaken a project to transition its post-trade clearing and settlement processes to a blockchain-based system.

Today, financial institutions are increasingly cognizant of the tangible benefits of blockchain in finance, particularly in the realm of digital currencies. These advantages, such as reduced transaction costs and accelerated transaction processing, are compelling financial entities worldwide to explore the potential shift towards digital currencies and the exploration of blockchain-based fintech software development solutions.

Additionally, the current payment system, which primarily relies on Internet payments or credit card payments, international money transfers, and providing banking services to the unbanked, exhibits inefficiencies. Credit cards, initially designed for physical payments, pose challenges in the realm of Internet transactions, including high processing fees, susceptibility to fraud, and security concerns—all of which can be effectively addressed through the adoption of blockchain technology within banking and related financial services.

Furthermore, the international payment system remains in a rudimentary state, characterized by a closed and compartmentalized structure. International payments typically require more than a day to process and are constrained by the operating hours of payment agencies. Payments undergo multiple transitions through various banking systems, each with distinct processes, necessitating extensive cross-checking of data. Cryptocurrency emerges as a solution to this complexity.

When a blockchain app development company embarks on the implementation of technology in fintech and banking, the challenge of reconciling data across diverse organizations involved in international fund transfers becomes streamlined and readily authenticated through multiple verification levels.

Lastly, the provision of banking services to the unbanked population stands as a significant challenge. Decentralized ledger technologies offer a promising solution, granting people without access to traditional bank accounts the opportunity to access banking services through their smartphones.

Related Read: Blockchain vs Distributed Ledger Technology – An Explanatory Guide You Can’t Miss On

According to a McKinsey report, approximately 2.5 billion adults lack access to banking services, nearly half the global adult population. However, a significant portion of this demographic possesses smartphones, enabling them to engage in financial transactions and gain direct access to microcredit.

Lending in the Cryptocurrency Space

Crypto lending revolutionizes the financial sector with an innovative, streamlined, and transparent lending procedure. Borrowers have the opportunity to use their crypto assets as collateral to secure loans denominated in fiat currency or stablecoins, while lenders provide the necessary assets at a predefined interest rate. Conversely, borrowers can also utilize stablecoins or fiat currency as collateral to obtain loans in crypto assets.

Review and Verification

This is a procedure that validates accounts and identifies discrepancies. It is not only inherently complex but also characterized by its sluggish pace. However, the utilization of blockchain technology simplifies this process significantly.

With the aid of this technology, you can engage your trusted blockchain application development partner to directly incorporate records into the ledger, offering an efficient method for storing and enhancing data.

Emerging Crowdfunding Approaches

Crowdfunding is centered on gathering financial support by soliciting small contributions from a large number of individuals, typically online.

Blockchain technology, via methods such as ICOs (Initial Coin Offerings), IEOs (Initial Exchange Offerings), and other approaches, significantly enhances the transparency and expediency of the fundraising process when compared to traditional funding models.

This shift towards blockchain-based fundraising methods, like ICOs, has evidently surpassed the level of interest generated by traditional venture capital fundraising models.

Identity in the Digital Sphere

The proliferation of fraudulent accounts continues unabated. Despite banks implementing rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, these measures are not foolproof. The absence of a standardized documentation process for clients to establish their identities makes them vulnerable to hacking attempts.

Blockchain technology offers a solution in the form of a digital identity system. Clients can undergo a single validation process and then use this validated identity for global transactions. In this regard, blockchain can also assist financial users in:

- Managing identity data

- Safely sharing data with others

- Digitally signing documents such as claims and transactions.

Commerce and Financial Transaction Handling

Trade finance continues to rely on the global circulation of paperwork to confirm information. This involves the physical mailing or faxing of documents.

Similarly, stock and share transactions entail a cumbersome process involving brokerage, exchanges, clearing, and settlement, a procedure that traditionally spans three days but can extend into weekends. Each trader must maintain their individual databases for transaction-related documents, regularly cross-referencing these databases for heightened accuracy.

The incorporation of blockchain technology within financial services in this sector offers traders a means to circumvent the arduous checks of counterparties while optimizing the entire trade lifecycle. This results in a reduction of associated risks, expedited settlement processes, and an enhancement of trade precision.

Compliance with Regulations

As the global demand for regulatory services is expected to increase in the coming years, fintech companies are increasingly turning to blockchain technology to enhance their regulatory compliance efforts. They rely on this technology to meticulously track and document each verified transaction, recording all associated actions.

This approach eliminates the need for regulators to independently verify record authenticity. Furthermore, blockchain empowers regulators to directly access original documents, reducing reliance on multiple copies.

Related Blog: Regulatory Compliance in Enterprise Blockchain

Additionally, the inherent immutability of blockchain technology plays a pivotal role in reducing the likelihood of errors and ensuring the integrity of records for financial reporting and audits. This, in turn, leads to a reduction in both the time and cost associated with auditing and accounting processes.

Now that we have explored blockchain and its applications in fintech, you may be eager to understand its future and make informed decisions. However, it’s crucial to gain clarity regarding which fintech companies are employing blockchain technology and the methods they are using to ensure more favorable outcomes.

Looking ahead, let’s delve into the benefits of utilizing blockchain in fintech. Subsequently, we will explore real-world examples of blockchain applications in the fintech industry.

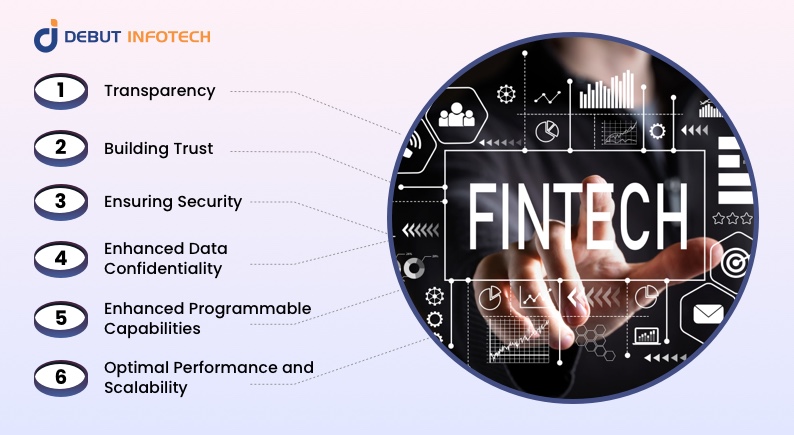

Advantages of Blockchain Technology in the Financial Industry

Blockchain has facilitated the creation of inclusive, transparent, and secure business networks, allowing for the rapid issuance of digital securities at reduced unit costs and a heightened level of customization. In recent years, the maturation of blockchain technology in the financial sector has been evident, showcasing the following advantages:

Transparency

Blockchain technology utilizes protocols, standardizes mutual agreements, and employs shared processes, serving as a unified source of growth for network participants. It enhances data integrity and elevates the customer experience through expedited processing.

Ensuring Security

Blockchain technology in finance enables the deployment of secure application code explicitly designed to resist tampering from malicious third parties, making it exceptionally challenging to manipulate or breach.

Building Trust

The immutable and transparent ledger simplifies data collaboration and agreement among various stakeholders in a business network. The blockchain serves as a distributed ledger system for securely recording, managing, storing, and transmitting transactions across various domains.

Enhanced Data Confidentiality

Blockchain data privacy in finance provides advanced tools across different layers of software stacks, facilitating selective data sharing within the business network. This enhances trust and transparency while preserving confidentiality and privacy.

Enhanced Programmable Capabilities

It supports the creation and execution of smart contracts—deterministic and tamper-resistant software that automates business logic, thereby enhancing programmability, efficiency, and trust.

Optimal Performance and Scalability

Blockchain technology in finance encompasses hybrid and private networks tailored to sustain a high transaction throughput, supporting hundreds of transactions per second. It also promotes interoperability between public and private chains, offering businesses robust resilience and global reach.

Practical Applications of Blockchain in the Fintech Industry

Blockchain is ushering in a profound transformation in the realm of business, leveraging its attributes of immutability, decentralization, distributed ledger, and transparency. Recognizing the significant growth prospects that blockchain integration holds for mobility solutions, blockchain development firms provide exemplary services to their clients.

Let’s delve into real-world instances of blockchain integration.

1. Celsius Network

Celsius Network was a cryptocurrency-oriented business that leveraged blockchain technology to offer decentralized lending and borrowing services. Their platform enabled individuals to lend their cryptocurrencies and earn interest, or alternatively, borrow assets using their digital holdings as collateral.

Unfortunately, in 2022, Celsius Network faced financial difficulties and ultimately declared bankruptcy. This downturn was attributed to mismanagement of investments during the cryptocurrency surge of 2020-2021, as reported by CoinDesk. The company had been overly optimistic about its prospects and failed to account for the stabilization of Bitcoin prices, which settled at around $20,000 per unit.

Nonetheless, Celsius Network demonstrated the potential of blockchain across various financial sectors. With improved regulatory oversight and a more rigorous approach to fund management, blockchain is poised to play a dominant role in the fintech industry, particularly in the lending market. The challenges faced by Celsius Network stemmed from strategy-related issues rather than fundamental flaws in the blockchain concept.

2. SALT Lending

SALT Lending facilitates the acquisition of loans by leveraging cryptocurrency as collateral, eliminating the need for rigorous credit assessments or concealed charges. Importantly, such loans do not affect a borrower’s credit rating.

In addition to conventional lending, fintech blockchain also enables peer-to-peer (P2P) lending, where investors can directly extend loans to borrowers without intermediaries.

For example, Upstart presents alternatives to credit cards and provides car refinance loans as replacements for existing loans from other lenders. Furthermore, they aid lenders in expanding their customer loan portfolios and achieving precise risk-based pricing.

3. Tradle & Civic

Tradle assists in establishing a digital identity framework, aiding fintech companies in adhering to KYC (Know Your Customer) and anti-money laundering regulations. Users maintain control over their identity data and can determine the extent of disclosure.

Another solution, Civic, empowers users to share only the necessary information required for particular transactions.

DeFi, with its multitude of advantages and practical applications, is ushering in a new era of financial services. However, as blockchain continues to make inroads in fintech, it is essential to recognize the challenges that must be addressed before it can revolutionize how businesses and individuals manage financial transactions.

4. Veem

Veem leverages blockchain to optimize international payments for businesses. Through the incorporation of blockchain technology within its platform, Veem provides secure and cost-effective cross-border transactions. These transactions offer real-time tracking, transparent fee structures, and simplified reconciliation processes, eliminating the necessity for intermediary banks. By utilizing these tools, the company successfully reduces expenses and enhances the speed of global payments.

5. Uniswap & Pax Gold

Uniswap serves as a prime illustration of a decentralized exchange. The technologies mentioned above empower users to link their Ethereum wallets and engage in the independent trading of securities.

Another noteworthy endeavor is Pax Gold—a blockchain startup that underpins cryptocurrency tokens with physical gold. This approach enables users to acquire fractional units (ounces) of gold, rendering gold investments more accessible to the general populace.

6. Swedish Central Bank

The Swedish Central Bank has embarked on experimental initiatives to introduce its own digital currency, termed “e-krona,” built upon R3 Corda distributed technology. This forward-looking move by the Swedish Central Bank represents a pioneering effort to establish a nationally accessible cryptocurrency.

7. J.P. Morgan

As of April 12, 2021, J.P. Morgan announced its utilization of blockchain technology to enhance money transfers, significantly reducing the verification time required for substantial payments.

Prominent Fintech Solutions Utilizing Blockchain

In the ever-evolving fintech realm, blockchain emerges as a cornerstone technology. From trade transparency to digital investments, these solutions are transforming the financial landscape.

Let’s provide you with a comprehensive overview

We.trade

We.trade, a platform developed in collaboration with IBM and 12 prominent European banks including CaixaBank, HSBC, Nordea, and KBC, leverages blockchain technology as a unified database. This allows all counterparties to access identical information about trade transactions while enhancing security measures.

Circle

Circle relies on blockchain technology to underpin its stablecoin, USDC (USD Coin). USDC is a digital currency pegged to the US dollar, enabling rapid and borderless fund transfers while maintaining transparency and auditability. It serves as a stable and dependable medium of exchange for individuals and businesses operating in the digital economy, enabling the seamless transfer of dollars worldwide.

Robinhood

Robinhood is another company that is reshaping the fintech landscape through blockchain technology. The company has developed a mobile application that simplifies stock investments, stock funds, cryptocurrencies, and more, all without additional fees.

Additionally, Robinhood launched a crypto platform in 2018, enabling users to buy and sell digital currencies such as Bitcoin, Ethereum, Litecoin, and Dogecoin.

CryptoPay

CryptoPay stands as one of the fintech companies providing top-notch blockchain-based payment solutions. Users can convert their bitcoins into US dollars, British Pounds, or Euros, facilitating easy transactions and safeguarding their funds against market fluctuations.

LAToken

LAToken is a cryptocurrency trading platform that bridges the gap between the traditional and crypto economies. It allows users to trade bitcoins globally, invest in tokenized assets, launch an initial coin offering (ICO) for their projects, and more.

Ripple

Ripple harnesses blockchain technology to facilitate swift and cost-effective cross-border payments. Through its payment protocol, XRP Ledger, financial institutions can achieve instantaneous transaction settlement. This innovation reduces dependence on traditional correspondent banking networks and decreases liquidity requirements.

Chainlink

Chainlink employs blockchain to enhance the reliability of data utilized in smart contracts. By bridging blockchain networks with real-world data sources, Chainlink ensures that smart contracts can access precise and trustworthy information.

This approach enables the execution of intricate financial agreements, including insurance claims, loan contracts, and derivatives contracts.

With these insights covered, let’s delve into the future of blockchain in the finance sector.

The Emerging Future of Blockchain in the Fintech Sector

Regarding the future trajectory of blockchain technology in the fintech sector, it is noteworthy that the adoption and utilization of this technology are experiencing substantial and accelerating growth.

Projections indicate that the worldwide Blockchain in the Fintech market achieved a valuation of $429.2 million in 2022 and is anticipated to reach $4,700.7 million by 2029, with a noteworthy compound annual growth rate (CAGR) of 40.8% during the forecast period. The assessment of market sizes took into account the impact of COVID-19 and the Russia-Ukraine War.

Fintech blockchain applications are poised to disrupt the industry significantly, transcending the boundaries of traditional banking. In the future landscape, it is not limited solely to banking institutions; rather, non-banking financial services, including asset and wealth management, are poised to harness the manifold benefits of this innovative platform.

It is imperative that financial institutions of varying sizes proactively seek expert guidance to effectively integrate and leverage this advanced technology within their business models. This strategic approach will empower them to establish unique standards for enhanced productivity, cost reduction, and elevated customer satisfaction throughout the entire value chain.

How Can Debut Infotech Facilitate the Integration of Blockchain into Fintech Enterprises?

Do you have an innovative fintech app concept in mind? Let Debut Infotech be your trusted blockchain-powered fintech app development partner. We are committed to enhancing your customer experience, boosting your operational efficiency, and elevating your business performance through cutting-edge technology.

If you’re a fintech business contemplating the adoption of financial industry tokenization, don’t hesitate! Get in touch with our fintech experts today to explore opportunities, discuss your requirements, and pave the way for a prosperous future.

FAQs

Q1. How is Blockchain Technology Transforming the Fintech Industry?

A1. Blockchain technology is reshaping the fintech sector in various ways, including the elimination of intermediaries, reduction in operational time and costs, and enhanced identity verification processes. These advantages, among others, are driving the digital transformation of the financial industry.

Q2. Which Blockchain Platforms Are Suitable for the Financial Services Sector?

A2. Ethereum, Hyperledger Fabric, Quorum, Corda, and Ripple are some of the blockchain platforms that can be considered for modernizing financial services. However, it’s essential to assess the potential of each platform and choose the one that aligns with your business objectives for optimal growth.

Q3. What Steps Are Involved in Integrating Blockchain into a Finance App?

A3. Integrating blockchain into a finance app involves complex and intricate processes. It is advisable to collaborate with experienced blockchain and fintech application development firms that possess a deep understanding of blockchain technology to ensure successful integration.

Q4. How Does Fintech Differ from Blockchain?

A4. Blockchain primarily serves cryptocurrency and Bitcoin applications, functioning as a decentralized digital ledger for transactions distributed across computer networks. In contrast, fintech, or financial technology, focuses on integrating technology into banking and financial services to streamline transactions and revolutionize the finance industry.

Q5. What Are the Key Categories of Fintech Innovations?

A5. Fintech innovations can be categorized into several key areas, including:

- Lending Transformation: Fintech companies are revolutionizing lending, allowing consumers to request loans online and receive quick approvals, eliminating the need for traditional banks or credit unions.

- International Money Transfers: Fintech streamlines international money transfers, reducing costs and enabling faster transactions compared to traditional banking methods.

- Payment Innovations: Fintech offers convenient peer-to-peer (P2P) payment solutions, simplifying transactions between individuals and organizations, often leveraging technologies like blockchain for cost-effective processing.

- Equity Financing: Fintech companies are increasingly facilitating equity financing, simplifying the fundraising process for businesses. Some platforms connect startups with accredited investors, while others use crowdfunding models to allow broader participation in new business ventures.

Q6. How Does Decentralized Finance (DeFi) Impact the Fintech Landscape?

A6. Decentralized Finance (DeFi) is an emerging trend within fintech that leverages blockchain and smart contracts to create a decentralized ecosystem for financial services. DeFi projects enable individuals to access various financial services, such as lending, borrowing, and trading, without traditional intermediaries like banks. This innovation promotes financial inclusivity and transparency, revolutionizing how financial services are accessed and utilized.

Q7. Can You Explain the Role of Artificial Intelligence (AI) in Fintech and Blockchain?

A7. Artificial Intelligence plays a pivotal role in both fintech and blockchain industries. In fintech, AI is used for fraud detection, credit scoring, and personalization of financial services. In blockchain, AI enhances security through anomaly detection and assists in smart contract automation. Together, AI and blockchain technologies are driving efficiency and innovation in the financial sector.

Q8. How is Regulatory Compliance Addressed in Blockchain-based Fintech Solutions?

A8. Blockchain-based fintech solutions often incorporate regulatory compliance mechanisms through smart contracts and immutable ledgers. These technologies enable real-time auditing, transparent record-keeping, and automated compliance checks, reducing the risk of regulatory violations and ensuring adherence to financial regulations.

Q9. What Are the Environmental Impacts of Blockchain in Fintech?

A9. Blockchain’s energy consumption, particularly in proof-of-work systems, has raised environmental concerns. However, some blockchain platforms are transitioning to energy-efficient consensus mechanisms like proof-of-stake. Additionally, efforts are underway to create eco-friendly blockchain solutions that minimize environmental impacts while maintaining security and functionality.

Q10. How Central Bank Digital Currencies (CBDCs) Influencing Fintech & Blockchain?

A10. Central Bank Digital Currencies (CBDCs) represent a significant development in both fintech and blockchain sectors. CBDCs leverage blockchain technology to create digital forms of national currencies, enhancing the efficiency of payments, reducing fraud, and promoting financial inclusion. The integration of CBDCs into fintech solutions is expected to accelerate the adoption of blockchain technology in the financial industry.

Leave a Comment